Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 11, 2016

Week Ahead Economic Overview

In a week that sees markets continue to digest Donald Trump's victory to become the 45th president of the United States, the release of inflation, industrial production and retail sales numbers will help guide Fed policy in the US. Meanwhile, third quarter GDP results are out in Japan and the eurozone, while the Office for National Statistics publishes updated UK labour market data.

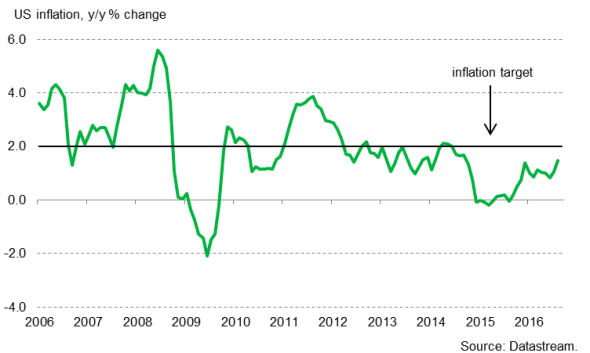

After leaving interest rates unchanged at its November meeting, the Fed said it expects US inflation to reach the bank's target of 2% in the "medium-term" and also added that the case for a rate hike "has continued to strengthen". Although markets are pricing in a lower probability of the Fed hiking in December following the US election, a tightening next month still looks very likely barring any significant financial market volatility. Consumer price figures and employee earnings data for October, released on Thursday will therefore be important steers to monetary policy. In September, inflation stood at 1.5% and average hourly earnings rose 2.8% (the biggest increase since mid-2009), suggesting that a tightening labour market is finally beginning to benefit workers.

US inflation

More information on US consumer spending and industry trends can meanwhile be gauged from updated industrial production and retail sales data. Although retail sales rebounded in September, over the third quarter as a whole sales were up just 0.7%, which is less than half of the 1.5% expansion seen in the second quarter. Meanwhile, US industry saw some signs of renewed life, as manufacturing production increased 0.3% in the three months to September (from -0.3% in the second quarter).

In the lead up to Philip Hammond's first Autumn Statement on November 23rd, analysts will be scrutinising the UK economic data flow in the next two weeks. The Office for National Statistics publishes updates on the UK labour market, inflation and retail sales during the week.

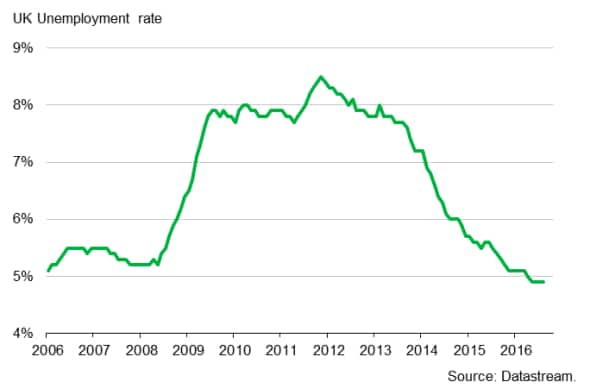

A strong labour market has been one of the features of the UK's economic upturn, with the jobless rate down to an 11-year low of 4.9%. However, there are some signs that the labour market is starting to cool slightly, with the single-month measure of unemployment at 5.0% and the number of people out of work rising by 10,000 in September. Despite PMI data signalling a slight acceleration in employment growth in October, the rate of job creation nevertheless remains far weaker than earlier in the year.

UK unemployment rate

Meanwhile, with the UK PMI measure for input prices experienced its largest monthly gain in 20 years of data collection, which was attributed by the majority of survey respondents to the weak pound driving up import prices. Moreover, with the Bank of England raising its inflation forecast, it is likely that we will see an acceleration in growth of consumer prices. The ONS releases official figures for October on Tuesday.

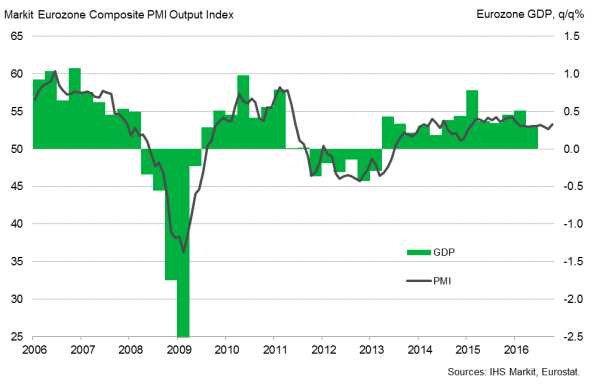

Over in the eurozone, third quarter GDP results are updated by Eurostat. A preliminary estimate showed the region's economy growing 0.3%. The national statistics bodies of France and Spain reported GDP growth of 0.2% and 0.7% respectively, and the Tuesday release will include more national detail. PMI data suggest that it is unlikely that German economic growth has accelerated from the 0.4% pace seen in the second quarter, while data for Italy point only to a mere 0.1% expansion. Other important euro area data releases include final inflation figures for October (the initial estimate showed inflation of 0.5%, which was the strongest in over two years) and industrial production and trade numbers.

Eurozone GDP and the PMI

Third quarter GDP results are also out in Japan. Although signs of recovery from Japan's industrial production have appeared and October's PMI results add to hopes that the country has lurched back into life at the start of the fourth quarter, it is likely that third quarter economic growth will only be slight at best (dragged down by adverse weather). Moreover, IHS Markit predicts Japan's real GDP to continue growing only modestly in the second half of 2016 through to 2018. It is therefore likely that the Bank of Japan will continue with its ultra-loose monetary policy in order to stimulate economic growth.

Monday 14 November

Preliminary third quarter GDP results are out in Japan, and Russia.

Industrial production numbers are released in Japan and China, with the latter also seeing the publication of retail sales figures.

Eurostat issues industrial production data for the currency union.

In Germany, wholesale price figures are updated, while Italy sees the release of consumer price numbers.

UK regional PMI results are published.

Tuesday 15 November

Inflation figures are issued in India.

Labour market data are published in South Africa.

Third quarter GDP results are updated in the eurozone (including national data).

ZEW releases economic sentiment data for Germany.

In France, Spain and the UK latest inflation numbers are out.

Retail sales and business inventory figures are meanwhile published in the US.

Wednesday 16 November

In Australia, wage inflation numbers are published.

Russia sees the release of industrial production data.

Retail sales figures are meanwhile issued in South Africa.

Labour market data are updated by the Office for National Statistics in the UK.

Information on the health of Brazil's service sector is released.

In Canada, manufacturing sales numbers are out.

Industrial production and mortgage data are published in the US.

Thursday 17 November

Labour market data are updated in Australia.

Inflation figures are released in the eurozone.

Meanwhile, unemployment numbers are published in France.

Trade balance data are out in Italy.

In the UK, retail sales figures are released.

Initial jobless claims, inflation and real earnings data are published in the US.

Friday 18 November

House price figures are updated in China.

In Russia, inflation, retail sales and unemployment data are released.

Current account figures are out in the eurozone.

Germany sees the publication of producer price numbers.

The UK Household Finance Index is released.

Consumer price data are meanwhile out in Canada.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11112016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}