Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 08, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

- Leveraged frackers see short sellers retreat amid oil's recent price recovery

- But biofuel producer Pacific Ethanol sees renewed shorting activity amid expansion

- Japanese watch maker Casio remains the most shorted in Apac

North America

Oil & gas stocks in North America continue to be among the most shorted ahead of earnings even as WTI prices continue to rally and are up by almost 20% since the beginning of March.

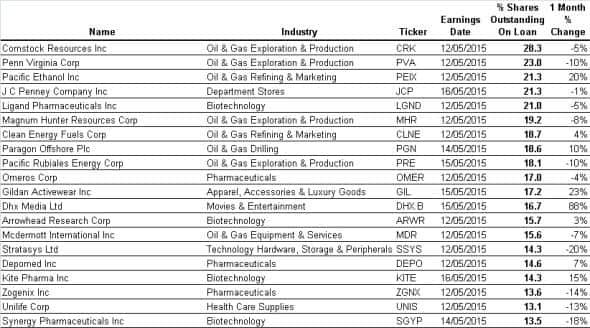

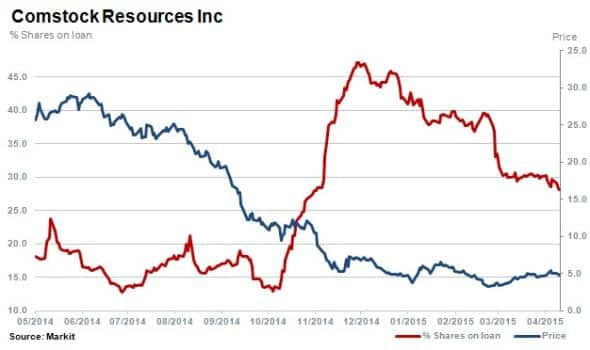

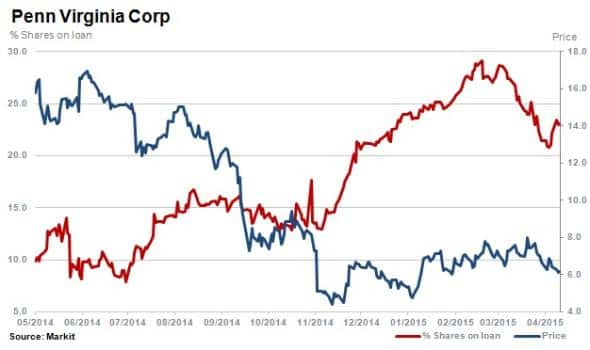

Financially geared alternative oil & gas producers Comstock Resources and Penn Virginia group have 28% and 23% of shares outstanding on loan respectively. Both companies have however seen short sellers cover positions in recent weeks as oil prices increased.

Investors in energy companies might be consoled by the recent rally in the oil price, but earnings forecasts and market sentiment overall remain negative. More turbulent times may lie ahead for bond and equity investors, particularly in the fracking industry.

Consensus analyst forecasts for Comstock expect a 40% decline in full year revenues and a tripling of last year's net losses with a per share estimated loss for the first quarter of $0.91 and $4.24 for the full year. Shares in the company have already decreased by 82% in the last 12 months.

With similar exposure to oil & gas assets Penn Virginia continues to see high levels of shorting activity, but has seen short interest retreat from highs close to 30% reached in mid-March, down to 23% currently.

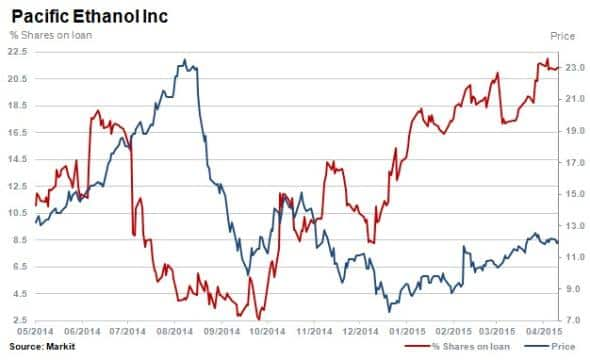

Pacific Ethanol is the third most shorted company in the run-up to earnings with a 20% increase in shares outstanding on loan over the last month. The low carbon grain-to-fuel producer has seen its share price tumble in line with gas prices and has seen shares outstanding on loan increase to 21%. Its share price has rallied 8% in the last month as oil rebounded.

After successfully restructuring post-bankruptcy filing in 2009, Pacific Ethanol generated record sales of more than $1bn in in 2014. Relatively better capitalised than its fracking short sold peers, the firm recently acquired competitor Aventin, doubling capacity and increasing its footprint across the US.

Western Europe

Italian bank Monte Dei Pashi Di Siena is the most shorted ahead of earnings this week in Europe with 12.6% of shares outstanding on loan.

LSE-listed South African platinum producer Lonmin has seen short sellers continue to build positions as the persistence of low platinum prices has forced the company to restructure and downsize. Shares outstanding on loan have breached 10% for the first time since the Marikana tragedy in 2012.

Flsmidth, Danish supplier of engineering and industrial equipment into the cement and mineral sectors has seen its share price rise and decline by ~15%. Shares outstanding on loan have continued to decrease year to date (ytd) by 30% to 11%, but remain at relatively high levels.

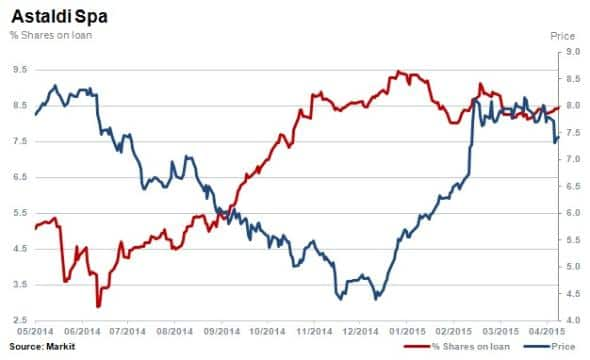

Two European infrastructure construction firms; Spanish group Obrascon and Italian Astaldi, have seen increased shorting activity in recent months despite positive sales and earnings growth expected. Shares outstanding on loan have increased to 8.4% for both Obrascon and Astaldi.

Both stocks declined by a third in 2014 but ytd, Astaldi has risen by 55% while shares in Obrascon have remained relatively flat.

Asia Pacific

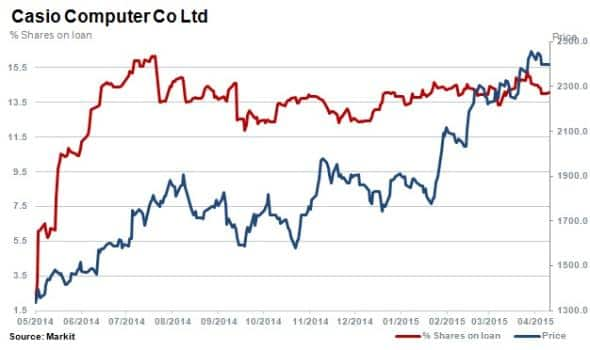

Short interest remains high in consumer electronics maker Casio. The company has continued to rally after posting consecutive quarterly earnings growth, with full year earnings (ending March 2015) expected to increase by an impressive 68%.

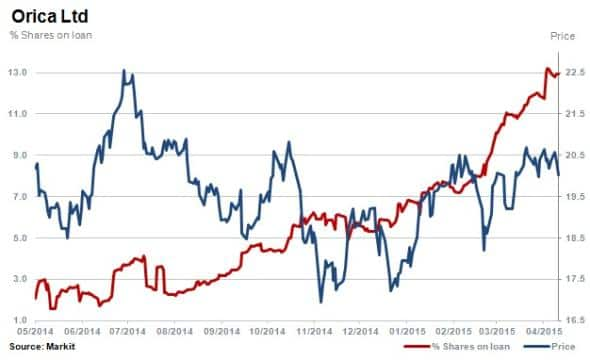

Orica, the largest supplier of commercial explosives to the Australian mining industry, has seen a steady increase in short interest throughout the year as shares outstanding on loan reached 13%. The slump in basic resources and continued lower iron ore prices continues to impact the mining industry.

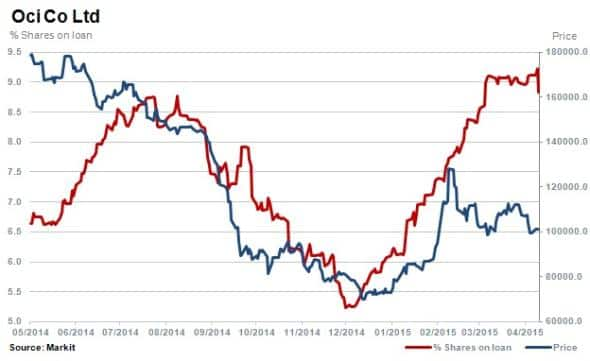

Korean manufacturer of a wide variety of industrial chemical products Oci Co, has seen shares decline by 44% in the last year. Shares have recovered in 2015 but have attracted renewed short interest ytd with shares outstanding on loan increasing by 66% to 8.7%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}