Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 11, 2015

UK election outcome boosts credit markets

The Conservative party claimed an unexpected majority win following last week's general election, buoying equity, currency and credit markets.

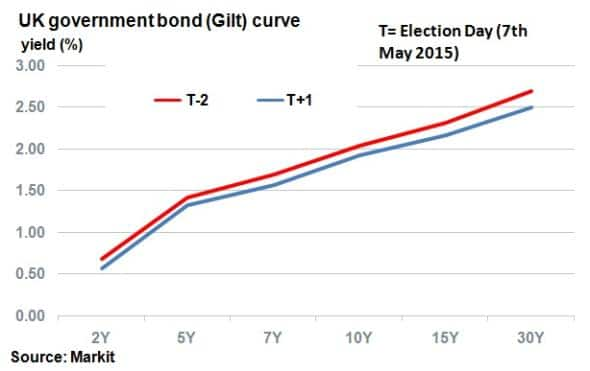

- The UK gilt curve tightened across the term, with the long end benefitting the most

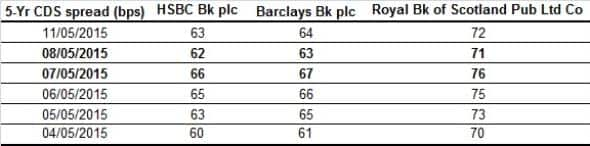

- UK banks saw a 4-5 bps drop in credit spreads, erasing pre election jitters

- The Markit iBoxx " Health Care index saw a 1.15% day jump, the best performing sector

A weekend has passed since the UK's general election, allowing time for investors to digest last Thursday's surprising result. The victory confounded opinion polls, which had suggested another hung parliament. This uncertainty leading up to the election resulted in an increased level of volatility in the markets.

The surprise election result was welcomed by investors on two fronts. Firstly, the majority victory led to the elimination of any near term uncertainty around the consequences of a hung parliament. Secondly, Conservative policies are generally seen as more business-friendly than those of the main opposing parties.

Asset classes across the board rallied. The FTSE 100 index adding over 200 points in 24 hours and the pound strengthened against the US dollar and euro. The fixed income market also welcomed the news.

Sovereign credit

The gilt market tightened across the term structure. Uncertainty around the result led to increased levels of volatility in the run up to the election. The 30-yr rate shifted 18bps tighter from the three days pre election to the day after the election.

10-yr yields, as represented by the 5% coupon UK gilt maturing in 2025 yielded 1.84% at the start of last week, dashing towards 1.98% mid week, before closing at 1.87% post election. UK 5-yr CDS spreads also inched tighter.

Corporate credit

The tightening was also seen on the corporate credit side. UK banks saw their 5-yr CDS spreads tighten across the board last Friday. The main opposition party, Labour, had threatened the breakup of large banks, a potential one off bonus tax and higher bank levy's. HSBC, Barclays and RBS all saw their 5-yr CDS tighten, eliminating risks that were associated with pre election jitters.

On the cash side, the best performing sector was healthcare, as represented by the Markit iBoxx " Health Care index. The price level increased 1.15% on the back of the election result. Labour had promised to roll back privatisation in the sector, and post-election tightening reflects relief from bond investors.

The election also boosted Utilities, which was the second best performing sector. Opposition parties had threated energy price caps which would have dented profitability.

But long term risks remain

While the election result has boosted markets, risks in the medium and long term remain. The Conservatives have promised an EU referendum in 2017, which could lead to businesses holding back plans for expansion. There is also threat of a second Scottish referendum with the Scottish Nationalist Party gaining considerable power. Further ashore, problems in Greece and tepid global growth remain, but the market seems to be taking these in its stride for now.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-credit-uk-election-outcome-boosts-credit-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-credit-uk-election-outcome-boosts-credit-markets.html&text=UK+election+outcome+boosts+credit+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-credit-uk-election-outcome-boosts-credit-markets.html","enabled":true},{"name":"email","url":"?subject=UK election outcome boosts credit markets&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-credit-uk-election-outcome-boosts-credit-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+election+outcome+boosts+credit+markets http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-credit-uk-election-outcome-boosts-credit-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}