Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 15, 2016

Week Ahead Economic Overview

Flash PMI data are the highlight of the week, providing policy guidance to central banks in the UK, Eurozone, US and Japan.

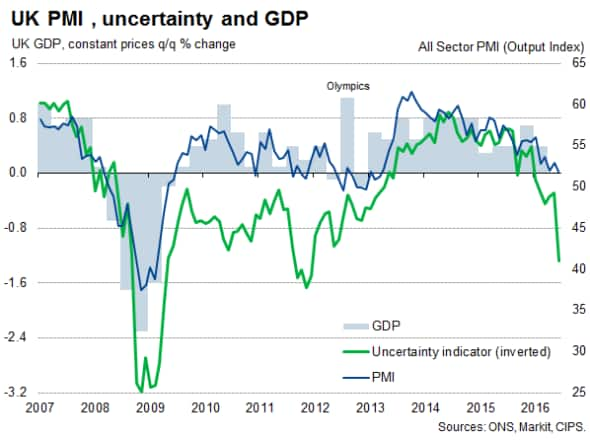

With the Bank of England having so far held off from any additional monetary stimulus in the wake of the UK's vote to leave the EU, the publication of a flash PMI for the UK will provide clues to possible action in August.

The flash PMI, to be released on 22nd July, will cover both manufacturing and services, with a series of weighted 'composite' indices providing a comprehensive picture of economic growth, employment and price trends in the aftermath of the 'Brexit' vote (data will be collected 12-21 July).

Any sharp downturn in the pace of economic growth and hiring signalled by the July flash PMI sets the scene for the Bank of England to cut interest rates at its August Monetary Policy Committee meeting, and possibly raises the prospect of further non-standard measures, such as additional quantitative easing or an extension of its Funding for Lending Scheme.

Official UK inflation, labour market, retail sales and public sector borrowing numbers are also published for June, as well as household finance survey data (for July) from IHS Markit.

Analysts will also be looking for signs that the steep drop in the value of the pound due to the referendum could be feeding through to higher inflation, and whether consumers pulled back on spending in the face of Brexit uncertainty.

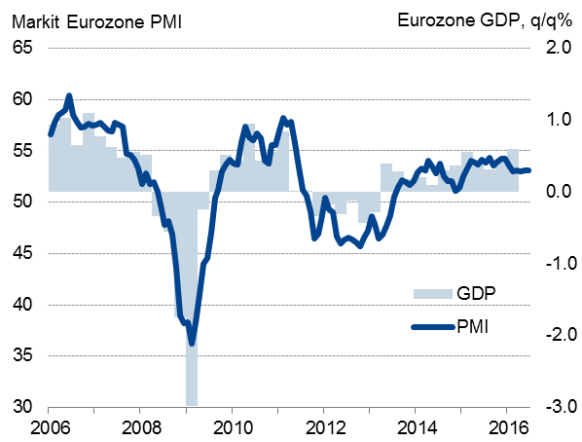

Flash PMI data will also reveal any impact of the Brexit vote in the euro area. Recent survey data showed Brexit cited as the most common threat to Eurozone companies, suggesting that heightened uncertainty across the region could hit third quarter growth.

Any significant impact could feed through to additional stimulus from the ECB, whose Governing Council meets on Thursday, though expectations are that the central bank will most likely wait until August or September before taking any further action.

Eurozone PMI and GDP

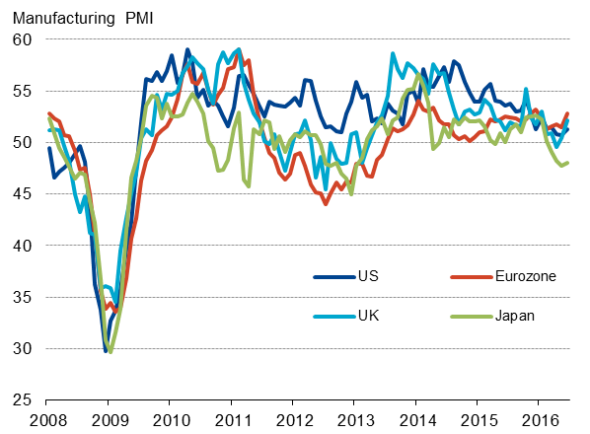

Flash manufacturing PMI data for July are also published for the United States and Japan, which should give further clues as to the next policy moves by the Fed and Bank of Japan.

Cheered by better jobs data in June, expectations have risen that the Fed remains on course to hike US interest rates at least one more time in 2016. But policy remains highly data dependent, and the flash PMI is important in being the first indicator of the health of the economy at the start of the third quarter. A weak flash US manufacturing PMI for June had rounded off the worst quarter since 2009.

While the next move by the Fed is anticipated to be one of tightening policy, Japan is expected to see further fiscal stimulus alongside more aggressive monetary easing, following signs of the economy weakening again. The Nikkei flash PMI will therefore be important in providing the first insight into third quarter manufacturing trends. June's reading had signalled a fourth successive monthly deterioration, with the second quarter average running at the lowest since the fourth quarter of 2012, down to levels that are usually soon followed by a decline in nominal GDP.

Forecasts for 2017 economic growth in Japan have been revised down, revealing the lacklustre outlook. With a planned sales tax hike now deferred from late 2017 to 2019, an anticipated increase in spending ahead to the tax rise will no longer take place.

Manufacturing PMIs

Monday 18 July

House price data are released in China.

The latest NAHB Housing Market Index is meanwhile issued in the US.

Tuesday 19 July

In Russia, latest inflation, retail sales and unemployment numbers are published.

ZEW releases latest current conditions and economic sentiment data for Germany.

The Office for National Statistics (ONS) issues June inflation figures for the UK.

Jobs data are meanwhile updated in Brazil.

The US sees the publication of housing starts and building permit numbers.

Wednesday 20 July

M3 money supply data are published in India.

Monthly GDP figures are updated in Russia.

South Africa sees the release of inflation numbers.

Eurostat issues current account data for the currency union, while the European Commission publishes consumer confidence figures.

Producer price numbers are meanwhile out in Germany.

Unemployment and earnings figures are released by the ONS in the UK.

Mortgage data are updated in the US.

Thursday 21 July

The Reuters Tankan survey is published in Japan.

The European Central Bank, the South African Reserve Bank and Brazil's Central Bank announce their latest monetary policy decisions.

Business confidence numbers are out in France, while current account figures are released in Greece.

In the UK, retail sales and public sector net borrowing data are published.

Canada sees the release of wholesale trade numbers.

Initial jobless claims figures, the latest Philly Fed Business Index and FHFA monthly home price data are out in the US.

Friday 22 July

Flash PMI results for July are published in Japan, France, Germany, the Eurozone, the US and - as a one-off - also for the UK.

In Italy, industrial orders and retail sales numbers are issued.

Meanwhile, inflation and retail sales data are out in Canada.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}