Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 16, 2015

Japan lifts out of recession, boosting equities and hitting bonds

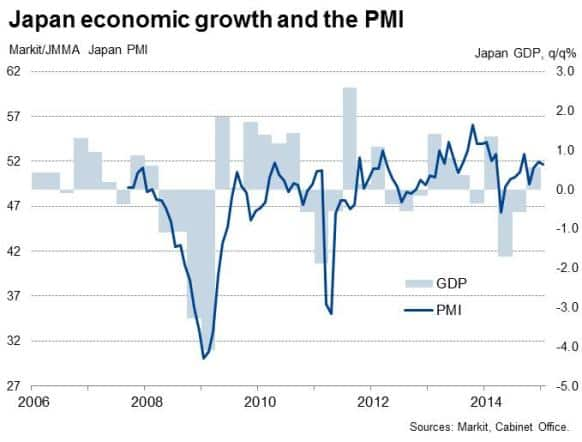

Official data have finally caught up with the survey data, signalling that Japan pulled out of its recession late last year. The improvement represents a setback to those anticipating imminent additional stimulus from the Bank of Japan. Government bond yields rose as a result. However, the data add to the improving news flow on Japan that has led to a surge in equity investor interest.

Gross domestic product rose 0.6% in the final three months of the year, recovering from the brief recession induced by the raising of the country's sales tax in April. GDP had slumped 1.7% in the second quarter and fallen 0.6% in the third quarter.

Although the fourth quarter rise was less than the 0.9% expansion analysts had been expecting, it was in line with the signal from Markit's PMI surveys.

Exports were a key driver of the renewed expansion, up 2.7% and indicating that the depreciation of the yen is helping boost overseas trade. Domestic consumption grew 0.3% and capital spending 0.1%.

Equities lifted by improved outlook

The renewed signs of life in the Japanese economy and its export performance, alongside the central bank stimulus which has involved plans to double the monetary base, have helped drive equities higher. The Nikkei pushed above 18,000 after the GDP data were released.

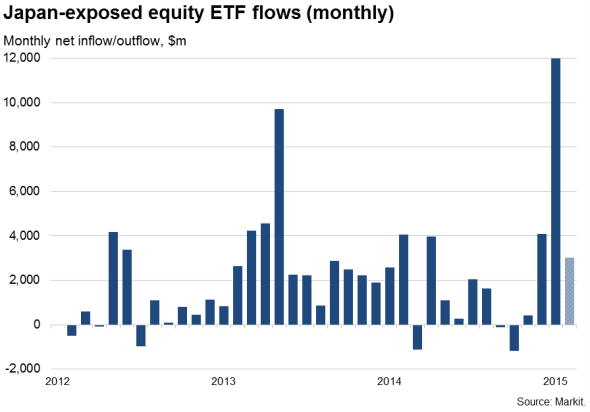

The increasing appetite for investor exposure to Japanese equities is further illustrated by strong inflows into ETFs in recent months. Markit's ETF data showed record net inflows into equity funds exposed to Japan in January, with a further net inflow seen in February to date. By comparison, equity funds had seen net outflows in September and October when worries about corporate health spiked higher amid news of the new recession.

* Shaded bar represents partial data for month (up to15 February).

Dividend outlook brightens

Renewed interest in Japanese equities is certainly justified according to the dividend outlook. Markit's forecasting team is expecting aggregate dividend growth for the JPX-Nikkei 400 constituents to rise by 12% in the 2015 fiscal year. That's down from 19.3% in 2014 but better than the 9% growth seen in 2012 and 2013.

The Automobiles & parts sector is expected to continue to be the top paying sector, accounting for 18.6% of the total pay-outs, followed by Industrial goods & services (17%) and Banks (11.3%).

Part of the easing in dividend growth compared to 2014 is the adverse impact of the weaker yen, which has increased firms' costs via higher import prices.

At the same time, weak domestic demand has meant core inflation remains at just 0.5%, well below the government's 2.0% target.

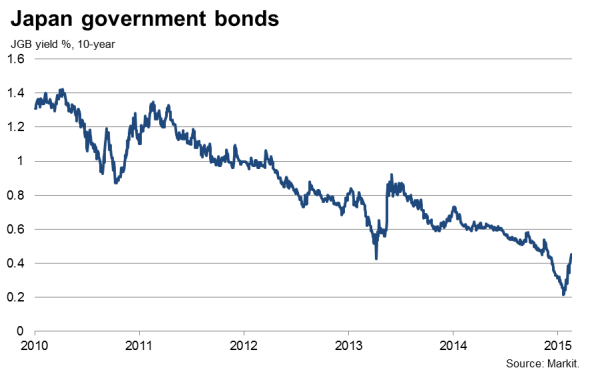

JGBs hit by less risk aversion

The BoJ is unlikely to add to its current asset purchase programme until at least later this year, amid signs that policymakers are becoming worried about the adverse impact of QE to date and its limited effect on inflation. Policymakers will no doubt want to see signs that QE is feeding through to higher wages before opening the stimulus tap further.

The reduced scope for further QE by the Bank of Japan meant government bond prices fell further after the GDP release, pushing the yield on 10-year bonds to 0.45% according to Markit's iBoxx data, their highest close since late-November.

Bond yields had hit a low of 0.21% on 20 January as investors sought safe havens amid the growing crisis in the eurozone. Since then, the announcement of ECB quantitative easing on 22 January has also helped drive money out of safe havens such as JGBs alongside the improving outlook for Japan.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-Economics-Japan-lifts-out-of-recession-boosting-equities-and-hitting-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-Economics-Japan-lifts-out-of-recession-boosting-equities-and-hitting-bonds.html&text=Japan+lifts+out+of+recession%2c+boosting+equities+and+hitting+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-Economics-Japan-lifts-out-of-recession-boosting-equities-and-hitting-bonds.html","enabled":true},{"name":"email","url":"?subject=Japan lifts out of recession, boosting equities and hitting bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-Economics-Japan-lifts-out-of-recession-boosting-equities-and-hitting-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+lifts+out+of+recession%2c+boosting+equities+and+hitting+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16022015-Economics-Japan-lifts-out-of-recession-boosting-equities-and-hitting-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}