Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 10, 2014

Chinese economy fears mount as exports fall and inflation slides to five year low

Worse than expected export performance and a steeper than anticipated drop in inflation are seen as factors raising the chances of further policy stimulus.

The Chinese economy grew at an annual rate of 7.3% in the third quarter, its weakest pace of expansion since 2009, and the recent flow of data suggest sustained malaise in the fourth quarter could mean the government misses its 7.5% target for the year.

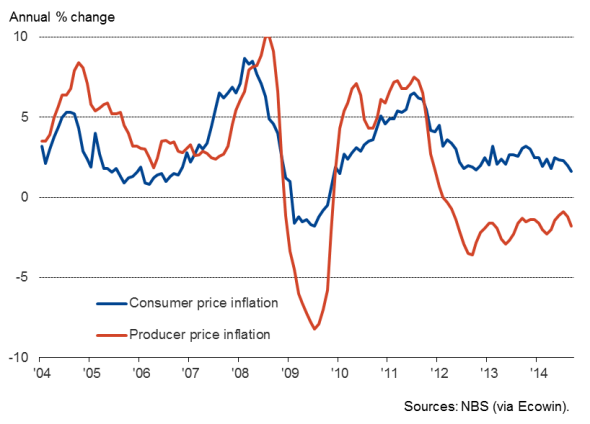

Inflation falls to five-year low

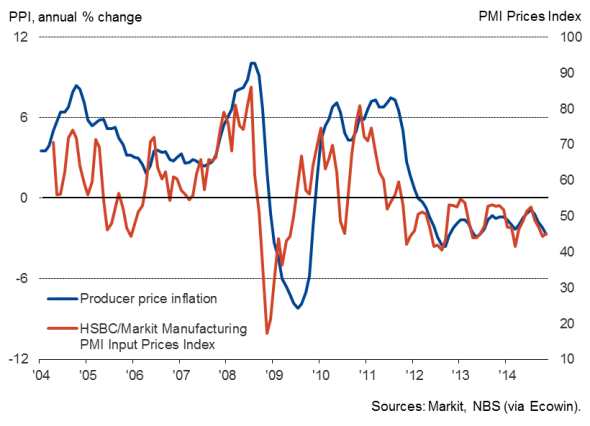

Consumer prices were just 1.4% higher than a year ago in November, down from 1.6% in October and the lowest annual rate of increase seen since November 2009. Analysts polled by Reuters had expected the rate to hold at 1.6%. A fall in producer prices, down 2.7% on a year ago, added to the sense that inflationary pressures are weakening.

Lower prices are partly linked to oil, which has slumped in price from a peak of $115 per barrel to a current low of $63. However, weak demand - from industry and consumers alike - is also driving down many prices.

The PMI Survey's Suppliers' Delivery Times Index - a key gauge of supply chain price pressures - points to few capacity constraints as factories cope easily with demand, meaning goods are often sold cheaply to avoid unwanted stock overhangs. The manufacturing PMI survey had recorded steep falls in both input and output prices in November.

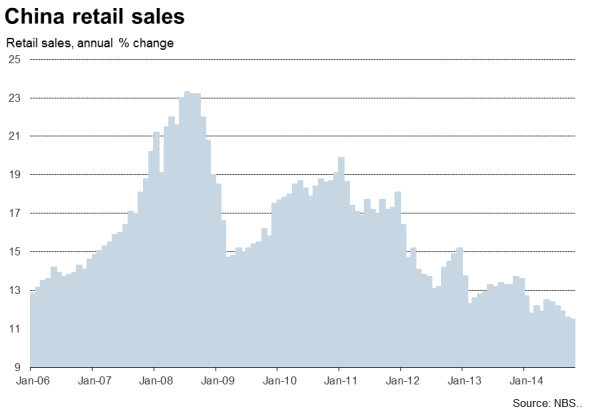

Retail sales are growing at the slowest underlying rate for a decade, highlighting the relative weakness of consumer demand. This softening of consumer spending has been widely linked to worries about the domestic property market, as well as the government's clampdown on corruption and conspicuous spending by officials.

Lower rates of inflation were evident for food, consumer goods and services.

Falling inflation

Worsening trade picture

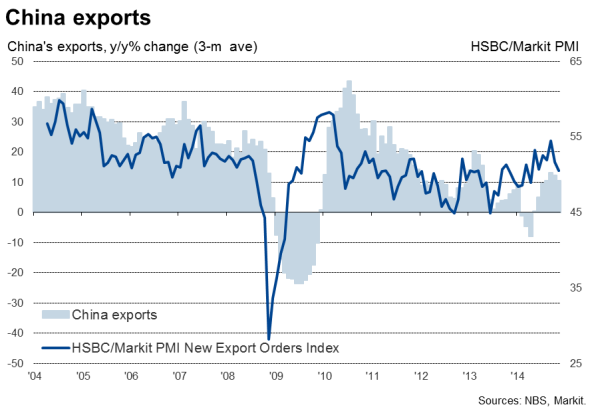

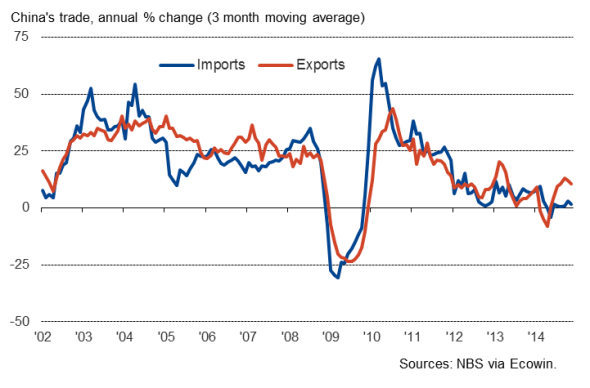

The weaker than expected inflation numbers follow signs of a waning in China's export performance. Exports were just 4.7% higher than a year ago in November, the weakest rise seen since April. The data are volatile, and the three-month trend rate suggested annual export growth has merely eased from a recent peak of 13.1% in the third quarter to a still-robust 10.5% in the three months to November. However, with the HSBC/Markit PMI survey's New Export Orders Index sliding to a seven-month low of 50.5 in November, there is mounting evidence that the trade situation has deteriorated in the face of slowing global economic growth.

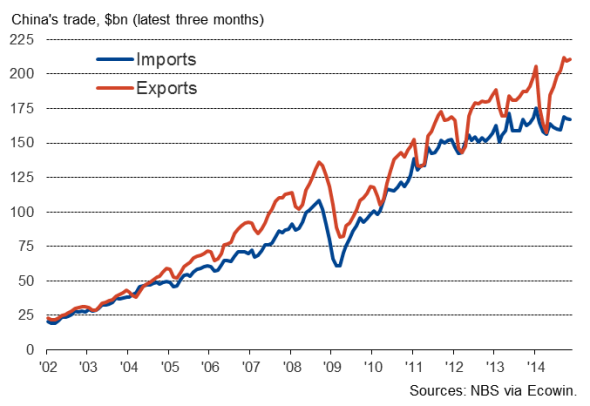

Growth of imports has also waned in recent months, pointing to subdued domestic demand.

Trade levels

Trade growth

Policy stimulus

The downturn in inflation, and the prospect of falling oil prices keeping inflation low in coming months (and certainly well below the central bank's 3.5% target) add leeway for the authorities to add further stimulus to the economy. Analysts' expectations have consequently risen that the central bank may cut interest rates further, or at least reduced banks' reserve ratio requirements, helping encourage further domestic lending.

Factory prices and the PMI

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Economics-Chinese-economy-fears-mount-as-exports-fall-and-inflation-slides-to-five-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Economics-Chinese-economy-fears-mount-as-exports-fall-and-inflation-slides-to-five-year-low.html&text=Chinese+economy+fears+mount+as+exports+fall+and+inflation+slides+to+five+year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Economics-Chinese-economy-fears-mount-as-exports-fall-and-inflation-slides-to-five-year-low.html","enabled":true},{"name":"email","url":"?subject=Chinese economy fears mount as exports fall and inflation slides to five year low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Economics-Chinese-economy-fears-mount-as-exports-fall-and-inflation-slides-to-five-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+economy+fears+mount+as+exports+fall+and+inflation+slides+to+five+year+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10122014-Economics-Chinese-economy-fears-mount-as-exports-fall-and-inflation-slides-to-five-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}