Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 09, 2016

American short sellers continue their streak in August

The most expensive stocks to borrow shares in North America underperformed the market for the fourth consecutive month, but short sellers are showing no signs of hanging in as these shares experienced some pretty significant short covering.

- Expensive short positions in North America underperformed the market by 0.77% over August

- Canadian precious metal mining firms helped drive short returns over the month

- Short sellers have covered 4.5% out of expensive trades in August, twice the market average

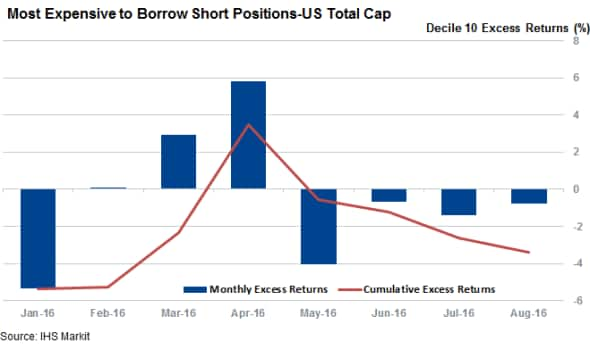

Despite the waning appetite to go short in the current market, short sellers are still managing to successfully pick out underperforming stocks. Using the cost to borrow 10% of shares which cost the most to borrow in the securities lending market to filter the shares which see the highest conviction among short sellers, we see that this group of stocks underperformed the Markit North American Total Cap universe by 0.77% over August.

This marks the fourth month in a row where high conviction short positions have failed to keep up with the rest of the market and takes the year to date underperformance for this group of shares to 3.4% since ytd. This underperformance has largely been delivered in the last three months as short sellers hit a rough patch between February and April which saw their high conviction positions rebound strongly from their lows.

It's worth noting that this performance is only relative as the surging equity market has carried the shares seeing the most bearish short sentiment up 0.7% over august and 8.1% for the year so far.

Materials firms drive returns

The underperformance of high cost to borrow shares was helped in large part by underperforming precious basic material firms as the 13 of the sector's constituents which feature in the group have fallen by 11.6% on average over August. Precious mining firms were at the forefront of the sector's underperformance as four Canadian silver and gold producers saw their shares fall by more than 20% over the month led by Primero Mining who's shares fell by over a third following the announcement of a $19.4m second quarter loss. Iam Gold and First Majestic Silver also turned out to be winning short bets over August as their shares gave up some of the winnings accumulated since the start of the year.

Deep water driller Ocean Rig proved to be the single most successful high conviction North American short position for the month as its shares sank by over two thirds following news that it was continuing to pursue a possible bankruptcy. Short sellers have been rewarded for staying the course in Ocean Rig despite a rally which saw its shares more than triple as investors hoped that the rebound in oil prices would be enough to see the company scrape through.

Concordia Pharmaceutical was another hugely successful high conviction share after its shares halved over the month following the company's withdrawal of its full year guidance and suspension of its dividend. Short sellers had borrowed more than 19% of Concordia shares at the beginning of the month but have covered more than half of their positions in the wake of the most recent collapse in Condordia's shares. This covering ironically means that Concordia saw the largest amount of short covering among the 300 highest conviction North American short positions.

The lack of appetite to let successful short positions ride has been a recurring theme among August's high conviction short positions as these shares have seen their average short interest decline by 4.5% over August which is twice the average covering seen across the entire Markit North American Total Cap universe.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092016-Equities-American-short-sellers-continue-their-streak-in-August.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092016-Equities-American-short-sellers-continue-their-streak-in-August.html&text=American+short+sellers+continue+their+streak+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092016-Equities-American-short-sellers-continue-their-streak-in-August.html","enabled":true},{"name":"email","url":"?subject=American short sellers continue their streak in August&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092016-Equities-American-short-sellers-continue-their-streak-in-August.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=American+short+sellers+continue+their+streak+in+August http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092016-Equities-American-short-sellers-continue-their-streak-in-August.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}