Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 15, 2016

Nigeria PMI signals economic downturn in February

Nigeria's private sector economy slipped into reverse gear during February, according to the latest PMI data compiled for Stanbic IBTC Bank by Markit. After having pointed to a notable growth slowdown in January, the latest seasonally adjusted PMI signalled an outright deterioration in business conditions. This was a survey-first, driven by unprecedented falls in output and new orders.

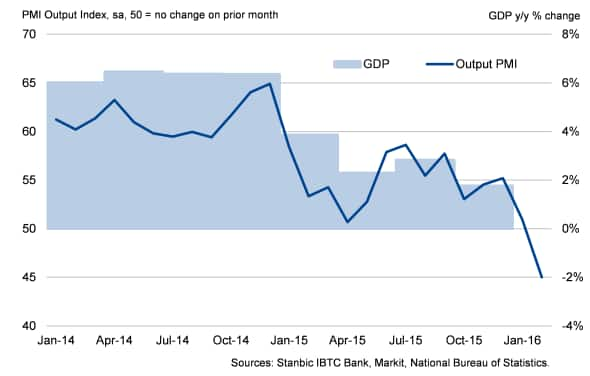

Official figures updated to the fourth quarter of 2015 released last week were equally worrying. Annual growth of gross domestic product at market prices in the fourth quarter eased to a new low of 1.8%, a far cry from the marked expansion seen in the same period during 2014 (6.4%). The recent downturn in the PMI and continually low oil prices suggests that growth could slow further or even turn negative in the first quarter of 2016.

Nigeria Output PMI vs GDP

Underlying issues dampen demand

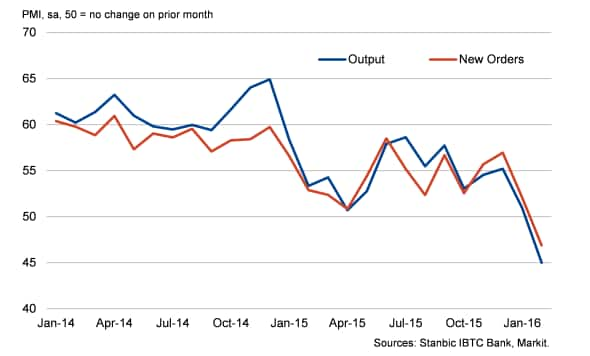

Delving deeper into the PMI dataset, multiple headwinds were flagged in February. Companies indicated that client demand was particularly subdued, leading to a solid reduction in new orders. Output dropped as a result for the first time since the series began at the start of 2014.

Nigeria PMI: Output vs New Orders

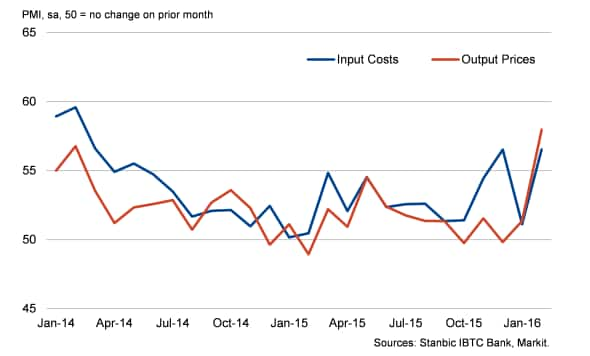

Sharply rising input costs was a key obstacle facing companies in Nigeria. This reportedly stemmed from currency weakness relative to the US dollar, which was linked in turn to the ongoing oil price slump. With cost pressures picking up, charges rose at the fastest pace since data collection began.

Nigeria PMI: Input Costs vs Output Prices

The weak oil price also appears to be hurting exports, which fell at a survey-record pace in February.

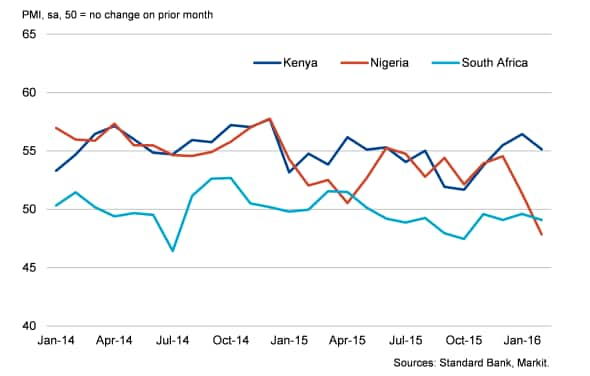

Nigeria joins South Africa in contraction territory

The scale of the challenges facing Nigeria was underlined by its status as Africa's worst-performing major economy in February, according to PMI data. Kenya's private sector has surged ahead in recent months, but the latest downturn in Nigeria was greater even than that seen in South Africa - a country which has been in contraction since last June.

Standard Bank Africa PMI

The next release of Nigerian PMI data from Stanbic IBTC Bank, scheduled for April 5th, will provide further clarity regarding the overall performance of the private sector economy in Q1 2016. For more information, please contact economics@markit.com.

Philip Leake | Economist, Markit

Tel: +44 149 146 1014

philip.leake@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Nigeria-PMI-signals-economic-downturn-in-Fe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Nigeria-PMI-signals-economic-downturn-in-Fe.html&text=Nigeria+PMI+signals+economic+downturn+in+February","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Nigeria-PMI-signals-economic-downturn-in-Fe.html","enabled":true},{"name":"email","url":"?subject=Nigeria PMI signals economic downturn in February&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Nigeria-PMI-signals-economic-downturn-in-Fe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nigeria+PMI+signals+economic+downturn+in+February http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15032016-Economics-Nigeria-PMI-signals-economic-downturn-in-Fe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}