Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 15, 2015

Chinese growth hits six-year low, hiring drop adds to stimulus hopes

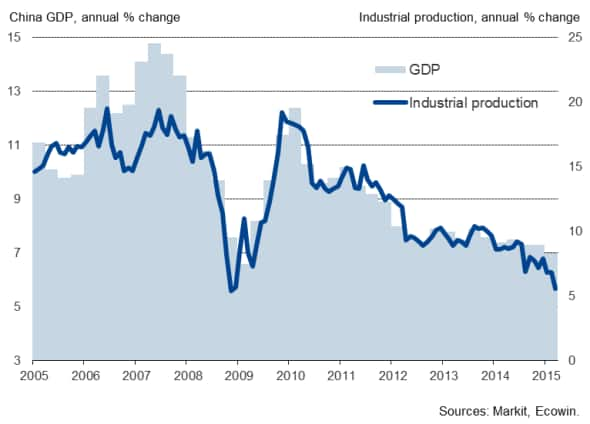

China's economy grew at its slowest rate in six years in the first three months of 2015. Gross domestic product grew 7.0% compared to a year earlier, its weakest rise since the height of the global financial crisis in the first quarter of 2009.

GDP was 1.3% higher than in the fourth quarter of last year, the weakest quarterly rise since comparable data were first available in 2010 and down from 1.5% in the fourth quarter.

'New normal'

The slower growth rate raises the prospect of the economy seeing the weakest annual expansion for a quarter of a century in 2015. The government has set a growth target of 'around 7%' for the year, a slowdown which it sees as appropriate and a 'new normal', as it steers the economy away from goods exports and investment towards domestic consumption and services.

The data certainly indicated a weakening of industrial production trend, with output rising just 5.6% on a year ago in March, its weakest expansion since November 2008. Investment in fixed assets meanwhile also grew at a reduced rate, up 13.5% on a year ago to register the lowest growth for 14 years, confirming the reduced contribution to the economy from construction of property, infrastructure and other building projects.

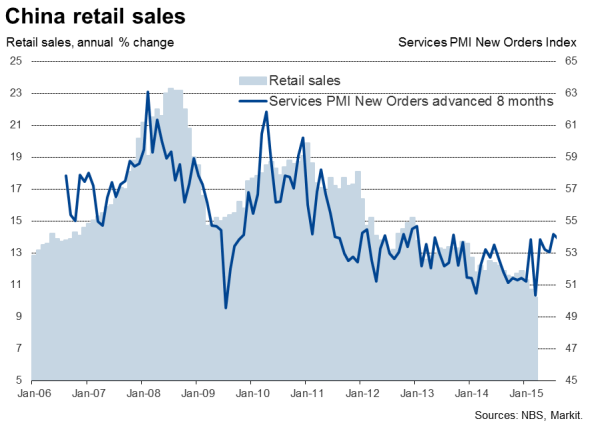

However, it is not clear that the weakening of investment and trade growth drivers is yet being offset by stronger domestic consumption. Retail sales were just 10.2% higher than a year ago in March, showing the weakest trend since the first quarter of 2009 (however, sales growth has been subdued in recent years in part due to the government's clampdown on conspicuous consumption by officials). Growth of imports has also slowed, indicating weakened growth of domestic demand.

China GDP and industrial production

Markit's dividend forecasting team consequently sees the dividend outlook to have deteriorated in 2015. The aggregate dividend of FTSE China A50 companies is expected to grow by just 3.1% in 2015 compared to the 14.5% growth seen in 2014.

Hiring fall adds to stimulus hopes

Although slowing, worries about a hard landing still seem overplayed, and the economy may regain some momentum. Markit's service sector PMI survey indicates that new orders in the services economy - a reliable leading indicator of retail sales - has remained elevated, pointing to stronger domestic consumption in coming months.

Both Markit and NBS manufacturing PMI surveys meanwhile point to stronger factory activity trends than the official industrial production data, suggesting some of the slowdown may prove temporary. However, both manufacturing surveys remain weak by historical standards, highlighting the new phase of slower growth that the Chinese industry appears to have moved into.

We must also remember, however, (as the government is keen to point out) that 7.0% growth is equivalent to 10% growth prior to the financial crisis in terms of the amount of extra output produced, given the economy is comparatively larger in absolute terms.

There's also scope for further stimulus. China's Premier Li Keqiang has noted that they are keen to step up their efforts to boost the economy if the slowdown shows signs of hitting the labour market, which is precisely what the PMI surveys are indicating. Markit's manufacturing and service sector PMIs surveys collectively indicated the first drop in employment for six months in March, led by a further drop in factory payroll numbers and the weakest hiring trend in the service sector since May of last year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Economics-Chinese-growth-hits-six-year-low-hiring-drop-adds-to-stimulus-hopes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Economics-Chinese-growth-hits-six-year-low-hiring-drop-adds-to-stimulus-hopes.html&text=Chinese+growth+hits+six-year+low%2c+hiring+drop+adds+to+stimulus+hopes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Economics-Chinese-growth-hits-six-year-low-hiring-drop-adds-to-stimulus-hopes.html","enabled":true},{"name":"email","url":"?subject=Chinese growth hits six-year low, hiring drop adds to stimulus hopes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Economics-Chinese-growth-hits-six-year-low-hiring-drop-adds-to-stimulus-hopes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+growth+hits+six-year+low%2c+hiring+drop+adds+to+stimulus+hopes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15042015-Economics-Chinese-growth-hits-six-year-low-hiring-drop-adds-to-stimulus-hopes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}