Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 15, 2015

Fed's Yellen sees US rates rising in 2015 despite manufacturing stagnation

US manufacturing remained in the doldrums in June, with factory output stagnating for a second straight month, according to official data and adding to signs that the economy is slowing again. However, Fed chair Janet Yellen sees longer-term strength, and seeks to prepare the markets for the policy normalisation process to start later this year with an initial rate hike.

Flat factory picture

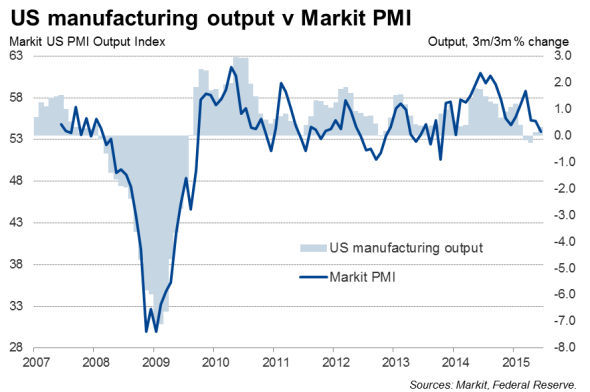

The data at least showed an upward revision to the 0.2% decline in factory output previously indicated for May, but the flat picture corroborates survey data which show producers struggling in recent months, in part due to the strong dollar hitting competitiveness.

Markit's latest US PMI survey revealed manufacturing to have suffered the weakest performance since October 2013, when business had been disrupted by the Federal government shutdown. June saw particular pain for exporters, with a further lack of export sales growth blamed once again by companies on the strong dollar. The resulting sluggish growth of order books points to manufacturers holding back on any expansion of output as we move into the third quarter.

It's also not just manufacturing that appears to be struggling. The production data follow news that retailers endured a tough month in June, with sales falling 0.3% compared to May, and across both manufacturing and services the business outlook has failed to lift from the post-recession low seen earlier in the year, according to recent survey data.

There was better news on the wider measure of industrial production, which showed 0.3% growth due to an upturn in mining. But it's the performance of manufacturing which is the far better bellwether of the underlying health of the economy.

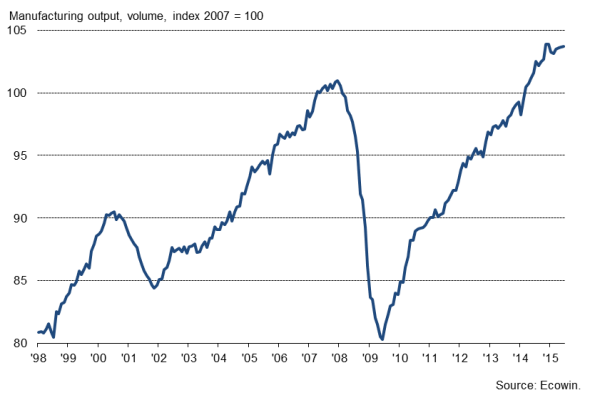

US manufacturing history

Losing momentum

While the GDP data are therefore set to show the pace of economic growth having picked up for the second quarter as a whole, there are strong suggestions from the recent flow of data that the rate of expansion cooled towards the end of the quarter and that growth may weaken in the third quarter.

At the moment, however, it remains unclear the extent to which the economy may have shifted down a gear due to worries about rising interest rates, the strong dollar, the crisis in Greece, stock market volatility in China and renewed weakness in emerging markets, or whether the recent batch of data merely represent a temporary blip.

In congressional testimony, Fed chair Janet Yellen meanwhile continued to build expectations that interest rates are likely to start rising later this year. The Fed sees the economic recovery as making "steady progress", emphasising the return to near full employment and the underlying strength of the economy, boosted in particular by the favourable impact of low oil prices and higher employment on consumer spending.

However, policymakers may once again have to step away from tightening policy any time soon if the current weak flow of data persists into coming months. More will become evident with next week's flash PMI data for July.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Economics-Fed-s-Yellen-sees-US-rates-rising-in-2015-despite-manufacturing-stagnation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Economics-Fed-s-Yellen-sees-US-rates-rising-in-2015-despite-manufacturing-stagnation.html&text=Fed%27s+Yellen+sees+US+rates+rising+in+2015+despite+manufacturing+stagnation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Economics-Fed-s-Yellen-sees-US-rates-rising-in-2015-despite-manufacturing-stagnation.html","enabled":true},{"name":"email","url":"?subject=Fed's Yellen sees US rates rising in 2015 despite manufacturing stagnation&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Economics-Fed-s-Yellen-sees-US-rates-rising-in-2015-despite-manufacturing-stagnation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fed%27s+Yellen+sees+US+rates+rising+in+2015+despite+manufacturing+stagnation http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15072015-Economics-Fed-s-Yellen-sees-US-rates-rising-in-2015-despite-manufacturing-stagnation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}