Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 10, 2017

Global auto sector booms, but also struggles with higher costs

Global auto production is booming, according to new survey data, but the industry is also suffering a squeeze on margins through higher costs.

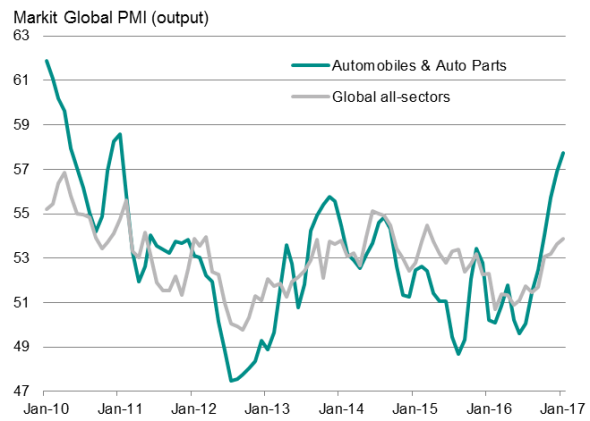

Global auto sector producers are seeing far stronger output growth than the all-sector average

IHS Markit's sector PMI data show worldwide auto industry production rising at its fastest rate in just over six years in recent months, with production surging again in January amid strong order book growth.

Inflows of new orders into the autos and parts sector rose at the start of the year at the fastest rate since early 2011; a period when post-recession incentives were boosting car sales globally.

The recent upturn in sales and production represents a marked contrast to the stagnation and decline seen during the early months of 2016.

Building capacity

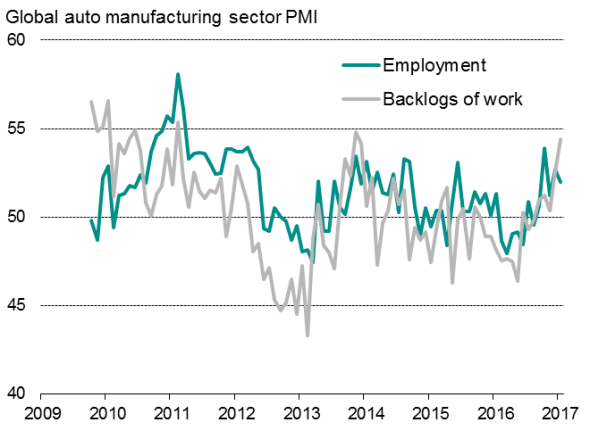

The sales turnaround is also encouraging the industry to take on more staff, with employment rising globally for the fifth month running in January. Net job losses had been recorded in six of the seven prior months.

With backlogs of uncompleted orders rising in January to the greatest extent since November 2013, the survey data also suggest that auto sector firms continue to lack capacity to meet current demand, in turn raising the prospect of further recruitment by the industry in coming months.

Despite taking on more staff, auto firms are seeing a sharp rise in backlogs of work due to high demand

Supply chain capacity pressures

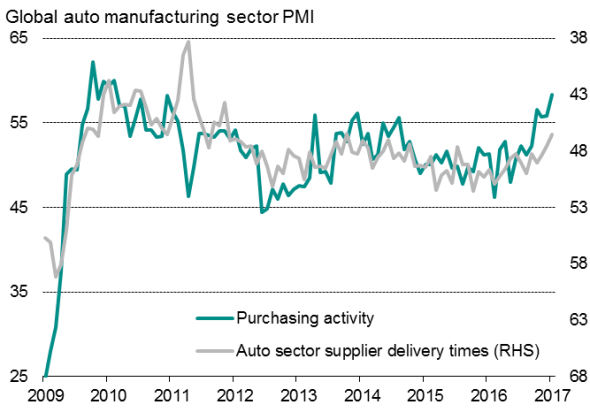

There are signs that capacity shortages are also appearing in auto sector supply chains. The auto sector PMI survey's Suppliers' Delivery Times Index signalled the most severe lengthening of lead-times for over three years, as auto suppliers increasingly struggled to meet demand without incurring delays. Purchasing activity at auto companies is running at its highest for seven years.

Supply chain delays have risen as auto manufacturers have stepped up their input purchasing

The sector has also ramped-up its inventory building, with January seeing one of the largest monthly increases in pre-production inventories since the global financial crisis.

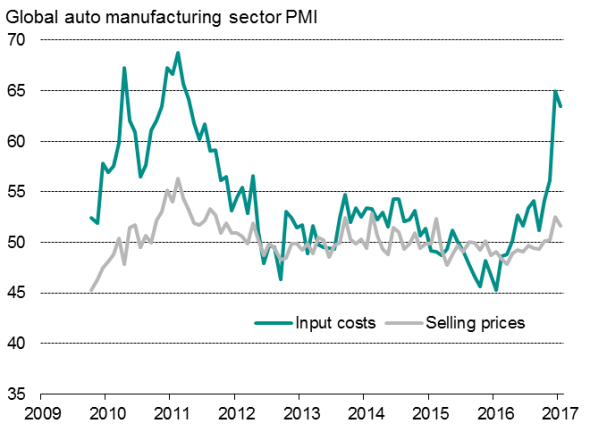

Price hikes

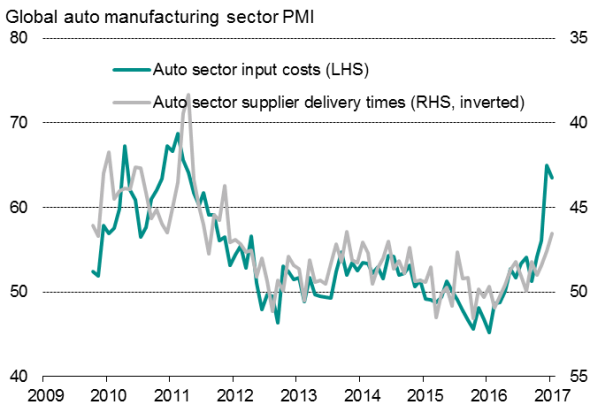

The increased number of bottlenecks and delays in auto supply chains are also helping suppliers push through price hikes, as end producers are willing to pay premiums to ensure supply. Incidences of suppliers offering discounts to boost sales have also fallen as demand has picked up.

At the same time, higher global commodity prices, notably for oil, energy and metals, is also pushing up auto production costs. The PMI data have shown auto sector input costs rising in recent months at the fastest rate for almost six years.

Increased bottlenecks and delays in auto supply chains are also driving up prices

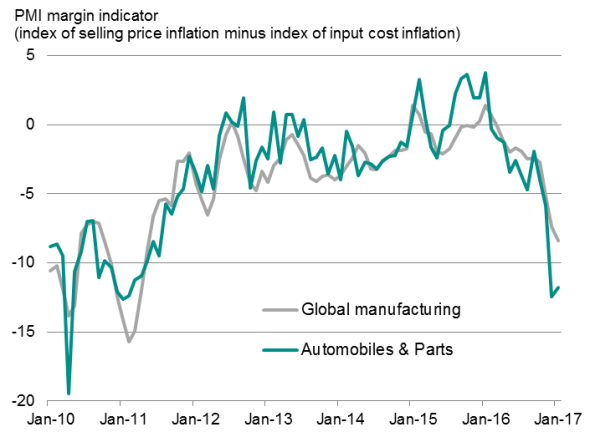

Profit squeeze

Selling costs are also rising, but at a much reduced rate compared to input costs. The differential between selling price and input cost inflation has consequently indicated the greatest squeeze on auto company operating margins since early-2011 in recent months.

Selling prices are rising at a slower rate than costs, meaning margins are being squeezed

The extent to which auto sector margins are being squeezed is also significantly greater than the average for all manufacturing.

The current strength of global car sales bodes well for corporate profits, but the extent to which margins are under pressure is a concern. Coming months will reveal whether producers seek to push through higher prices in order to offset the increase in costs, or whether cost pressures will abate. Monthly PMI data will be the first to reveal these trends.

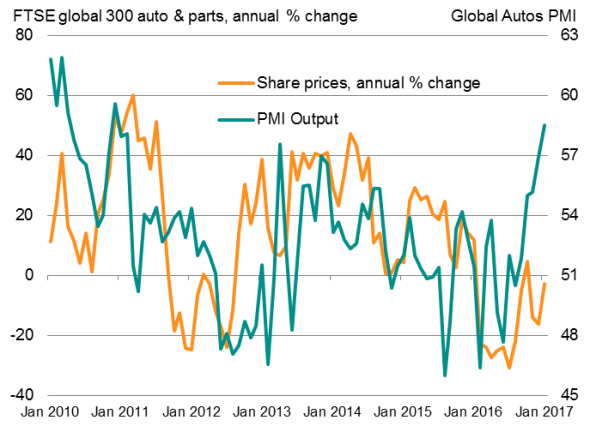

Strong PMI bodes well for share price trend

Auto sector margins are being squeezed to a greater extent than the average for all manufacturing

Sources for charts: IHS Markit, JPMorgan, FTSE.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Global-auto-sector-booms-but-also-struggles-with-higher-costs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Global-auto-sector-booms-but-also-struggles-with-higher-costs.html&text=Global+auto+sector+booms%2c+but+also+struggles+with+higher+costs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Global-auto-sector-booms-but-also-struggles-with-higher-costs.html","enabled":true},{"name":"email","url":"?subject=Global auto sector booms, but also struggles with higher costs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Global-auto-sector-booms-but-also-struggles-with-higher-costs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+auto+sector+booms%2c+but+also+struggles+with+higher+costs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022017-Economics-Global-auto-sector-booms-but-also-struggles-with-higher-costs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}