Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2015

Week Ahead Economic Overview

The week sees the release of flash PMI data for Japan, the eurozone and the US, all of which will provide fresh evidence on the health of the global economy. Other highlights include fourth quarter GDP numbers for Japan, a labour market update in the UK, inflation numbers across Europe and minutes from the latest monetary policy meetings in the UK and the US.

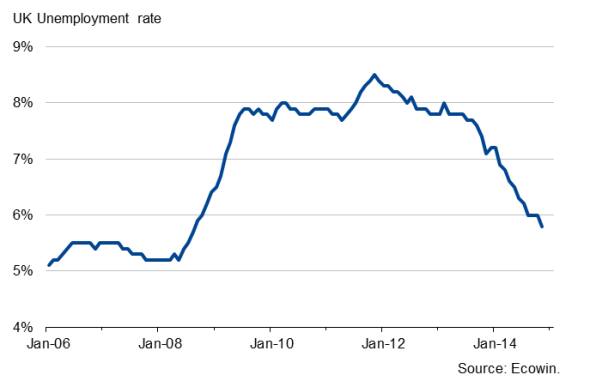

In the UK, eyes will be focused on the Bank of England. The minutes from February's Monetary Policy Committee meeting will be released on Wednesday alongside the latest batch of labour market data. The minutes are likely show that all nine committee members again voted to keep policy on hold, despite PMI survey data signalling a reassuringly robust start to the year for the UK economy.

UK policymakers want inflation to remain low to help boost consumer spending and drive growth, but don't want low inflation to feed through to weaker wage negotiations. Data on Tuesday are due to show UK inflation falling further after already dropping to a fourteen-and-a-half year low of 0.5% in December, and Mark Carney has stated that it "is more likely than not to turn negative at some point in the spring". The labour market data published on Wednesday will therefore be especially closely watched to see how pay growth is developing. Any signs of wage growth faltering will fuel speculation that the next move in UK interest rates may even be a cut.

The minutes from the January Federal Open Market Committee will also be scoured on Wednesday for guidance on US interest rate policy. Economic data for the US have been mixed in recent months. Recent PMI survey data and retail sales figures point to the weaker pace of economic growth seen in at the end of last year persisting into the new year, but buoyant job market data leave the door open for a first hike in interest rates in the summer.

UK unemployment

US manufacturing output and the PMI

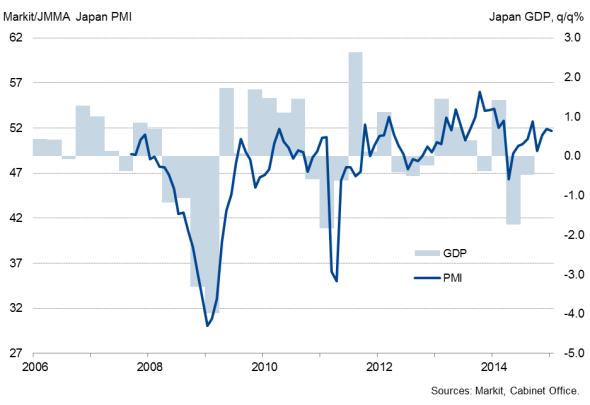

Japan GDP and the PMI

US policymakers will also be looking at the release of industrial production data and flash Manufacturing PMI results for further indications of US economic health.

In Japan, GDP data for the final quarter of last year are released, which are expected to show that the economy pulled out of recession after GDP fell 1.7% and 0.5% in the second and third quarters respectively. PMI survey data have been more positive in recent months and indicated a return to growth at the end of 2014. Flash Manufacturing PMI data for February will give clues as to whether the economy has been able to maintain this growth in the first quarter.

Flash PMI data are also released for the eurozone. January's data showed that the currency bloc enjoyed a positive start to 2015, as growth of economic activity accelerated to the highest for six months. While Spain and Ireland were the stand-out performers, growth also picked up in Germany and Italy. It's possible that the announcement of quantitative easing by the ECB will have boosted the economy by lifting business and household confidence, but it's unclear how much any beneficial impact might be offset by risk aversion arising from uncertainty over Greece and Russia.

China's flash PMI publication is delayed due to the Lunar holidays.

Composite PMI Output Index

Monday 16 February

Fourth quarter GDP numbers and industrial output data are published in Japan, while India sees the release of wholesale price figures.

Meanwhile, the Bank of Scotland Report on Jobs is out.

In Russia, industrial production figures are issued.

Tuesday 17 February

In China, house price data are released.

Inflation numbers are meanwhile out in Greece and the UK.

An update on Italy's trade balance is provided by ISTAT.

Economic sentiment data for Germany and the eurozone are published by ZEW.

The US sees the release of the latest NAHB Housing Market Index.

Wednesday 18 February

In India, M3 money supply information are issued.

The UK Household Finance Index is released by Markit, while the Bank of England publishes minutes from its February meeting and unemployment data are also out.

The European Central Bank's Governing Council meet, but no interest rate decision is scheduled.

Unemployment numbers are meanwhile the highlight in Russia.

In South Africa, retail sales figures and inflation numbers are out.

Canada sees the release of wholesale trade data, while payroll job growth numbers are issued in Brazil.

In the US, industrial production figures are released alongside housing starts data and producer price numbers. Furthermore, the FOMC releases minutes from its latest meeting.

Thursday 19 February

In Japan, trade data are updated.

Current account numbers and consumer confidence data are released for the euro area.

Inflation figures are meanwhile out in France.

The Confederation of British Industry releases orders data.

Initial jobless claims numbers and the Conference Board Leading Indicator are issued in the US.

Friday 20 February

The UK House Price Sentiment Index and Flash PMI results for Japan, the eurozone and the US are released by Markit.

The Reuters Tankan Index is issued in Japan.

Producer price numbers are out in Germany, while Greece sees the publication of current account data.

Retail sales figures are issued in the UK and Canada.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13022015-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}