Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 14, 2014

German economy avoids recession, but growth expected to remain subdued

The German economy expanded in the third quarter of 2014, thereby marginally avoiding a recession. However, the goods-producing sector contracted for a second quarter in a row and survey data suggest that growth is likely to remain sluggish in the fourth quarter.

Economy grows slightly in third quarter, but worries persist

Gross domestic product rose 0.1% in the three months to September, following a 0.1% contraction in the second quarter (previously reported as -0.2%). The statistics body Destatis attributed the rise in GDP to increased household consumption and a positive trade balance. However, gross fixed capital formation declined, with a marked fall in investment on machinery and equipment. Construction also fell further. Meanwhile, data for the first quarter were revised slightly higher, up from 0.7% to 0.8%.

Earlier in the week, industrial output data showed that Germany's goods-producing sector fell into a technical recession, with production down 0.3% in the three months to September, following a 1.1% decline in the second quarter.

While the German economy avoided a mild recession despite cutting back spending and investments in infrastructure, the question is whether or not the eurozone's largest member state will be able to sustain growth in the absence of additional capital expenditure.

Trade is another worry. Exports made a good contribution to growth in the third quarter, but if economic growth continues to remain subdued in Germany's main export destinations, and notably many eurozone neighbours, this source of growth is likely to wane. While the UK and the US have performed strongly in recent quarters, France (Germany's main export partner), China, Austria and Italy are not performing as well as German exporters would hope.

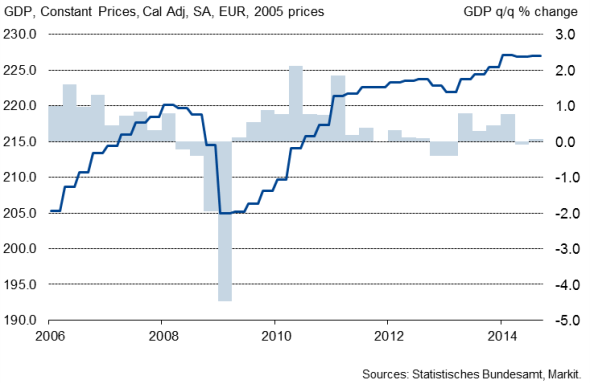

German economic growth

German GDP growth and the PMI

Mixed signals for fourth quarter, but current data point to further growth

Geopolitical tensions also remain a key risk to sustainable growth in the fourth quarter and survey data suggest that economic growth slowed in October, with the Composite PMI Output Index in fact the second-weakest in one year. While it is encouraging that the PMI remains firmly above the 50.0 no-change mark, the big worry is the weak inflow of new business. New order growth slowed to a 15-month low despite a reduction in selling prices, suggesting that output growth might ease even further in the fourth quarter.

November's flash PMI data, released on 20 November should provide further important insights into the performance on Germany's economy in the fourth quarter.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-German-economy-avoids-recession-but-growth-expected-to-remain-subdued.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-German-economy-avoids-recession-but-growth-expected-to-remain-subdued.html&text=German+economy+avoids+recession%2c+but+growth+expected+to+remain+subdued","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-German-economy-avoids-recession-but-growth-expected-to-remain-subdued.html","enabled":true},{"name":"email","url":"?subject=German economy avoids recession, but growth expected to remain subdued&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-German-economy-avoids-recession-but-growth-expected-to-remain-subdued.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+economy+avoids+recession%2c+but+growth+expected+to+remain+subdued http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112014-Economics-German-economy-avoids-recession-but-growth-expected-to-remain-subdued.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}