Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 10, 2017

Official data confirm survey picture of UK manufacturing strength contrasting with construction plight

Official data confirm the survey signals of a multi-speed economy. While manufacturing is enjoying strong growth, construction is in the doldrums, entering a new technical recession.

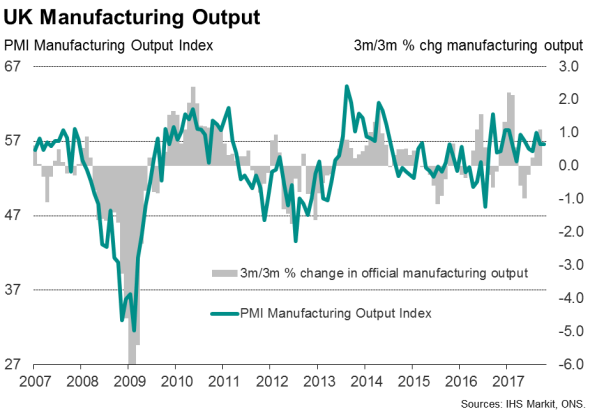

Manufacturing growth spurt

According to data from the Office for National Statistics, both industrial production and manufacturing output surged 0.7% in September, notching up the best performance so far this year. The wider measure of industrial production (which includes energy and mining) and factory output were consequently both 1.1% higher in the third quarter, providing an important boost to the economy.

It's especially encouraging to see sectors such as machinery and equipment recording strong growth in the third quarter, where output was up 3.0%, as this is a good indicator of rising business investment. It remains unclear, however, as to how much of this was exported or intended for domestic customers.

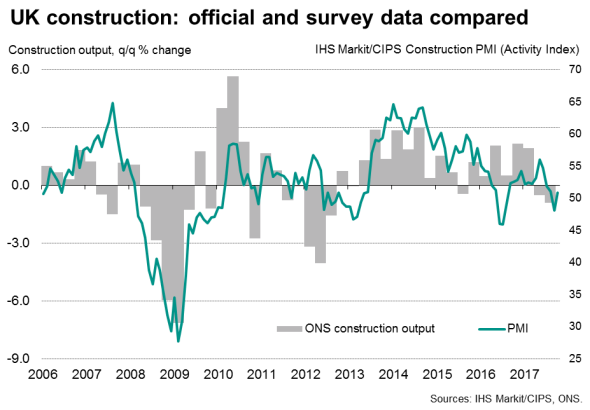

Construction 'recession'

It was a different story altogether for the building sector, with construction output down 1.6% in September. That leaves construction output 0.9% lower in the third quarter following a 0.5% decline in the second quarter.

The third quarter decline pushes the building sector into a technical recession for the first time since 2012. As seen in the recent PMI survey data, the commercial construction sector suffered the largest drop in output, highlighting how businesses appear to be pulling-back on investing in new offices, factories and retail space.

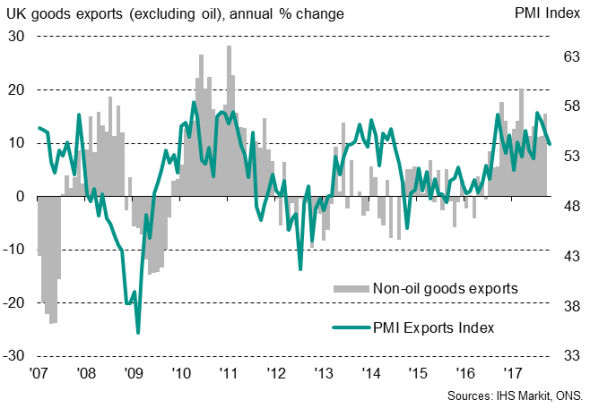

Export gains focused on EU

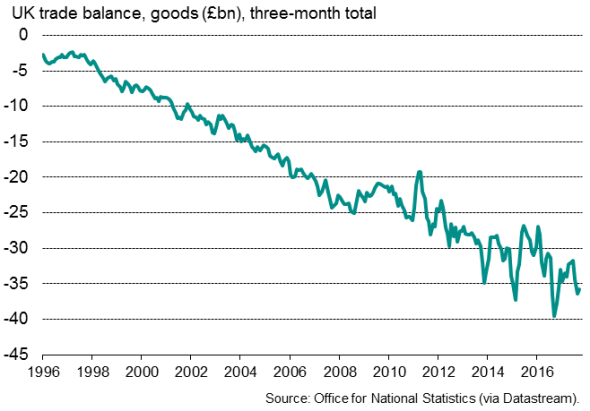

Trade statistics meanwhile showed the trade deficit narrowing to its lowest since May in September, albeit with net trade still looking to have acted as a drag on the economy over the third quarter as a whole.

UK goods exports

Total exports were 0.2% lower in the third quarter while imports rose 1.6%. Goods exports were down 0.9% compared to a 2.7% rise in goods imports.

Exports of goods to EU countries increased by £0.9 billion (2.2%) in the third quarter, most likely reflecting the strengthening economic upturn in the euro area, but exports to non-EU countries fell by £1.7 billion (3.8%).

UK trade deficit (goods)

Economy showing overall resilience

The data leave the picture for the economy in the third quarter unchanged on prior estimates of GDP up by 0.4%.

The official data tally with recent PMI business surveys, which also show the economy enjoyed a strong start to the fourth quarter, with growth led by manufacturing alongside an upturn in service sector growth. Construction continued to struggle, however, hampered in particular by sluggish demand for commercial building.

The overall picture is therefore one of the economy continuing to show relatively resilient growth, albeit with an undercurrent of heighted uncertainty surrounding Brexit posing downside risks to economic activity in coming months, especially business investment.

The next insight into the health of the UK economy will be provided by the tri-annual IHS Markit Global Business Outlook Survey, which will provide a forward-looking analysis of business expectations for both manufacturing and service sector companies.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112017-economics-official-data-confirm-survey-picture-of-uk-manufacturing-strength-contrasting-with-construction-plight.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112017-economics-official-data-confirm-survey-picture-of-uk-manufacturing-strength-contrasting-with-construction-plight.html&text=Official+data+confirm+survey+picture+of+UK+manufacturing+strength+contrasting+with+construction+plight","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112017-economics-official-data-confirm-survey-picture-of-uk-manufacturing-strength-contrasting-with-construction-plight.html","enabled":true},{"name":"email","url":"?subject=Official data confirm survey picture of UK manufacturing strength contrasting with construction plight&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112017-economics-official-data-confirm-survey-picture-of-uk-manufacturing-strength-contrasting-with-construction-plight.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Official+data+confirm+survey+picture+of+UK+manufacturing+strength+contrasting+with+construction+plight http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112017-economics-official-data-confirm-survey-picture-of-uk-manufacturing-strength-contrasting-with-construction-plight.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}