Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 12, 2017

Decade-high growth for European consumer goods producers lifts corporate earnings prospects

The latest PMI figures for the European Union have been notably positive, driven by six-year high growth in the euro area during the second quarter. The Consumer Goods sector has emerged as one of the main contributors to the region's strong performance. With a PMI of 55.9, the sector recorded its fastest expansion in over ten years in June. The brightening picture is the result of an overall boost in new orders amid a strengthening labour market, and coincides with a slowing in the rate of input price inflation.

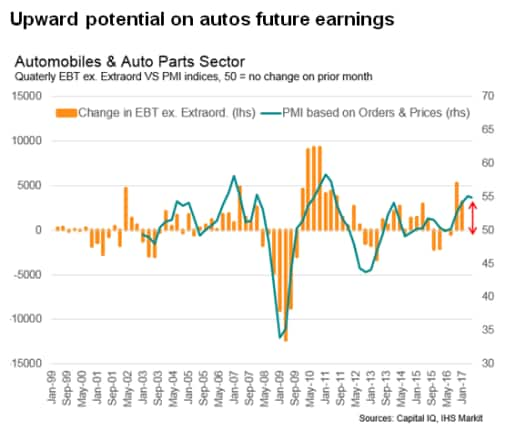

The detailed sector PMI data give investors precious, unique information on future corporate earnings. For example, the Automobiles & Auto Parts PMI is indicating robust company earnings in the sector in the very near-term.

Strong new order growth

Similar to the headline PMI, the New Orders Index for the Consumer Goods sector rose to its highest in over ten years in June, at 57.2. The outstanding performance was led by two constituent sectors, Beverages and Automobiles & Auto Parts, with the latter recording the strongest new order growth for three-and-a-half years. Compared with the summer of 2016, when the PMI data were indicating only moderate growth, the surveys are now implying a stronger upturn and a more promising outlook for corporate earnings.

Cost pressures are decreasing

Costs pressures in the economy have meanwhile softened for the past four months. Looking at the Consumer Goods sector as a whole, the Input Prices Index has pulled back from a peak of 70.2 in February to 58.9 in June. The easing trend signals less upward pressure on companies' costs and points to a boost in their profits, with the Output Prices Index rising to a joint 70-month high in June.

The decline of the Input Prices Index has been sharper for the Automobiles & Auto Parts sector than for Beverages companies, reflecting the former's greater exposure to metal prices. However, the trends in the Output Prices Indexes indicate that the Beverages sector is more prone to passing higher costs onto customers. To illustrate the argument, for the past two months the rate of increase of prices charged by Beverages firms has exceeded that of input costs.

Corporate earnings should grow for Autos

The PMI data can be an excellent indicator for tracking company earnings within a sector. As shown in the final chart of the note, a composite index combining the New Orders, Backlogs of Work and Output Prices Indexes for the Automobiles & Auto Parts sector is well correlated with the quarterly changes of earnings before tax (ex.-extraordinary) of the 14 biggest companies in terms of market capitalisation.

Based on the growth in new orders and the positive trends for output prices, the data suggest that future earnings for Automobiles & Auto Parts companies should continue to grow in the near-term. This provides an opportunity for investors to compare this PMI earnings potential against analysts' forecasts and look for positive or negative surprises.

See more in the download below.

Mathieu Ras | Economist, IHS Markit

Tel: +442072602145

mathieu.ras@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072017-Economics-Decade-high-growth-for-European-consumer-goods-producers-lifts-corporate-earnings-prospects.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072017-Economics-Decade-high-growth-for-European-consumer-goods-producers-lifts-corporate-earnings-prospects.html&text=Decade-high+growth+for+European+consumer+goods+producers+lifts+corporate+earnings+prospects","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072017-Economics-Decade-high-growth-for-European-consumer-goods-producers-lifts-corporate-earnings-prospects.html","enabled":true},{"name":"email","url":"?subject=Decade-high growth for European consumer goods producers lifts corporate earnings prospects&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072017-Economics-Decade-high-growth-for-European-consumer-goods-producers-lifts-corporate-earnings-prospects.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Decade-high+growth+for+European+consumer+goods+producers+lifts+corporate+earnings+prospects http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12072017-Economics-Decade-high-growth-for-European-consumer-goods-producers-lifts-corporate-earnings-prospects.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}