Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 14, 2016

Global economic growth kicks higher at start of fourth quarter but outlook darkens

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

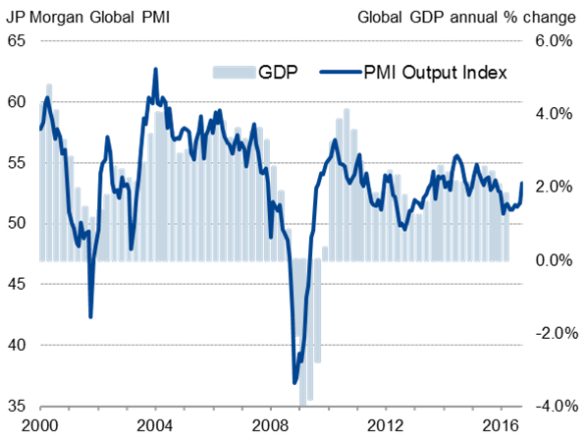

Global PMI at 11-month high in October

Global economic growth kicked higher at the start of the fourth quarter, according to PMI survey data. The JPMorgan Global PMI, compiled by IHS Markit, rose from 51.7 in September to an 11-month high of 53.3. The improvement means that the PMI points to annual global GDP growth (at market prices) accelerating above 2% at the start of Q4 and pulling out of the malaise that had been evident through the second and third quarters.

Output and new orders both expanded at faster rates, with manufacturers and services providers seeing an improvement, while the recent drag from inventory reduction continued to ease. In manufacturing, inventories of both finished goods and inputs showed the smallest declines for over a year.

Global PMI & economic growth

Sources: IHS Markit, JPMorgan.

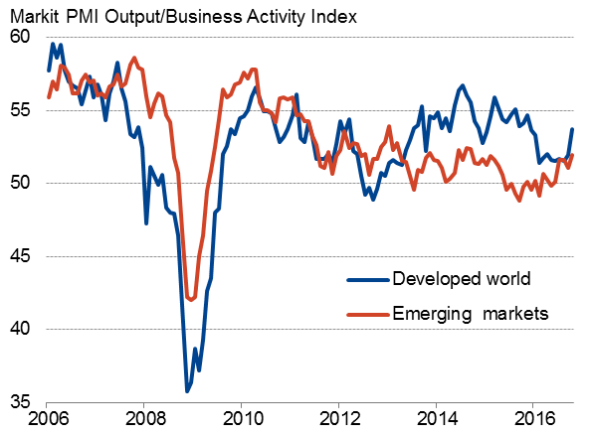

Developed & emerging market output

Source: IHS Markit

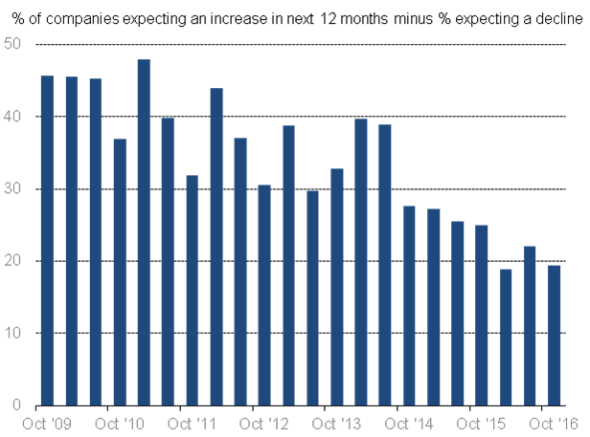

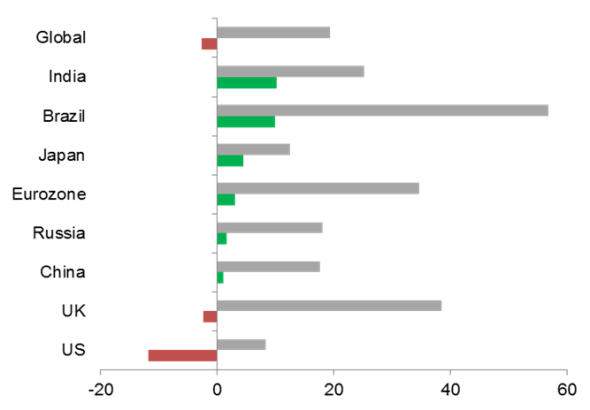

Global business optimism at post-crisis low amid political worries

Despite global growth lifting higher at the start of Q4, the October Markit Global Business Outlook survey, which looks at expectations for the year ahead across 12,000 PMI-survey companies, recorded the joint-weakest level of optimism since data collection started seven years ago. The mood was darkened by reduced optimism among US and UK companies, mainly reflecting worries about how the US election and Brexit may affect business conditions in the coming year. However, optimism improved in Japan, Eurozone, China, Russia, India and Brazil.

Global investment and employment intentions remain close to survey lows. Global profits were also under pressure as firms generally reported an inability to pass expected higher costs on to customers.

Global business optimism

Source: IHS Markit.

Countries ranked by change in optimism

Grey bar: % net balance of optimists - pessimists Oct'16

Green bar: +ve change in outlook Jun '16 to Oct '16

Red bar: -vechange in outlook Jun '16 to Oct '16

Source: IHS Markit.

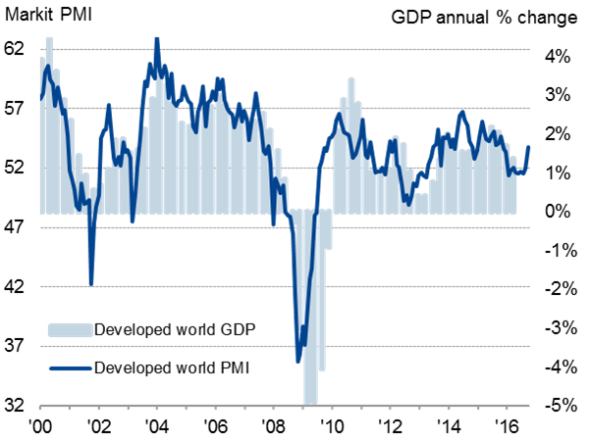

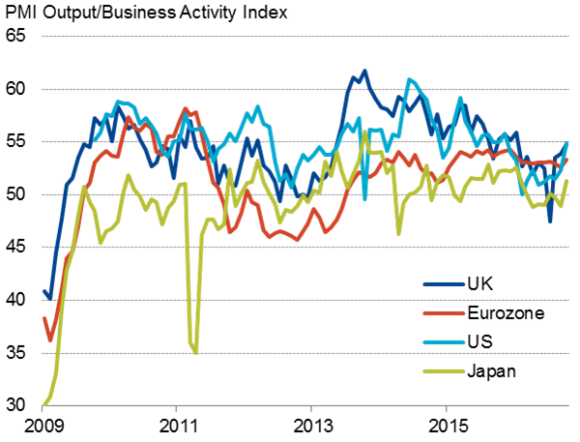

Developed world growth buoyed by broad-based upturn

Growth of developed world business activity was the highest for almost a year, helped by improvements in almost all of the major economies. At 53.8, the developed world PMI was consistent with almost 2% annual GDP growth and contrasted markedly with the 1% growth rate signalled in Q2 and Q3.

US growth accelerated sharply to the highest since last November with a similar robust growth rate seen in the UK, where the expansion was the strongest since January. Eurozone growth also ticked higher, though failed to match the expansions seen in the US and UK. Japan continued to trail behind, but saw growth revive to register the largest monthly upturn since January.

Developed world PMI* & economic growth

Source: IHS Markit.

* PMI shown above is a GDP weighted average of the survey output indices

Sources: IHS Markit, CIPS, Nikkei.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Economics-Global-economic-growth-kicks-higher-at-start-of-fourth-quarter-but-outlook-darkens.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Economics-Global-economic-growth-kicks-higher-at-start-of-fourth-quarter-but-outlook-darkens.html&text=Global+economic+growth+kicks+higher+at+start+of+fourth+quarter+but+outlook+darkens","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Economics-Global-economic-growth-kicks-higher-at-start-of-fourth-quarter-but-outlook-darkens.html","enabled":true},{"name":"email","url":"?subject=Global economic growth kicks higher at start of fourth quarter but outlook darkens&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Economics-Global-economic-growth-kicks-higher-at-start-of-fourth-quarter-but-outlook-darkens.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+growth+kicks+higher+at+start+of+fourth+quarter+but+outlook+darkens http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112016-Economics-Global-economic-growth-kicks-higher-at-start-of-fourth-quarter-but-outlook-darkens.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}