Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 15, 2016

Global all-industry output loses growth momentum amid slowdowns in manufacturing and services

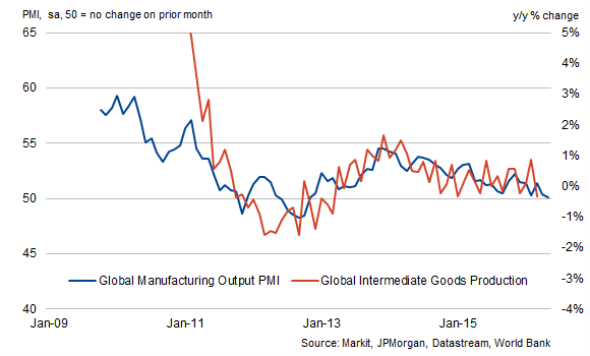

Although the global economy remained in expansion mode during May, a subdued trend in output growth prevailed, with the rate of expansion being among the slowest in over three-and-a-half years. Sector data highlighted intermediate goods as the weakest link in manufacturing, where a renewed slump in production was recorded to suggest that other manufacturers were pulling back on their purchases of components. In services, the overall slowdown was reflective of stagnant activity at consumer-facing service providers.

Global PMITM data compiled on behalf of J.P.Morgan include a breakdown for three sub-sectors in manufacturing (covering consumer, intermediate and investment goods) and three services (business-to-business, consumer and financial services).

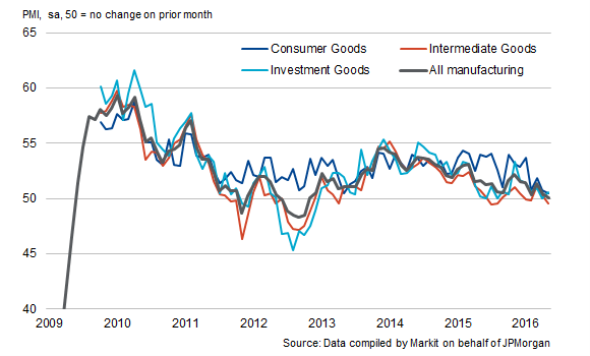

Intermediate goods output slides

Ending a two-month sequence of expansion, intermediate goods production declined in May. The latest fall counteracted increases in both the consumer and capital goods sectors, leading to broadly stagnant levels of output in the manufacturing economy as a whole.

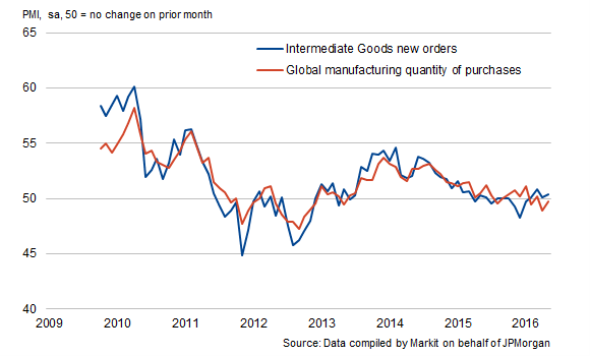

The data also suggest that the economic malaise at worldwide intermediate goods producers is likely to persist and that the road to recovery will be bumpy. Whereas new business inflows rose, the growth rate remained weak by historical standards, which in turn stymied hiring. Even with a reduced workforce size, firms were able to lower their outstanding business suggesting further layoffs in coming months. Buying levels also decreased in May, leading to the fastest contraction in pre-production stocks for five months.

Of concern, feeble demand for intermediate goods output points to hesitancy among investment and consumer goods companies with regards to intentions to build inventories and raise capital expenditure on plant & machinery.

Global manufacturing: output

Global manufacturing: intermediate goods output

Intermediate goods new orders vs global manufacturing purchasing activity

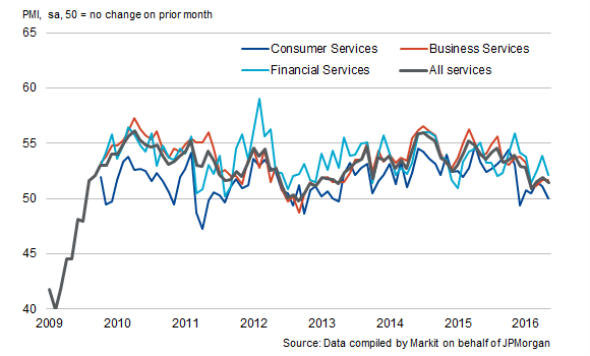

Stagnation in consumer services activity

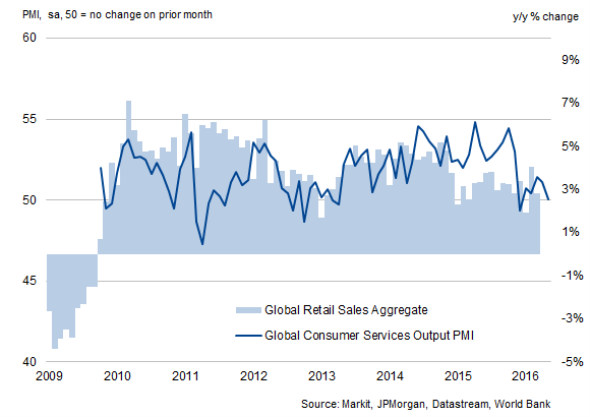

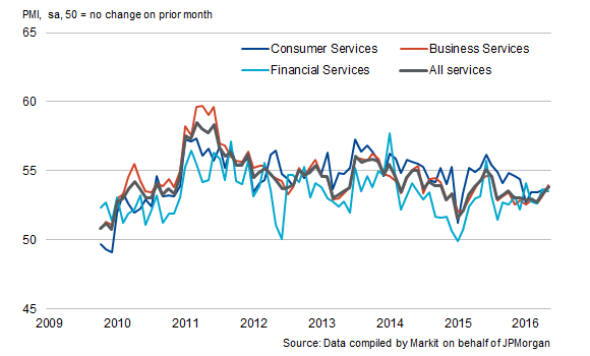

Global services output rose at the second-slowest pace in over three years during May. Although growth was sustained in both the business services and financial services categories, consumer services activity stagnated. This was only the second time since April 2013 that the sector failed to expand.

Falling levels of incoming new work, the first in 41 months, was the main cause of the latest stagnation in worldwide consumer services output. Undeterred by deteriorating household demand, businesses took on additional workers and raised their selling prices during the month. Rates of increase were, however, marginal in both cases.

Global services: output

Consumer services and global retail sales

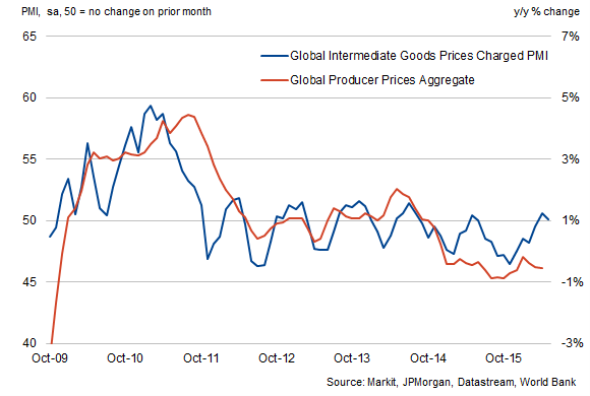

Global cost inflation strengthens

May saw all-industry input costs rise at the quickest rate in ten months, with companies worldwide reporting higher prices paid for a range of commodities, particularly oil. In manufacturing, cost inflation accelerated at both investment and intermediate goods producers, while the rate of increase among consumer goods companies was unchanged since April. Within services, upward trends in cost pressures were evident in business services and consumer services. Although a slower increase was seen in financial services, cost inflation remained solid.

Output prices rose in five of the six tracked sub-sectors, the exception being investment goods. Where increases were noted, rates of inflation were weak by historical standards, providing further evidence of bleak demand conditions at the global level.

Global services: input prices

Intermediate goods: output prices

Further information

Further information on how to access the new J.P.Morgan PMI indices can be obtained by contacting economics@markit.com.

Pollyanna De Lima | Principal Economist, IHS Markit

Tel: +44 149 146 1075

pollyana.delima@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-Economics-Global-all-industry-output-loses-growth-momentum-amid-slowdowns-in-manufacturing-and-services.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-Economics-Global-all-industry-output-loses-growth-momentum-amid-slowdowns-in-manufacturing-and-services.html&text=Global+all-industry+output+loses+growth+momentum+amid+slowdowns+in+manufacturing+and+services","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-Economics-Global-all-industry-output-loses-growth-momentum-amid-slowdowns-in-manufacturing-and-services.html","enabled":true},{"name":"email","url":"?subject=Global all-industry output loses growth momentum amid slowdowns in manufacturing and services&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-Economics-Global-all-industry-output-loses-growth-momentum-amid-slowdowns-in-manufacturing-and-services.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+all-industry+output+loses+growth+momentum+amid+slowdowns+in+manufacturing+and+services http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15062016-Economics-Global-all-industry-output-loses-growth-momentum-amid-slowdowns-in-manufacturing-and-services.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}