Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 14, 2014

UK inflation slumps to five-year low

UK inflation slumped to a five-year low in September. In fact, with the exception of September 2009, at the height of the financial crisis, the rate was the lowest seen for a decade.

Data from the Office for National Statistics showed consumer prices rising at an annual rate of 1.2% in September, down from 1.5% in August and lower than expectations of a drop to just 1.4%.

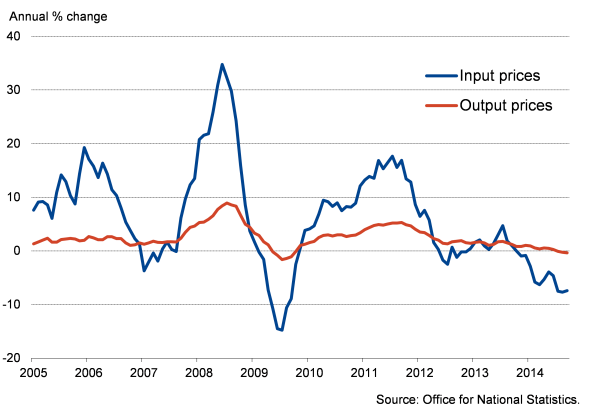

Other data meanwhile showed producers' input costs down 7.4% on a year ago in September, leading to a 0.4% drop in factory gate prices on the year. That was the largest decline for five years.

With oil and petrol prices falling, import costs dropping due to the exchange rate, supermarkets engulfed in price wars and wage growth at a record low, it's hard to see why inflation should do anything other than fall further in coming months.

This more benign inflation outlook should certainly take pressure off the Bank of England to raise rates, and could even add to calls for policymakers to do more to shore up the recovery amid signs that growth could fade in coming months.

While a few months ago, the likelihood was growing that the Bank might need to hike interest rates in late-2014 or early next year, the data are now stacking up to suggest a hike could be delayed at least until next summer, after the General Election.

Benign outlook

What's changed compared to earlier in the year to present the more benign inflation outlook?

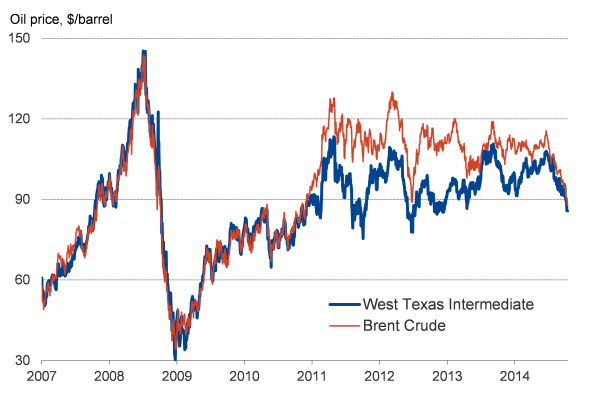

First, global economic growth is proving weaker than expected, meaning lower demand is pushing down commodity prices, and notably oil prices. Brent crude is down 24% from its June peak. Emerging markets have failed to see growth resume to pre-crisis trends, with slowdowns evident in China, Russia, India and Brazil this year. The eurozone also remains in crisis, with many analysts fearing it faces the prospect of another recession.

The IMF recently revised down its global growth forecast for this year down from 3.7% to 3.3%, acknowledging the bleaker outlook for emerging markets and the eurozone malaise.

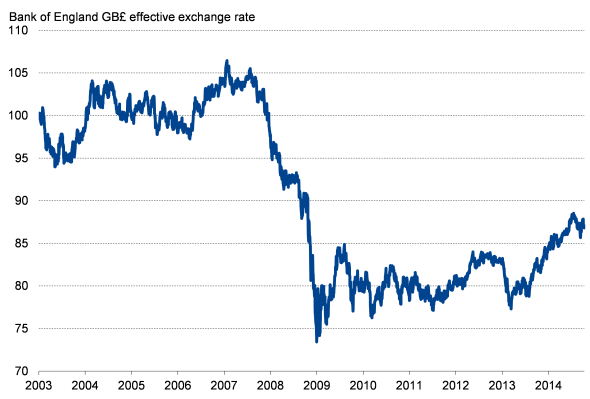

Second, sterling's appreciation is reducing the cost of imports. Although down from July's highs, the pound remains approximately 7% higher than a year ago on a trade weighted basis.

Third, at home, supermarkets have entered into fierce price wars, which will bring households' grocery costs down.

Fourth, the price wars are extending on to petrol station forecourts, which should mean motorists benefit from lower oil prices.

Fifth, earlier in the year, wage growth was showing signs of picking up. Oddly, despite unemployment falling further, these wage pressures have all disappeared. Regular pay rose just 0.7% on a year ago in the three months to July, the weakest rate of increase on record and down from 1.4% back in February.

Loose policy prescription

There's certainly a possibility that pay growth could pick up again in coming months, which will change the longer term inflation outlook to some degree. More may become evident on this front tomorrow with the release of updated labour market data. Sterling also looks likely to lose some of its strength as interest rate hikes look less appropriate. But at the moment, the combination of low oil prices and supermarket price wars is warding off the threat of the Bank of England having to tighten policy any time soon.

With manufacturers and exporters appearing to be struggling in the face of weaker demand from overseas, calls may in fact strengthen for policymakers to do more to boost growth in the face of these headwinds is the numbers continue to disappoint in coming months.

Exchange rate

Source: Bank of England.

Oil prices

Source: Ecowin.

Producer prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-Economics-UK-inflation-slumps-to-five-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-Economics-UK-inflation-slumps-to-five-year-low.html&text=UK+inflation+slumps+to+five-year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-Economics-UK-inflation-slumps-to-five-year-low.html","enabled":true},{"name":"email","url":"?subject=UK inflation slumps to five-year low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-Economics-UK-inflation-slumps-to-five-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+inflation+slumps+to+five-year+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14102014-Economics-UK-inflation-slumps-to-five-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}