Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 15, 2014

Fall in inflation stokes worries about domestic demand in China

Inflation has fallen to its lowest for nearly five years in China, stoking worries that domestic demand remains too weak to support an economic upturn in the absence of further stimulus measures.

Consumer prices rose 1.6% on a year ago in September, down from 2.0% in August and the lowest since January 2010.

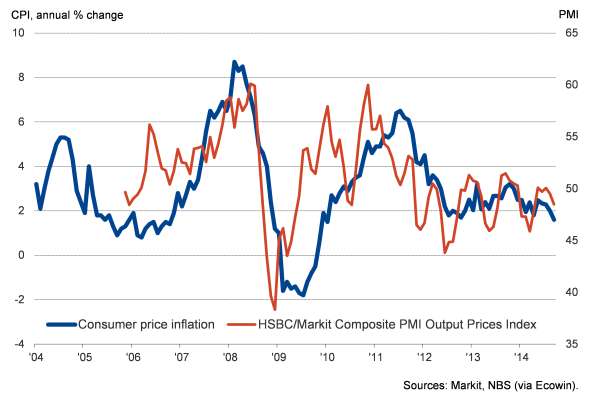

Survey and official price data compared

The data follow surveys which revealed a lack of inflationary pressures due to weak domestic demand.

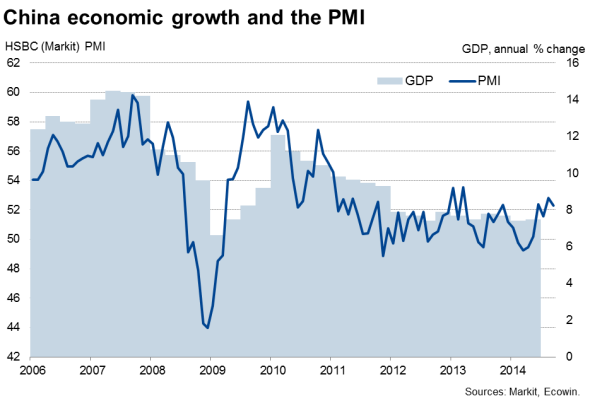

Although the HSBC PMI surveys, produced by Markit, collectively suggest that economic growth picked up in the third quarter to the fastest since early 2013, domestic demand clearly remains in the doldrums. Any growth in the manufacturing sector is being driven by exports, growth of which accelerated to the steepest since March 2010 in September, according to the PMI. Overall manufacturing order books grew only modestly, dragged down by weak domestic sales.

In the service sector, inflows of new business rose only slightly in September, the rate of growth slowing compared to August and well down on pre-crisis rates, again stymied by lacklustre domestic demand.

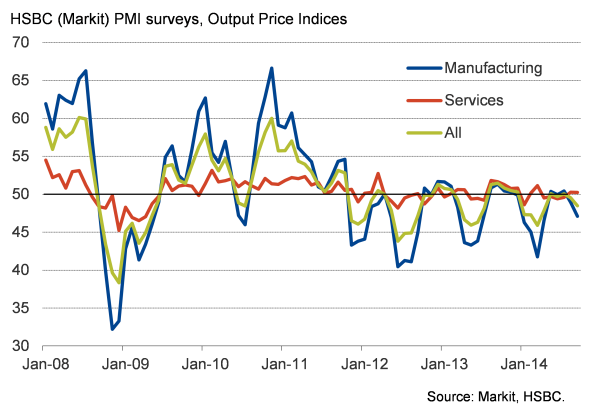

Manufacturers are consequently cutting prices in an effort to boost flagging sales. Prices charged for goods by factories showed the steepest monthly fall since April, according to the September PMI. Input prices also fell at the fastest rate since April as suppliers competed to win sales. Suppliers' delivery times - a key gauge of inflationary pressures in the supply chain - showed barely any change in September.

Survey and official producer price data compared

In the service sector, the PMI survey showed prices broadly stagnating.

The data stoke worries that sluggish domestic demand may cause growth to fall below the government's 7.5% 2014 target unless Beijing unleashes more stimulus measures.

Speculation has therefore intensified that the government will add to measures taken earlier in the year, notably the bringing forward of planned public expenditure on infrastructure projects as well as targeting credit expansion, perhaps through a cut to banks' reserve requirements and a possible interest rate cut. However, given the upturn in export-led growth signalled by the surveys, it is unlikely that the authorities will feel the need to take significant measures, preferring instead to look at targeted initiatives to boost growth and shore up the cooling property market.

There is plenty of leeway for additional stimulus measures if the authorities decide to take further action, as the government targets an inflation rate of 3.5%.

PMI survey data on prices charged

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-Fall-in-inflation-stokes-worries-about-domestic-demand-in-China.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-Fall-in-inflation-stokes-worries-about-domestic-demand-in-China.html&text=Fall+in+inflation+stokes+worries+about+domestic+demand+in+China","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-Fall-in-inflation-stokes-worries-about-domestic-demand-in-China.html","enabled":true},{"name":"email","url":"?subject=Fall in inflation stokes worries about domestic demand in China&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-Fall-in-inflation-stokes-worries-about-domestic-demand-in-China.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fall+in+inflation+stokes+worries+about+domestic+demand+in+China http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-Fall-in-inflation-stokes-worries-about-domestic-demand-in-China.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}