Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 13, 2017

Nigerian economy returns to growth

A tentative but positive performance in Q2

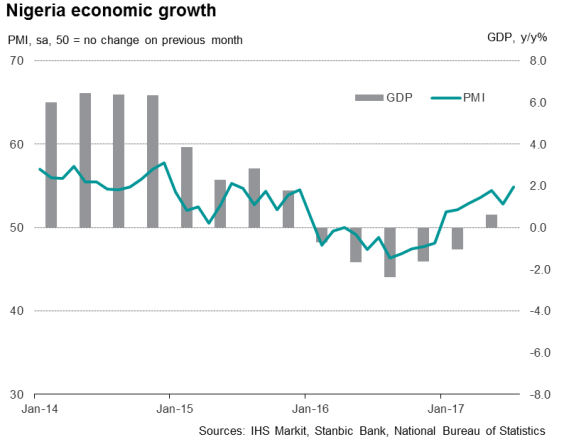

Nigeria has returned to growth in the second quarter of 2017, in line with trend seen in the Stanbic IBTC Bank Nigeria PMI. Furthermore, August data indicate growth may accelerate in the third quarter.

Official GDP growth figures signalled the Nigerian economy returned to growth territory in the three months to June. Figures released by the National Bureau of Statistics (NBS) announced a growth rate of 0.55% year-on-year in the second quarter of 2017. The finding brings an end to the downturn seen throughout the past five quarters in Nigeria; the worst recorded since 1991.

Despite providing some positive news, the latest figure represented only a tentative upturn in the Nigerian economy. Weaknesses in foreign exchange supply, dependence on oil prices and the tight monetary policy agenda continue to weigh on growth. That said, closely watched economic indicators provide insight that growth momentum may continue to build in the third quarter.

Recovery from 2016

For the vast majority of 2016, the PMI survey's output and new orders indices registered below the critical 50.0 no-change mark. During this period, companies frequently remarked that growth was dampened by the slump in oil prices and currency difficulties.

The most recent official data release followed the trend outlined by the Stanbic IBTC Bank Nigeria PMI over the course of 2017 so far. A continual expansion in private sector output has been recorded since January. Furthermore, the headline PMI has continued to gain momentum throughout 2017 so far, indicating the strongest growth for over two years in August.

Stanbic IBTC Bank Nigeria PMI indices

Output price inflation stabilises

Policymakers will meanwhile welcome the survey's news on inflation. In 2017, the Central Bank of Nigeria renewed its commitment to controlling inflation as its priority. The bank has kept its lending rate at a record high of 14% to curb inflation. The results of the tight monetary policy agenda can be seen in the PMI Output Prices Index, which has signalled a marked softening in price pressures since early 2016.

Growth forecast

IHS Markit predicts a real GDP expansion of 0.3% in 2017. Despite being conservative in comparison to the headline Stanbic IBTC Bank Nigeria PMI figure, critical components of the survey such as the Employment Index and the New Export Orders Index remain subdued, thus signalling underlying weaknesses in the Nigerian economy. The next Stanbic IBTC Bank Nigeria PMI will be released on October 4th. The numbers will provide valuable insight into whether the Nigerian economy can maintain its upward growth momentum.

Forthcoming economic data releases:

- September 15th: Inflation rate

- September 29th: Q2 unemployment rate

- October 4th: Stanbic IBTC Bank Nigeria PMI

Sam Teague | Economist, IHS Markit

Tel: +44 14 9146 1018

sam.teague@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-Economics-Nigerian-economy-returns-to-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-Economics-Nigerian-economy-returns-to-growth.html&text=Nigerian+economy+returns+to+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-Economics-Nigerian-economy-returns-to-growth.html","enabled":true},{"name":"email","url":"?subject=Nigerian economy returns to growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-Economics-Nigerian-economy-returns-to-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nigerian+economy+returns+to+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13092017-Economics-Nigerian-economy-returns-to-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}