Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 12, 2017

Zambian employment growth hits two-year high as recovery continues

Zambian companies took on staff at the fastest pace in just over two years in August, according to survey data, amid sustained expansions in output and new orders. This adds to growing signs that the economy is in an improving phase at present.

Output continues to rise

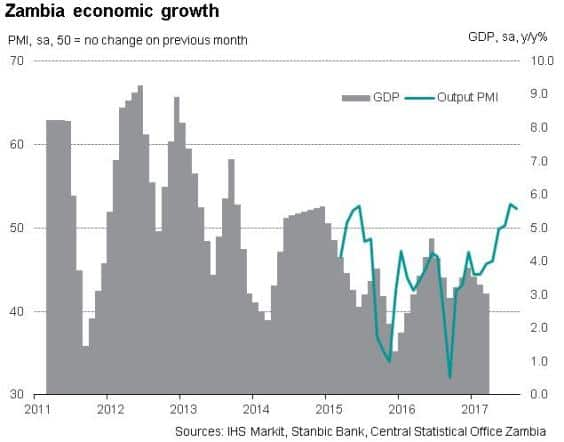

The Stanbic Bank Zambia PMI, compiled by IHS Markit, signalled that output increased for the third month running, with the rate of expansion solid again in August. The latest data support recent evidence that Zambian economic growth has gathered pace during 2017.

Output growth continued to reflect increases in new orders. New business has risen in each month since April. Sustained expansions in workloads added to business confidence, with firms showing signs of being increasingly willing to invest in their workforces to expand capacity. The rate of job creation quickened to the fastest in just over two years in August.

Discounts help to support growth

Comments from panellists suggested that price discounting had helped to boost new orders in the latest survey period as firms attempted to attract customers. Output prices decreased at the fastest pace since the survey began in January 2014, dropping for the sixth month running. Companies will hope that improvements in demand continue in coming months, reducing the need for discounting.

Reasons cited by companies for reductions in output prices in August

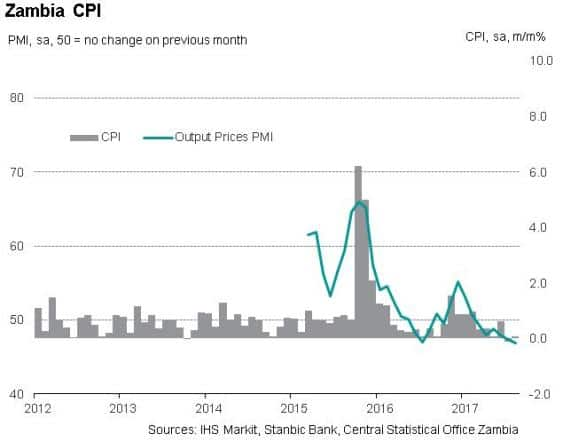

Companies were able to reduce charges due to a lack of cost inflation. Overall input prices rose only slightly, with inflationary pressures much weaker than in 2015 and at the end of 2016.

The lack of inflationary pressures signalled by the PMI data is matched by official consumer price data. The Zambian economy continues to benefit from the strong rebound in international commodity prices leaving the kwacha exchange rate 10.5% stronger against the U.S. dollar during the first eight months of 2017.

Good rainfall has furthermore lifted agricultural production significantly, while improved local food supply left food prices down and pulled headline inflation into single digits at 6.3% by August from 19.6% for the same period a year ago.

Outlook continues to brighten

Alongside improvements in demand and moderating inflation, hydro-electrical power supply also strengthened, boosting overall manufacturing and mining output. The finalisation of a future IMF support program is likely to send a strong signal to investors and anchor the country's fiscal consolidation path moving forward. The positive sentiment has spilled over to improved employment conditions in the economy and will be a boost to the country's consumer market in the near term.

The PMI data for September will be release on October 4th, completing the picture of the Zambian economy for the third quarter of the year.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-Economics-Zambian-employment-growth-hits-two-year-high-as-recovery-continues.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-Economics-Zambian-employment-growth-hits-two-year-high-as-recovery-continues.html&text=Zambian+employment+growth+hits+two-year+high+as+recovery+continues","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-Economics-Zambian-employment-growth-hits-two-year-high-as-recovery-continues.html","enabled":true},{"name":"email","url":"?subject=Zambian employment growth hits two-year high as recovery continues&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-Economics-Zambian-employment-growth-hits-two-year-high-as-recovery-continues.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Zambian+employment+growth+hits+two-year+high+as+recovery+continues http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12092017-Economics-Zambian-employment-growth-hits-two-year-high-as-recovery-continues.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}