Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 15, 2018

Official data confirm UK PMI signals of export-led factory growth and construction woes

- UK industrial production, manufacturing and construction output all rise 0.4% in November

- Factories show strength on back of rising exports, but construction trend remains one of decline

- Official data are in line with PMI surveys, the latter boding well for a good December

Official data showed UK industry performing well in November, aided by export gains, which should help boost the economy in the fourth quarter. Construction was found to be struggling, however, underscoring concerns about a lack of investment in commercial building in particular.

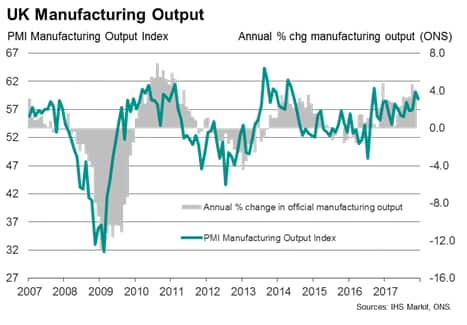

Export-fuelled manufacturing upturn

Data from the Office for National Statistics showed manufacturing output up 0.4% in November, representing the seventh successive robust monthly increase. Factory output is running 3.5% higher than a year ago, up 1.4% in the latest three months. The wider measure of industrial production, which includes energy, was also up 0.4% in November.

In the fourth quarter so far, industrial output is running 0.9% higher than in the third quarter, with manufacturing output up 1.1%, setting the scene for a decent contribution to GDP.

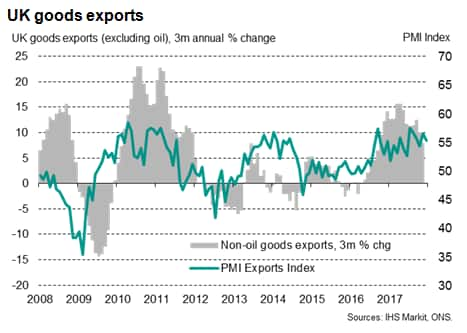

Industry has been buoyed by rising exports, which is in turn a reflection of the weak exchange rate and strong growth in key export markets such as the eurozone, where the pace of economic expansion has accelerated sharply in recent months. The latest ONS data showed goods export volumes surging by 9.1% compared to a year ago in the three months to November. Imports were up a mere 2.6% by comparison.

Struggling construction sector

In the construction sector, output rose 0.4% in November, but in the latest three months output was down 2.0% compared to the prior three months, the largest decline since 2012.

Only private house building showed any increase in the latest three months, up 1.2%. The steepest downturn was seen in private commercial building, which is a key bellwether sector of business investment and which saw output drop some 5.4% in the three months to November. On average in the fourth quarter so far, construction sector output is down 1.8% compared to the third quarter, pointing to a further drag on GDP.

Surveys point to robust December

The official data are in line with survey data which have likewise shown an export-led recovery in manufacturing in recent months while a beleaguered construction sector has become reliant on house building. Encouragingly, PMI survey data indicated that manufacturing fared well again in December and that the construction sector continued to show signs of stabilising somewhat after the downturn seen earlier in the year. The data suggest that fourth quarter economic growth could match, or even beat, the 0.4% expansion of GDP seen in the third quarter.

The caveat is that business confidence about the outlook remains very subdued, highlighting downside risks to future growth if uncertainty intensifies, notably in relation the UK’s trading relationship with the EU. However, in the absence of any upsets, it seems likely that the UK will continue to muster steady – but by no means impressive - growth over the course of 2018. IHS Markit’s forecast is for the economy to grow a mere 1.2% in 2018.

Chris Williamson, Chief Business Economist at IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012018-official-data-confirm-uk-pmi-signals-export.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012018-official-data-confirm-uk-pmi-signals-export.html&text=Official+data+confirm+UK+PMI+signals+of+export-led+factory+growth+and+construction+woes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012018-official-data-confirm-uk-pmi-signals-export.html","enabled":true},{"name":"email","url":"?subject=Official data confirm UK PMI signals of export-led factory growth and construction woes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012018-official-data-confirm-uk-pmi-signals-export.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Official+data+confirm+UK+PMI+signals+of+export-led+factory+growth+and+construction+woes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15012018-official-data-confirm-uk-pmi-signals-export.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}