Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 10, 2016

ECB responds to renewed economic weakness with aggressive stimulus

The European Central Bank announced a more aggressive series of stimulus measures than expected at its March governing council meeting.

The central bank's monthly asset purchase (QE) programme was ramped-up from "60bn to "80bn, with the range of assets the bank can buy extended to cover (non-bank) corporate bonds. Previously, the program was limited to government bonds, covered bonds and asset backed securities (bundles of loans).

Interest rates were also cut to record lows. The main deposit rate was moved further into negative territory, down from -0.3% to -0.4%. The cut makes it more expensive for banks to store money at the central bank, the hope being that this will stimulate lending. The main refinancing rate was meanwhile cut from 0.05% to zero.

A new tranche of cheap lending packages for banks was also announced, known as targeted long-term refinancing operations (TLTROs). These loans, to last four years starting in June, could also be provided at negative rates, though rates depend on the amount that banks borrow and lend. The negative rates on TLTROs therefore take some of the pressure off banking sector margins and relieve some of the concerns of the impact of negative rates on the financial sector. It is also of course essentially a form of paying the banks to lend.

"Weaker than expected" start to the year

The aggressive stimulus was required, according to ECB President Mario Draghi, as growth had been "weaker than expected" at the beginning of the year. The ECB expects economic growth to come in at merely 1.4% this year, though a downward lurch in the region's PMI survey in February suggests that even this meagre pace may not be achieved.

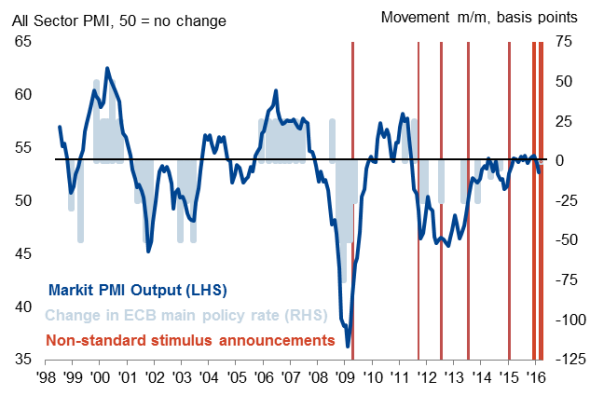

Eurozone PMI business activity and ECB policy

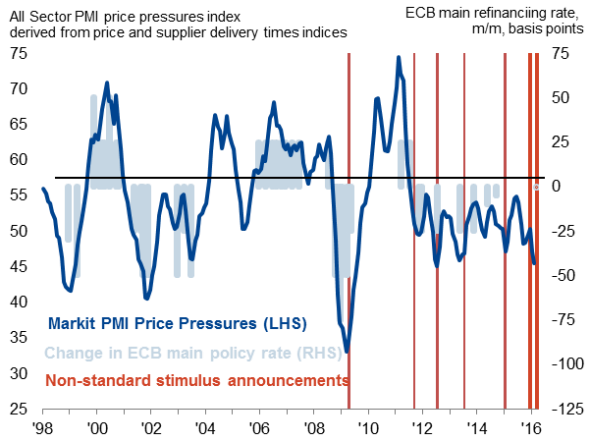

Eurozone PMI price pressures and ECB policy

The survey data are pointing to GDP growth of just 0.2% in the first quarter. Price pressures meanwhile also waned further. The combination of weaker growth and falling prices suggest deflationary forces have intensified, with both gauges in typical stimulus territory (see charts).

The concern is that there is a limit to how much a central bank can do in terms of persuading banks to lend money and offer borrowers attractive rates of interest to take on debt and spend. If there is no demand for loans, then stimulus is ineffective. Hence the press conference saw Draghi join others, notably the OECD and IMF, in calling for governments to implement growth-supporting fiscal policies where needed.

Flash PMI data, released on 22nd March, will provide the first indication of business conditions in the month and also wrap-up the survey signal for first quarter gross domestic product. Data collection starts 11th March.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Economics-ECB-responds-to-renewed-economic-weakness-with-aggressive-stimulus.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Economics-ECB-responds-to-renewed-economic-weakness-with-aggressive-stimulus.html&text=ECB+responds+to+renewed+economic+weakness+with+aggressive+stimulus","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Economics-ECB-responds-to-renewed-economic-weakness-with-aggressive-stimulus.html","enabled":true},{"name":"email","url":"?subject=ECB responds to renewed economic weakness with aggressive stimulus&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Economics-ECB-responds-to-renewed-economic-weakness-with-aggressive-stimulus.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+responds+to+renewed+economic+weakness+with+aggressive+stimulus http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-Economics-ECB-responds-to-renewed-economic-weakness-with-aggressive-stimulus.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}