Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 14, 2017

Business confidence falls to series low in Myanmar

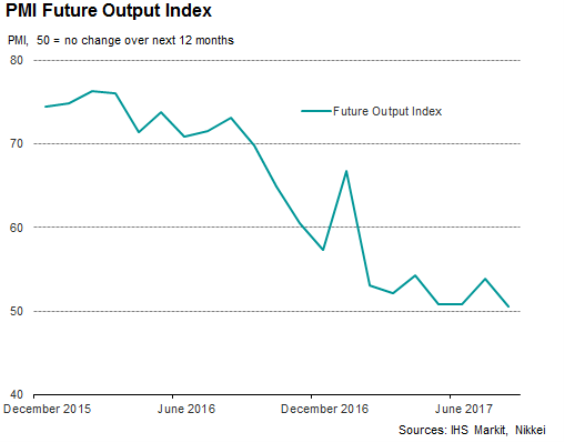

The latest survey data reveal growing uncertainty regarding future output among manufacturers in Myanmar, underpinned by difficult demand conditions. The fall in confidence has been sharp, despite expectations of stronger GDP growth in 2017.

Recent performance

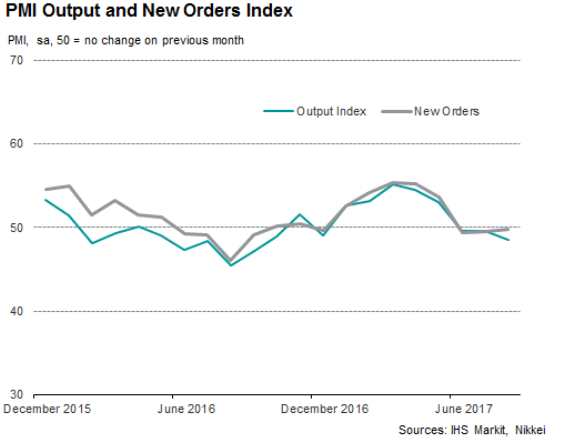

Manufacturing companies in Myanmar indicated a third successive month of deteriorating operating conditions in August. Driven by contractions in production and new orders, the sector is on course for a period of malaise in the third quarter.

Floods and damage to the agricultural industry hit the emerging manufacturing sector in 2016, with the Nikkei Myanmar Manufacturing PMI, compiled by IHS Markit, signalling a strong contraction last August.

Since then, firms in Myanmar indicated solid growth in the early stages of 2017, suggesting the industry had regained momentum. The output, new orders and employment indices all signalled an expansion (on average) throughout the first half of the year. The recent disappointing PMI numbers therefore suggest the upturn has suffered a renewed loss of traction.

Trends in manufacturing

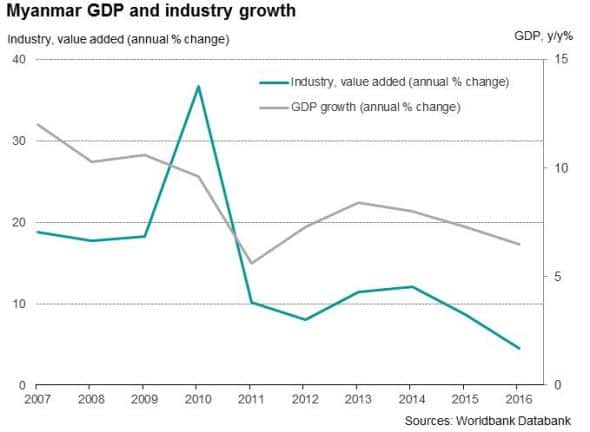

Accounting for just over a quarter (27.5%) of GDP[1] in 2016, goods producers in Myanmar are largely centred around food production, commodity extraction and the processing of natural resources. The main exports produced are natural gas, agricultural commodities and products derived from abundant resources. In total, food processing and the related products made account for two-thirds of total manufacturing output.

Official GDP data likewise indicated that the pace of economic growth moderated in 2016, with the annual figure dropping from 7.3% in 2015 to 6.5% in 2016[1], in line with the weakness in the PMI. Many forecasters expect this figure to rebound in 2017.

IHS Markit currently place GDP growth in 2017 at 7.4%, increasing again in 2018 to 7.5%. This is similar to the trends expected by the IMF and World Bank, who predict GDP growth will average at 7.1% over the next three years. PMI data suggest that the upturn strengthened through the first half of 2017, in line with official forecasts. However, these annual forecasts require the PMI to regain some strength to justify the rosier outlook.

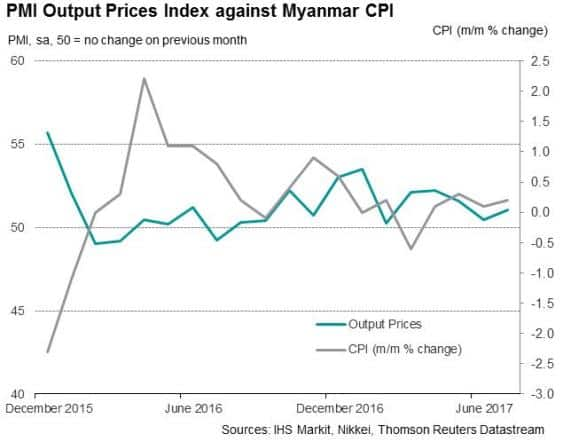

Inflationary pressures continue to rise

Prices also pose an additional concern. After a sharp rise in cost burdens linked to flooding at the end of 2016, input price inflation began to soften as transportation issues and supplier shortages were reduced. That said, producers continue to link higher costs to exchange rate fluctuations and a scarcity of raw materials. Output prices have been rising only modestly, in line with the lack of inflationary pressures signalled by CPI data. Limited overall pricing power, as indicated by the moderate rate of increase in output charges, also suggests that goods producers are facing difficult demand conditions.

Key points going forward

In recent months, Myanmar has been further affected by flooding, reported cases of the H1N1 virus and political disruptions. Although the consensus points towards solid GDP growth in 2017, concerns surrounding scarcity of raw materials and components may begin to impact the manufacturing sector. As has been highlighted by the New Orders, Output and Backlogs of Work Indices, domestic and foreign demand is not currently strong enough and is not supporting the industry sufficiently. Growing pessimism and uncertainty among firms in the sector has been reflected in the Future Output Index, which fell to a series low in August.

In the medium term, policymakers will need to consider schemes that increase productivity across all sectors and prioritise the improvement of infrastructure. Since US sanctions were removed in 2016 firms in Myanmar have faced greater competition from international companies. To remain competitive in the face of multinationals, local firms should look to diversify and expand their product base away from commodity dependence.

Forthcoming data release: Nikkei Myanmar Manufacturing PMI (September) : October 2nd 2017 [1] CIA World Factbook [2] Worldbank

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Economics-Business-confidence-falls-to-series-low-in-Myanmar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Economics-Business-confidence-falls-to-series-low-in-Myanmar.html&text=Business+confidence+falls+to+series+low+in+Myanmar","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Economics-Business-confidence-falls-to-series-low-in-Myanmar.html","enabled":true},{"name":"email","url":"?subject=Business confidence falls to series low in Myanmar&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Economics-Business-confidence-falls-to-series-low-in-Myanmar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Business+confidence+falls+to+series+low+in+Myanmar http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14092017-Economics-Business-confidence-falls-to-series-low-in-Myanmar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}