Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 10, 2015

Mixed messages on UK economy as trade deficit narrows but construction output falls

The UK's trade deficit with the rest of the world shrank far more than expected in May, down to the lowest for almost two years. It's wise to treat the monthly improvement with caution, however, as the data are volatile, and survey data indicate that that the export trend in particular has in fact deteriorated in the second quarter.

Alongside falling manufacturing output and news of a dip in construction sector activity in May, the economy is once again looking vulnerable and reliant on domestic demand to drive economic growth via higher spending in the service sector.

Smallest trade deficit for almost two years

The goods trade deficit fell to "8.0bn in May, its lowest since June 2013, though the brighter news was tempered by an upward revision to April's deficit from "8.6bn to "9.4bn. The revision was due to higher than previously thought imports - a salient reminder that both the trade and construction data have been withdrawn recently as National Statistics due to concerns about data quality.

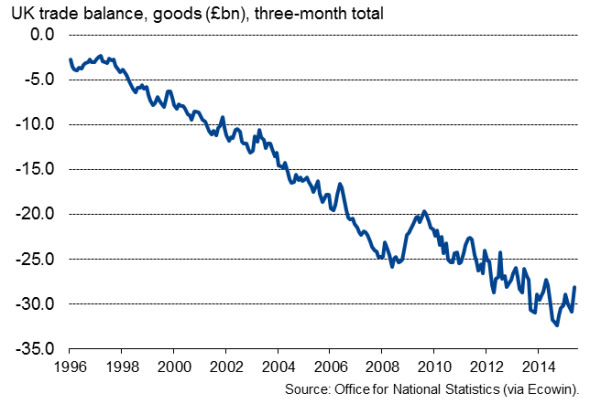

The May improvement in the deficit was more to do with falling imports rather than better export performance. Goods exports rose a mere 0.1% in volume terms (down 0.1% in value) during the month, while goods imports apparently slumped 5.5% (or 4.1% by value). Let's also not forget that the goods deficit is still running at one of the highest recorded in recent history (see chart).

Trade deficit

If services are included (a sector in which concerns over data quality are even greater), the deficit fell to "393m, also its lowest for just under two years and down markedly from "1.83bn in April.

Trade susceptible to further weakness

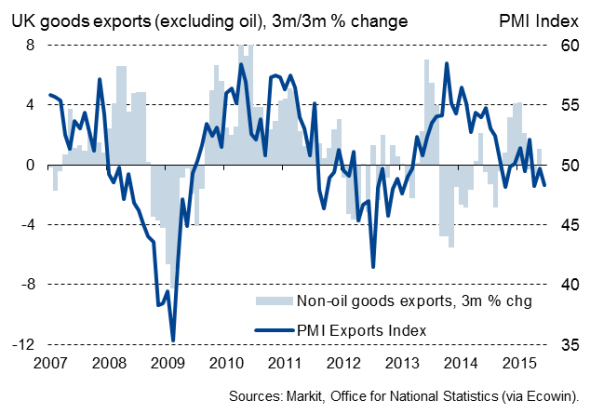

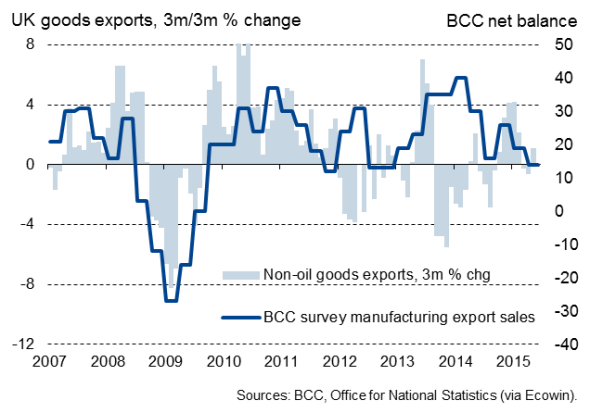

Given concerns over data quality, it's difficult to know how much importance to place on the official trade numbers. Survey data from the British Chambers of Commerce and Markit/CIPS PMI surveys are painting a disappointingly grim picture of UK trade performance (see charts). The latest PMI data showed manufacturers' overseas orders falling for a third successive month in June, rounding off the worst quarter for exporters since the start of 2013. Companies are blaming the strong pound - which has risen to its highest since early-2008 on a trade-weighted basis - as well as slumping demand in overseas markets, especially previously fast growing emerging markets, which are now seeing their steepest downturn since the global financial crisis, according to PMI data.

Our suspicion is therefore that the volatile official trade data are susceptible to deteriorating again in June.

Exports and PMI survey

Exports and BCC survey

Construction dip

The ONS also released data showing the output of the UK construction industry to have fallen 1.3% in May. It's likely that this largely reflected a lull in building activity around the General Election. Survey data showed a similar slowdown but then rebounded again in June. However, the drop in building activity adds to the possibility of a disappointing GDP number for the second quarter. (It should also be noted that, like the trade data, the ONS construction numbers have also recently been withdrawn as National Statistics due to data quality issues, suggesting healthy doses of salt are required when interpreting the data.)

Second quarter growth reliant on services

Trade, manufacturing and, possibly, construction are all therefore likely to act as drags on the economy in the second quarter, constraining economic growth to around 0.5%. Although up on the 0.4% expansion seen in the opening quarter of the year, this is considerably weaker than late last year, reflecting how unbalanced the upturn has become this year. Manufacturing output is set to fall by 0.3% in the second quarter. The weakness of the manufacturing sector in particular means economic growth is once again overly reliant on the service sector, and consumers in particular, which should be a worry for politicians and policymakers alike.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Economics-Mixed-messages-on-UK-economy-as-trade-deficit-narrows-but-construction-output-falls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Economics-Mixed-messages-on-UK-economy-as-trade-deficit-narrows-but-construction-output-falls.html&text=Mixed+messages+on+UK+economy+as+trade+deficit+narrows+but+construction+output+falls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Economics-Mixed-messages-on-UK-economy-as-trade-deficit-narrows-but-construction-output-falls.html","enabled":true},{"name":"email","url":"?subject=Mixed messages on UK economy as trade deficit narrows but construction output falls&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Economics-Mixed-messages-on-UK-economy-as-trade-deficit-narrows-but-construction-output-falls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mixed+messages+on+UK+economy+as+trade+deficit+narrows+but+construction+output+falls http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Economics-Mixed-messages-on-UK-economy-as-trade-deficit-narrows-but-construction-output-falls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}