Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 16, 2016

UK pay growth remains muted as household job insecurity rises

The start of 2016 saw UK unemployment fall and employment hit an all-time high, according to official data, while pay growth also showed signs of picking up. However, the rate of pay growth remains disappointingly weak, especially given the low level of unemployment in the economy.

More up to date survey data also show the labour market losing some of its fizz in February, and households have meanwhile grown increasingly worried about falling incomes and job security in March, suggesting the outlook has darkened in recent months.

Jobless fall

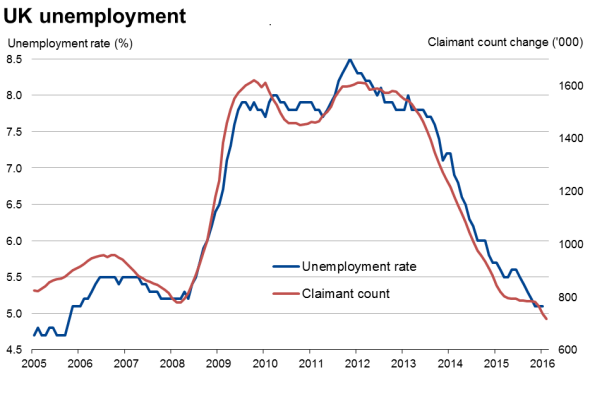

Unemployment fell by 28,000 in the three months to January, down to 1.68 million, leaving the unemployment rate at its ten-year low of 5.1%, according to the Office for National Statistics. The drop in joblessness was aided by a 116,000 rise in employment, taking the number of people in work to an all-time high of 31.42 million.

The claimant count series was meanwhile revised back to May 2013, taking the total down to 716,700 in February, its lowest since April 1975 and suggesting that the jobless rate will fall to 5.0%.

Pay growth still muted

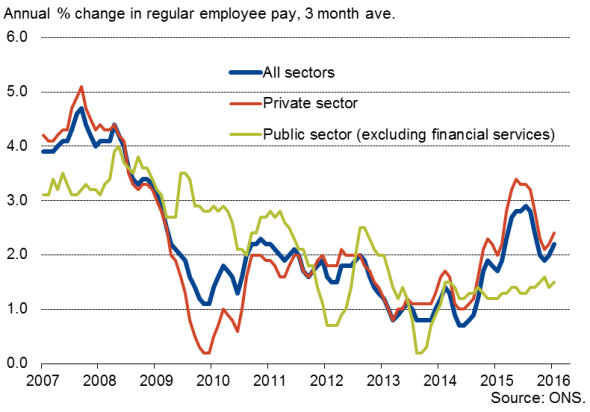

Pay growth picked up but remained muted by historical standards. Including bonuses, pay was 2.1% higher than a year ago in the three months to January, up from 1.9% in the closing quarter of last year. However, wages jumped 2.5% in January alone, which the ONS say may have reflected changes in the timing of banking sector bonuses, so should be treated with caution. However, even excluding bonuses, pay growth picked up from 2.0% to 2.2%, providing some tentative suggestion that we may be seeing a welcome upswing in pay growth, albeit still frustratingly modest and hardly a rate to get excited about.

Pay growth

Signs of slowing labour market

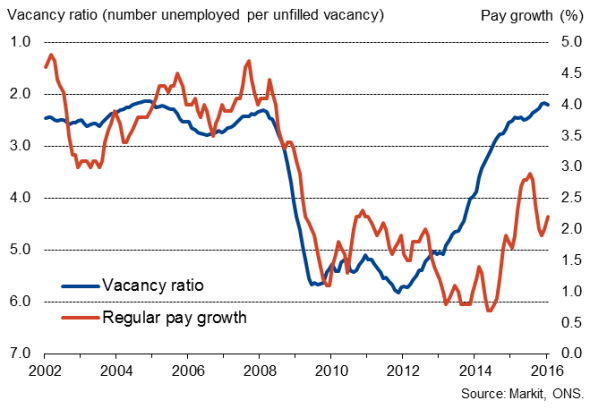

While pay growth appears to continue to rise steadily for new hires, pay reviews seem to be being held back by low inflation, restraining overall wage growth in the economy. Recruitment agencies, for example, reported that demand for staff continued to rise at a solid pace in February, once again driving up pay rates needed to attract new hires. However, Markit's latest Household Finance Index, based on a representative survey of 1500 households, showed income from employment falling and job security on the wane again. The latter may be linked to a slowing of the labour market in February, a month for which the Markit/CIPS PMI surveys indicated that employment rose at the slowest rate since August 2013 amid a marked slowing in economic growth.

Pay growth and labour market tightness

ONS data has also hinted at a slowing in the labour market this year, with job vacancies suffering the largest monthly fall since March of last year in January, down by 10,000.

One positive from the HFI survey was that, despite the drop in incomes, households' financial outlooks were on average the brightest since January 2015, the mood buoyed as spending power is expected to be boosted by muted inflation.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Economics-UK-pay-growth-remains-muted-as-household-job-insecurity-rises.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Economics-UK-pay-growth-remains-muted-as-household-job-insecurity-rises.html&text=UK+pay+growth+remains+muted+as+household+job+insecurity+rises","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Economics-UK-pay-growth-remains-muted-as-household-job-insecurity-rises.html","enabled":true},{"name":"email","url":"?subject=UK pay growth remains muted as household job insecurity rises&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Economics-UK-pay-growth-remains-muted-as-household-job-insecurity-rises.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+pay+growth+remains+muted+as+household+job+insecurity+rises http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032016-Economics-UK-pay-growth-remains-muted-as-household-job-insecurity-rises.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}