Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 10, 2016

Oil sector leads UK industrial decline in fourth quarter

UK industrial output slumped in the closing quarter of last year, led down by collapsing production in the energy market and a stagnant manufacturing sector.

Oil sector downturn

Industrial production fell 0.5% in the fourth quarter of 2015, according to the Office for National Statistics, down some 1.1% in December - its biggest fall for just over three years - after a 0.8% dip in November.

The severity of the downturn largely reflects steep losses in the mining and quarrying industries (including oil & gas extraction), where output fell some 4.0% in December after a 1.4% decline in November. This decline is not too surprising, given the precipitous fall in oil prices seen in recent months and warm weather (which will have reduced demand for heating), but further illustrates the current plight of the oil sector, which looks braced for further capacity reduction.

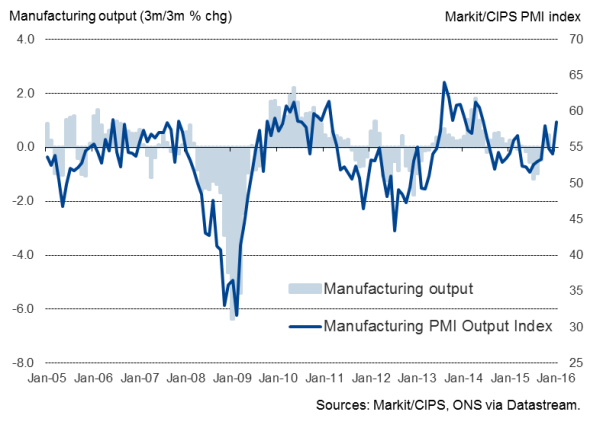

Manufacturing output stagnant in Q4

Perhaps more worrying from a broader perspective of the economy's health is the ongoing weakness of manufacturing, where output fell 0.2% in December. This was the third successive month in which factory output had declined, leaving the volume of manufacturing production unchanged in the fourth quarter compared to the third quarter.

Manufacturing output

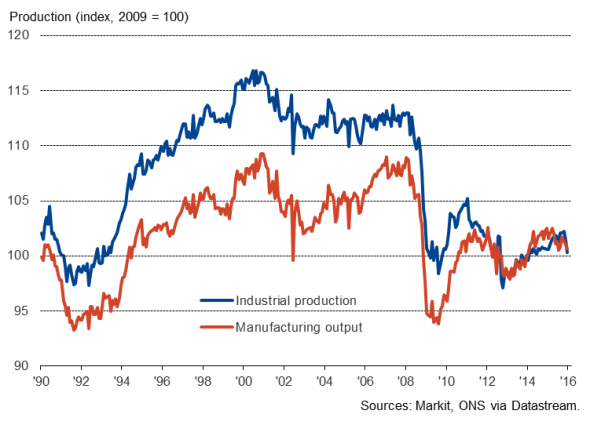

The extent to which the UK has failed to rebalance towards manufacturing is further highlighted by the industrial sector as a whole and manufacturing being 9.8% and 6.5% respectively smaller than their pre-recession peaks seen at the start of 2008.

Output levels

Challenging start to the year

The start to the year also looks to have been challenging for UK producers. Although PMI survey data indicated an uptick in production, this may prove short-lived as exports showed a renewed fall, order book backlogs deteriorated (meaning firms have less work-in-hand), and job losses were reported for the fourth time in six months. Companies are battling against weak global demand and intense competition both at home and abroad, while at the same time growing increasingly nervous about the outlook amid financial market volatility and 'Brexit' worries.

The service sector continues to act as a reassuringly robust prop to the economy at the start of the year, though even here the survey data reveal a number of cracks appearing in the economy's resilience which suggest that growth could weaken in coming months.

While the fourth quarter production figures were worst than expected, some solace can at least perhaps be sought from the declines being not severe enough on their own to lead to a downgrading of the latest official estimate of economic growth of 0.5%, which had assumed a mere 0.2% drop in industrial production.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-economics-oil-sector-leads-uk-industrial-decline-in-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-economics-oil-sector-leads-uk-industrial-decline-in-fourth-quarter.html&text=Oil+sector+leads+UK+industrial+decline+in+fourth+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-economics-oil-sector-leads-uk-industrial-decline-in-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=Oil sector leads UK industrial decline in fourth quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-economics-oil-sector-leads-uk-industrial-decline-in-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+sector+leads+UK+industrial+decline+in+fourth+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-economics-oil-sector-leads-uk-industrial-decline-in-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}