Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 11, 2017

Official data for UK add to picture of manufacturing strength and construction woes

Official data on the output of manufacturing and construction in October highlight the divergent trends in the UK economy, as rising exports boost the goods producing sector but weak domestic demand hinders the construction industry. The data are in line with PMI survey data, which indicate that the divergence persisted into November.

Best manufacturing spell for a decade

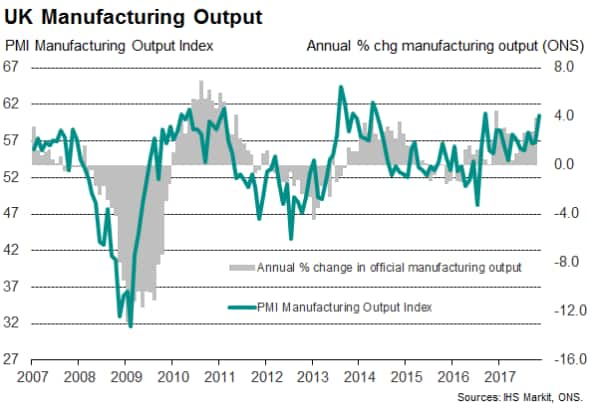

The data from the Office for National Statistics found manufacturing output rising just 0.1% in October, but the rise came on the back of a 0.7% surge in September. The October increase takes output up a healthy 1.2% in the latest three months compared to the prior three months, its best performance since the three months to February. The health of the manufacturing sector is underscored by output having now risen for six consecutive months, representing the longest period of sustained growth for over a decade.

The manufacturing upturn tallies with PMI survey data, which show the sector to have been faring well in 2017, enjoying the twin tailwinds of the weaker currency and resurgent demand in the UK's main trading partner, the eurozone, which is enjoying its best year since 2010. Growth in fact even picked up further in November, according to the latest data.

The upturn also puts to bed ill-founded worries earlier in the year (recorded in the media and fueled by analysts focusing on noisy, volatile official data) that manufacturing was sliding back into another downturn.

Key to the difficulty in interpreting the trend in the official output data has been major changes in the 'lumpy' production of the auto industry, with weakness earlier in the year replaced with an export-led growth spurt in recent months.

When looking for signals from the official data, it's worth bearing in mind that periods of sustained downturns, the extent to which takes the annual rate of growth of manufacturing output into negative territory, have only ever been recorded when the PMI survey's output index has fallen below 52.6 for more than one month. All other occasions have proved to be brief downturns that have soon been reversed. The lowest the PMI output index hit this year was 54.3, back in March.

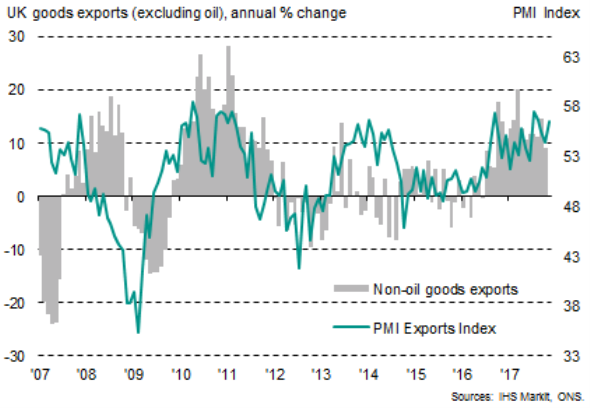

Export gains

Trade statistics meanwhile showed imports rising more than exports in the three months to October, widening the trade deficit, but exports were nonetheless on the rise, as has also been indicated by the survey data. The PMI's export orders index has so far recorded the best year of overseas sales since 2010, with robust growth persisting into November. The official data have been more volatile, but have also shown signs of improving exports. The October trade data showed exports up 9.1% on a year ago, having risen 4.6% in the latest three months.

UK goods exports

Construction 'recession'

While the news on manufacturing and exports has been encouragingly upbeat in recent months, the opposite applies to the building sector. Official data showed construction output down 1.7% in October after a similar drop in September. That leaves construction output down 1.4% in the latest three months compared to the prior three months, and suggests that the sector could see its technical recession extend into the fourth quarter.

The construction sector weakness had ben trailed in advance by the PMI survey, with both also tallying on the details of the current construction environment. While house building and industrial construction has provided a recent support to the sector, commercial building has been especially weak. In particular, the ONS data have shown new construction work for industrial buildings up 16.5% in the latest six months, but commercial building is down 8.3% over the same period. As such, the data likely highlight the diverging trend of manufacturing and the rest of the economy, to show how non-manufacturing businesses appear to be pulling-back on investing in new offices and retail space.

Lack of optimism

The services sector was not covered by the latest ONS data, but the PMI surveys have shown resilient growth in recent months. Worryingly, however, the surveys also reveal that optimism about future growth remains historically weak, linked to Brexit anxiety and perhaps helping to explain the lack of appetite to invest in new fixed assets.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122017-Economics-Official-data-for-UK-add-to-picture-of-manufacturing-strength-and-construction-woes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122017-Economics-Official-data-for-UK-add-to-picture-of-manufacturing-strength-and-construction-woes.html&text=Official+data+for+UK+add+to+picture+of+manufacturing+strength+and+construction+woes","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122017-Economics-Official-data-for-UK-add-to-picture-of-manufacturing-strength-and-construction-woes.html","enabled":true},{"name":"email","url":"?subject=Official data for UK add to picture of manufacturing strength and construction woes&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122017-Economics-Official-data-for-UK-add-to-picture-of-manufacturing-strength-and-construction-woes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Official+data+for+UK+add+to+picture+of+manufacturing+strength+and+construction+woes http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122017-Economics-Official-data-for-UK-add-to-picture-of-manufacturing-strength-and-construction-woes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}