Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 11, 2014

Retail sales upturn adds to picture of ongoing US economic buoyancy

Robust retail sales growth adds to signs that the US economic upturn continues to impress as we move towards the end of the year. However, the data also raise the likelihood of more policymakers being persuaded to start raising interest rates.

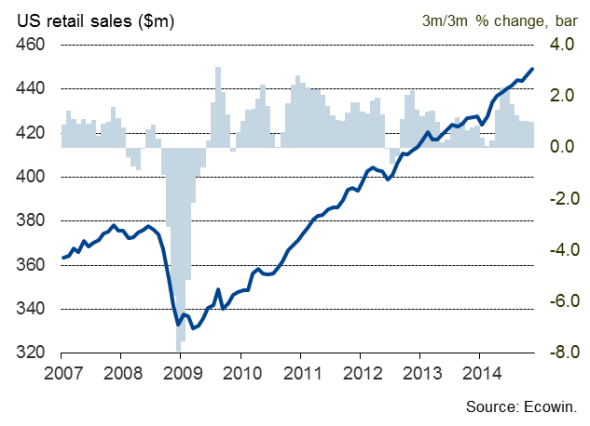

Sales rose 0.7% in November following a 0.5% rise in October, according to the Commerce Department, pushing sales some 5.1% higher than a year ago. The monthly increase was the largest seen since March while the annual rate of increase is the fastest since July of last year.

Core sales, which exclude autos, gasoline, building materials and food services, rose 0.6%, up marginally from the 0.5% rise seen in October.

Retail sales in the fourth quarter are so far running 1.0% higher than in the third quarter on average, suggesting consumer spending will help drive yet another healthy GDP increase in the final quarter of the year.

Retail sales

Ongoing economic surge in fourth quarter

The upturn in sales supports survey evidence that the economy's recent growth surge is showing few signs of stalling, despite a gloomier-looking global economy. We expect, however, that the upturn is cooling compared to the heady rates of expansion seen in the summer. Markit's US PMI surveys point to GDP growth slowing to approximately 2.5% in the fourth quarter. That follows GDP growth of 4.6% in the second quarter and 3.9% in the third quarter.

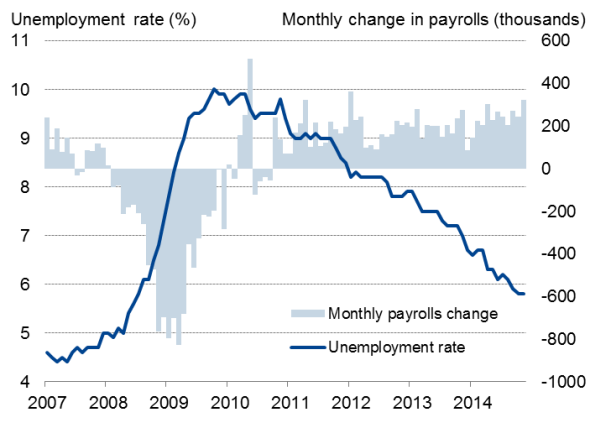

Spending is being driven by an improved labour market, with rising employment helping to bring down the jobless rate and boosting incomes. Job growth smashed expectations in November, with non-farm payrolls rising 321,000 to register the largest rise since the start of 2012. Pay growth picked up to 2.1%, clearly remaining subdued by historical standards, but at least moving in the right direction and overall incomes (when we consider the increase in the number of people now earning) is clearly rising.

Labour market

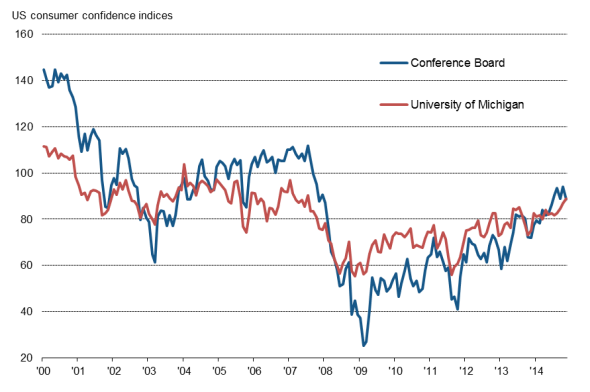

Consumer confidence measures have unsurprisingly risen, running at their highest levels for nearly seven years in recent months, which should help sustain spending growth. Falling oil prices should also help boost household spending on items other than fuel.

Consumer confidence

Sources: Univ. of. Michigan, Conference Board via Ecowin

Rate rises

With the economy set to another period of robust economic growth in the fourth quarter, job creation accelerating and consumer spending rising at a brisk pace, there are plenty of arguments to support the case for the US to move off emergency-loose policy and for interest rates to start rising gradually. Such action would also avoid the potential for steeper rises in future.

There are clearly few inflationary pressures, and oil price falls mean inflation should cool further in coming months, suggesting there is no imminent need for rates to rise, but Fed rhetoric is likely to increasingly point to a scenario where rates start rising in mid-2015.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Retail-sales-upturn-adds-to-picture-of-ongoing-US-economic-buoyancy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Retail-sales-upturn-adds-to-picture-of-ongoing-US-economic-buoyancy.html&text=Retail+sales+upturn+adds+to+picture+of+ongoing+US+economic+buoyancy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Retail-sales-upturn-adds-to-picture-of-ongoing-US-economic-buoyancy.html","enabled":true},{"name":"email","url":"?subject=Retail sales upturn adds to picture of ongoing US economic buoyancy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Retail-sales-upturn-adds-to-picture-of-ongoing-US-economic-buoyancy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retail+sales+upturn+adds+to+picture+of+ongoing+US+economic+buoyancy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Economics-Retail-sales-upturn-adds-to-picture-of-ongoing-US-economic-buoyancy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}