Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 12, 2015

Euro area industry grows less than expected in April

Weak industrial production data are a reminder of the fragility of the euro area economy, but should not be a cause for excess pessimism. In fact, the data include some promising signs of life for the sustainability of the region's recovery.

The euro area's industrial sector grew less than expected in April, eking out only modest growth of 0.1% after a steeper than previously though 0.4% decline in March, according to Eurostat.

The marginal expansion in April comes as a disappointment compared to expectations of a 0.3% rise, but one that looks better once we dive into the data. In particular, there are signs that companies are restocking and investing more in equipment such as computers, plant and machinery.

The weakness was driven by a 1.6% fall in energy production, most likely linked to the lower oil price, and 0.8% drop in non-durable consumer goods. More promisingly, production of capital goods such as computers, plant and machinery rose 0.7%, and output of durable consumer goods jumped 1.0%, both sectors enjoying the largest rises since December. Production of intermediate goods meanwhile rose 0.3%, also the largest increase in 2015 so far, suggesting that manufacturers are restocking.

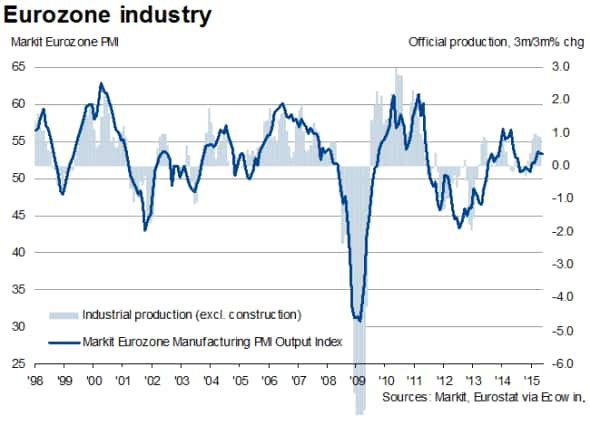

The data also tend to be quite volatile, so it's preferable to look at the three-month trend to get a better idea of growth momentum. The data show production rising 0.9% in the three months to April compared to the prior three months, meaning the euro area's industrial sector has been enjoying the strongest rate of growth for two years so far this year, though thanks largely due to a strong 1.0% rise in February.

Temporary soft-spot

The current spell of weakness also looks to be only temporary. Markit's PMI survey data indicate that the manufacturing economy enjoyed further growth of output and order books in May, albeit with the rates of expansion remaining relatively weak by historical standards and failing to accelerate. Worries about Greece and, in northern Europe, sanctions with Russia, are likely to be constraining, but not quashing, growth.

The region still looks to be on course to grow by a reasonable but unexciting 0.3-0.4% in the second quarter, building on the steady expansions seen since the third quarter of last year.

The ECB will not be overly worried by the weakness seen in the official data in March and April, focusing on the stronger underlying trend and the positive signs from the business surveys. However, the bank will inevitably be watching carefully for signs of any further softening of the survey data, especially if uncertainty regarding Greece intensifies.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-Euro-area-industry-grows-less-than-expected-in-April.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-Euro-area-industry-grows-less-than-expected-in-April.html&text=Euro+area+industry+grows+less+than+expected+in+April","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-Euro-area-industry-grows-less-than-expected-in-April.html","enabled":true},{"name":"email","url":"?subject=Euro area industry grows less than expected in April&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-Euro-area-industry-grows-less-than-expected-in-April.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Euro+area+industry+grows+less+than+expected+in+April http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-Euro-area-industry-grows-less-than-expected-in-April.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}