Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 13, 2017

Asia economic growth regains momentum in March, improving to near three-and-a-half year high

The following is an extract from IHS Markit's Asia monthly economic overview. For the full report please click the link at the bottom of the article.

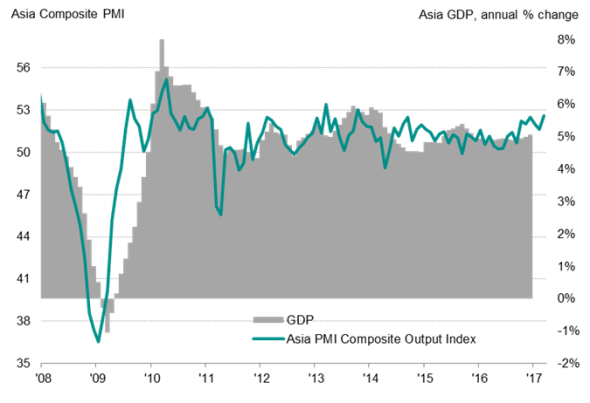

After slowing in the opening two months of the year, Asia economic growth regained some momentum in March, buoyed by the quickest service sector expansion in 2" years. The Asia Composite PMI, compiled by Markit from its various national surveys, rose from February's five-month low of 51.6 to 52.6 in March, its highest in nearly 3" years.

March's upturn meant the average PMI reading for Q1 was the second-strongest since the final quarter of 2013, just behind Q4 2016. Historical comparisons with official GDP data shows the PMI is consistent with Asia's GDP growing at an annual rate of around 5.5% in the first quarter of 2017.

Asia PMI & economic growth

Sources: IHS Markit, Nikkei, Caixin, Thomson Reuters Datastream.

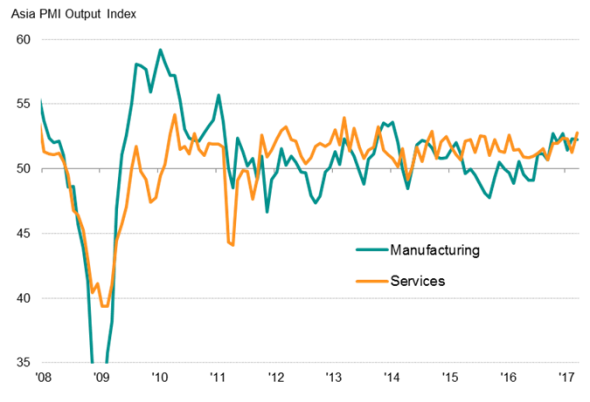

Manufacturing output growth was unchanged since February, with the rate of expansion across Q1 as a whole broadly in line with services.

Manufacturing & service sectors

Sources: IHS Markit, Nikkei, Caixin.

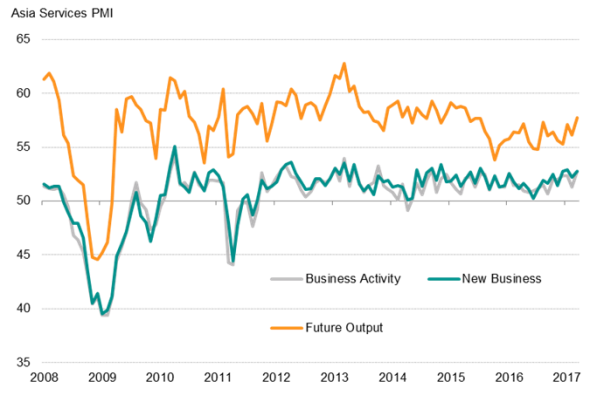

Asia services PMI at 30-month high

After a dip in February, the Asia services PMI rebounded to the highest since September 2014. The faster upturn in services activity coincided with an improvement in business confidence to the strongest in over 1" years.

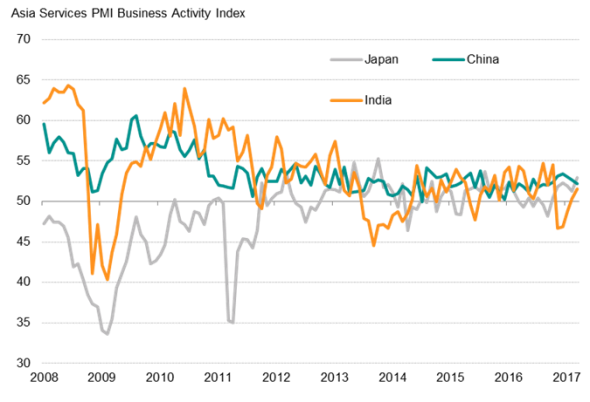

Japan's services economy recorded the fastest rate of expansion among the major Asian economies, with growth at a 19-month high. India meanwhile saw a further recovery in its service sector following the disruption caused by demonetisation. China's services growth eased for a third straight month, though remained solid overall, according to the Caixin PMI.

Asia services PMI

Major Asian economies

Sources: IHS Markit, Nikkei, Caixin

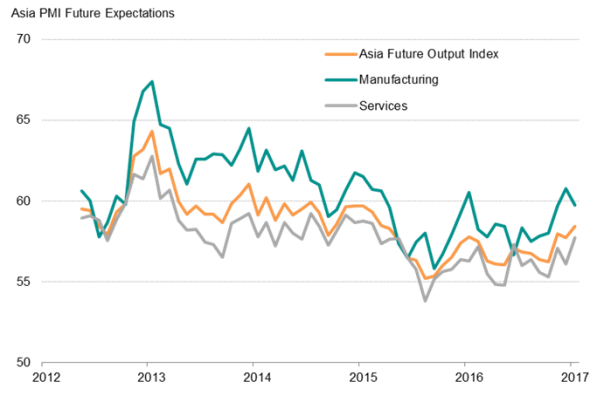

Brighter prospects marred by cost pressures

Forward-looking indicators suggest that the strengthening of Asia growth is poised to extend into the second quarter. Growth in new business accelerated to a 28-month high in March, rounding off the best quarter for nearly seven years.

Business optimism meanwhile reached the highest since May 2015. Greater capacity pressures saw Asia's rate of jobs growth stay at a 3" year high, though still modest overall.

Business expectations

Sources: IHS Markit, Nikkei.

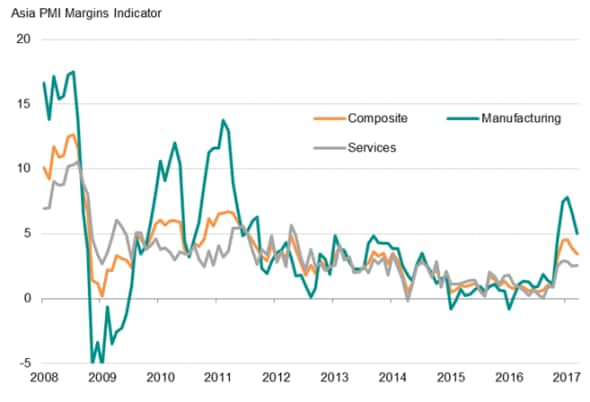

However, cost pressures remained elevated, with manufacturers in particular seeing another sharp (albeit slower) increase in input costs, linked to higher global commodity pricesand, in some cases, weaker domestic currencies.

Asia margins indicator*

* The Asia PMI Margins Indicator is derived from the difference between the PMI Input Price Indices and Output Price Indices.

Sources: IHS Markit, Nikkei.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Asia-economic-growth-regains-momentum-in-March-improving-to-near-three-and-a-half-year-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Asia-economic-growth-regains-momentum-in-March-improving-to-near-three-and-a-half-year-high.html&text=Asia+economic+growth+regains+momentum+in+March%2c+improving+to+near+three-and-a-half+year+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Asia-economic-growth-regains-momentum-in-March-improving-to-near-three-and-a-half-year-high.html","enabled":true},{"name":"email","url":"?subject=Asia economic growth regains momentum in March, improving to near three-and-a-half year high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Asia-economic-growth-regains-momentum-in-March-improving-to-near-three-and-a-half-year-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia+economic+growth+regains+momentum+in+March%2c+improving+to+near+three-and-a-half+year+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Asia-economic-growth-regains-momentum-in-March-improving-to-near-three-and-a-half-year-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}