Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 09, 2017

The risk of rising inflation monitored by EU Sector PMI data

Inflation has picked up sharply in the eurozone, and survey data suggest that the rate of increase will continue to accelerate. Clues as to whether higher prices are affecting demand can be gleaned from unique PMI data.

Consumer price inflation in the eurozone jumped to 1.8 percent year-on-year in January from 1.1 percent the month before, according to official figures from Eurostat. This is the highest inflation rate that the euro area has seen since February 2013. Although currently in line with the ECB's target of "below, but close to, 2%", the PMI indicators point to an even stronger rise given the lead they have over official statistics.

ECB President Mario Draghi remains confident that the recent rise in inflation is largely linked to higher commodity prices and exchange rate factors, with little sign of core inflation increasing. However, it is crucial to monitor the potential impacts of this developing situation by understanding how it could affect companies' sales.

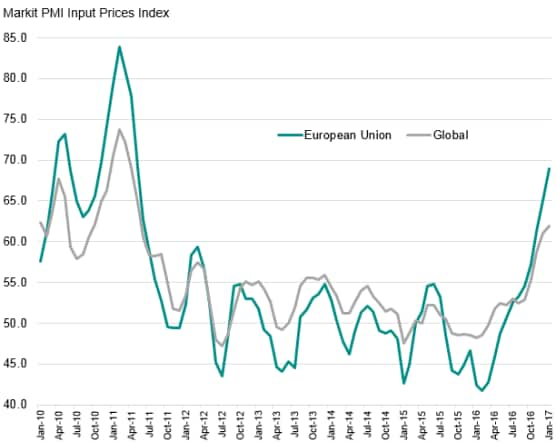

European manufacturing inflation

Inflation is currently impacting the manufacturing sector more than services. Looking at the PMI Input Prices Indices for goods producers worldwide, the trend appears to be global, although it seems that the European Union is experiencing even stronger cost inflationary pressures. Whereas the global Input Prices Index was at 61.9 in January, its highest level for over five-and-a-half years, the EU Input Prices Index was at 69.0 (also the highest since May 2011).

Manufacturing cost inflation

A key milestone was August 2016, when the EU Manufacturing Input Prices Index surpassed the equivalent global index for the first time in over a year. Looking at the detailed sectors within manufacturing, there's a suggestion that this change in the input cost environment may already be having an impact on companies behaviour.

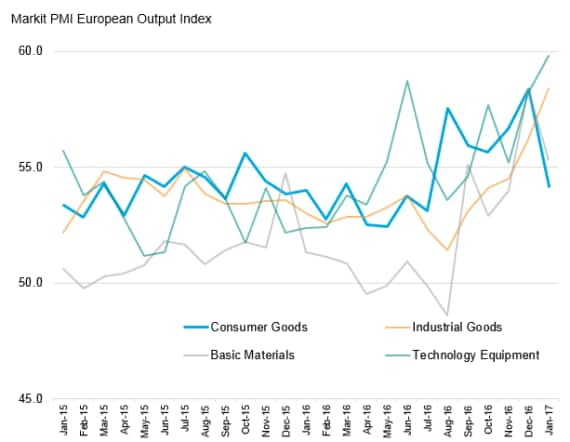

Consumer goods sector slows

Looking at the data in more detail, we can acknowledge that sectors are not responding in the same way to the current inflationary environment.

EU Sector PMI: output

While the industrial goods and technology equipment sectors recorded strong and accelerated increases in output at the start of the year, consumer goods, and to a lesser extent, basic materials companies saw growth slow markedly in January.

This correction in the consumer goods sector might not yet indicate a sustained slowdown, though other sub-indices for the sector are indicating potential weakness in the medium-term.

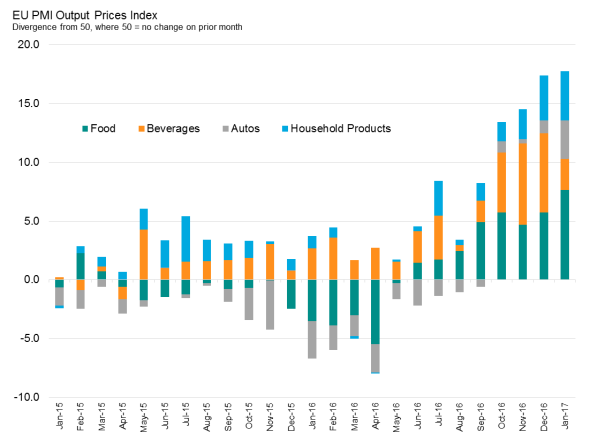

Companies are transferring rising costs

The Output Prices Index for the consumer goods sector has signalled rising selling prices in every month since June 2016 as firms pass on higher costs to customers, with the index at its highest level since September 2011 in January.

EU Consumer Goods: output prices

The main concern here is that, if companies' output prices are rising sharply, household consumption will be squeezed and demand will suffer as a consequence. Considering that the trend was initiated in June 2016, we look at how the consumption environment has reacted since then.

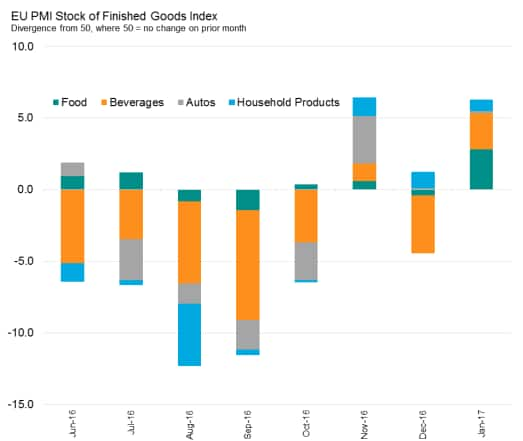

Resilient automobiles & auto parts sub-sector

The first metric to look at is the Stocks of Finished Goods Index. In the case of the consumer goods sector, there was a broad-based accumulation of post-production inventories in November 2016 and again in January, with the Stocks of Finished Goods Index for the food sub-sector at a ten-month high of 52.8 in January. This seems to reveal a change in the sales environment compared to the third quarter of 2016, when companies were indicating a solid pace of destocking. Rising inventories has the potential to weigh on future output as companies seek to control their levels of working capital.

EU Consumer Goods: finished goods

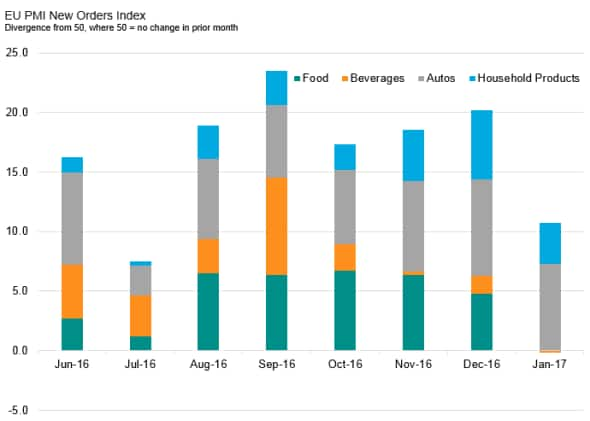

The second metric to consider is new orders. There has been no significant drop in new work for any of the consumer goods sub-sectors in the eight months since June 2016. However, the New Orders Index fell to a three-month low in January, reflecting stagnation in food and beverages new orders. The main factor supporting ongoing solid growth in new work was resilience in the automobiles & auto parts sub-sector. This sub-sector was among the strongest performers in January.

EU consumer goods: new orders

Short-term inflation or real threat to consumption?

The signs of potential negative impacts from rising inflation on demand have so far been minor and there's little to suggest they will intensify in the short-term. However, the EU Sector PMI data will provide users with an early insight into the developing trends initiated by the inflation environment, such as the slowdown of consumption and the next move by the ECB.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022017-Economics-The-risk-of-rising-inflation-monitored-by-EU-Sector-PMI-data.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022017-Economics-The-risk-of-rising-inflation-monitored-by-EU-Sector-PMI-data.html&text=The+risk+of+rising+inflation+monitored+by+EU+Sector+PMI+data","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022017-Economics-The-risk-of-rising-inflation-monitored-by-EU-Sector-PMI-data.html","enabled":true},{"name":"email","url":"?subject=The risk of rising inflation monitored by EU Sector PMI data&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022017-Economics-The-risk-of-rising-inflation-monitored-by-EU-Sector-PMI-data.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+risk+of+rising+inflation+monitored+by+EU+Sector+PMI+data http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022017-Economics-The-risk-of-rising-inflation-monitored-by-EU-Sector-PMI-data.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}