Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 14, 2016

UK labour market weakens, but rising pay helps lift household gloom

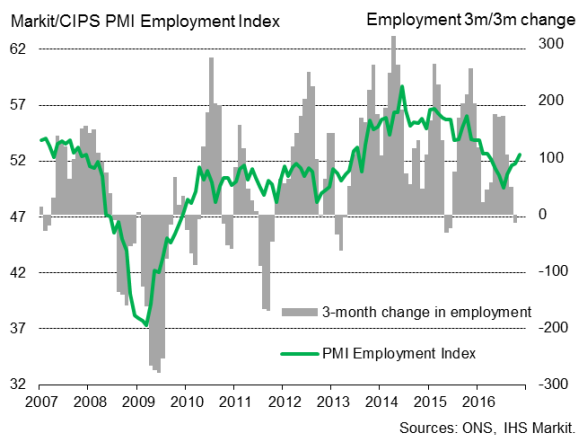

Official data showed the number of people in work declining for the first time in over a year, confirming earlier survey evidence that Brexit worries have caused employers to pull back on hiring. However, the same surveys are already signalling a revival of hiring as companies expand capacity in line with stronger demand, albeit with overall employment growth remaining well down on earlier in the year.

Employment

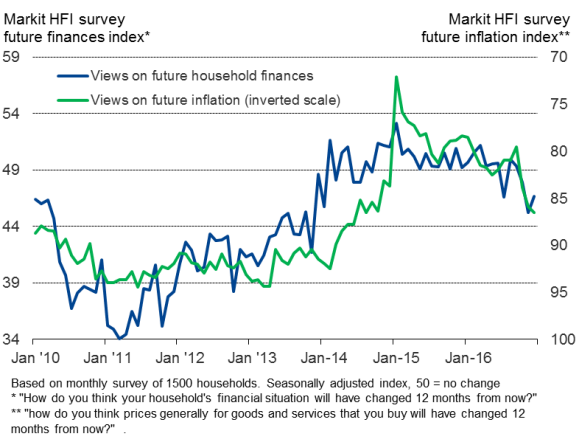

Pay growth has meanwhile picked up, as have households' views on their current finances, though worries about the year ahead continue to dominate, linked mainly to the prospect of higher inflation.

Policymakers face a difficult year ahead, keeping a close eye on the threat of inflationary pressures becoming embedded in the economy while simultaneously keeping the economy growing at a steady pace amid Brexit uncertainty.

Employment falls

The latest official data showed the number of people employed fell by 6,000 in the three months to October, according to the Office for National Statistics, the first decline since the spring of 2015.

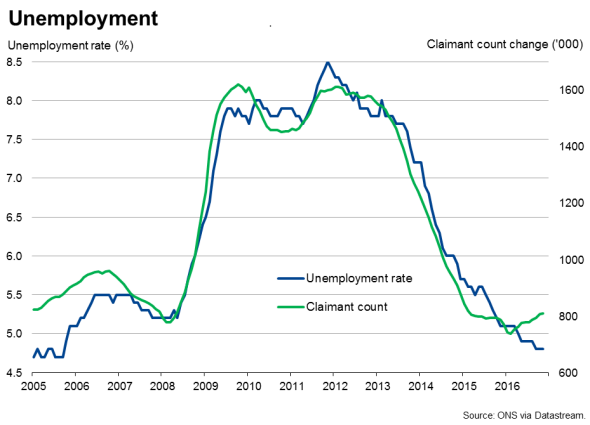

Further signs of a weakening labour market also appeared in the unemployment data. Although the unemployment rate held steady at 4.8%, the number of people claiming jobless benefits rose for a fourth month running in November. The claimant count now stands at 809,000, its highest since February 2015.

Pay rises

There was better news on pay, perhaps reflecting the combination of historically low unemployment and recognition among employers that pay needs to rise to compensate for higher inflation if they wish to retain workers.

Average employee earnings rose at an annual rate of 2.5% in the three months to October, its joint-highest for over a year and up from 2.4% in the three months to September. Excluding bonuses the underlying rate improved to 2.6%, which was also the fastest rate of increase for just over a year.

Brighter survey data

While the latest data paint a gloomy picture of the employment trend, recent survey data indicate that recruitment has started to recover since the summer as increasing numbers of employers shrug off Brexit uncertainty and focus instead on raising capacity to meet higher than expected demand. The monthly REC survey of recruitment consultancies, compiled by Markit, found the number of people placed in permanent jobs by agencies to have risen at the fastest rate since February. The hiring trend had slowed in the spring, with the number of people placed in jobs then falling in both June and July, but has since steadily picked up again.

Like the ONS data, the recruitment survey also points to rising pay pressures as the labour market tightens again.

PMI surveys likewise showed employment growth improving in November, rising to an eight-month high as firms sought to boost workforce numbers in line with stronger order book growth. The rate of job creation nevertheless remained well below a year ago as many companies continued to take a cautious approach to hiring.

Households gloomy on financial outlook

The upturn in pay has meanwhile helped to reduce the squeeze on household finances, according to survey data also released today. However, sentiment about future finances continues to run at one of the lowest levels seen over the past three years in December, linked mainly to expectations of higher inflation and a commensurate hiking of interest rates by the Bank of England.

Households' expectations of future finances and inflation

Source: IHS Markit. HFI Survey

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122016-Economics-UK-labour-market-weakens-but-rising-pay-helps-lift-household-gloom.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122016-Economics-UK-labour-market-weakens-but-rising-pay-helps-lift-household-gloom.html&text=UK+labour+market+weakens%2c+but+rising+pay+helps+lift+household+gloom","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122016-Economics-UK-labour-market-weakens-but-rising-pay-helps-lift-household-gloom.html","enabled":true},{"name":"email","url":"?subject=UK labour market weakens, but rising pay helps lift household gloom&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122016-Economics-UK-labour-market-weakens-but-rising-pay-helps-lift-household-gloom.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+labour+market+weakens%2c+but+rising+pay+helps+lift+household+gloom http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14122016-Economics-UK-labour-market-weakens-but-rising-pay-helps-lift-household-gloom.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}