Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 07, 2016

EM bonds continue to appeal as PMIs pick up

Emerging market bonds continued their outperformance in August which has emboldened some sceptics. However investors' appetite for the asset class continues unabated especially since growth among emerging market countries has started to catch up with developed economies.

- CDX EM index trading at 18 month lows

- Yield difference between the iBoxx USD EM Sovereign index and $ Treasuries below long term average

- Emerging market sovereign bond ETFs have extended their inflow streak to 18 week

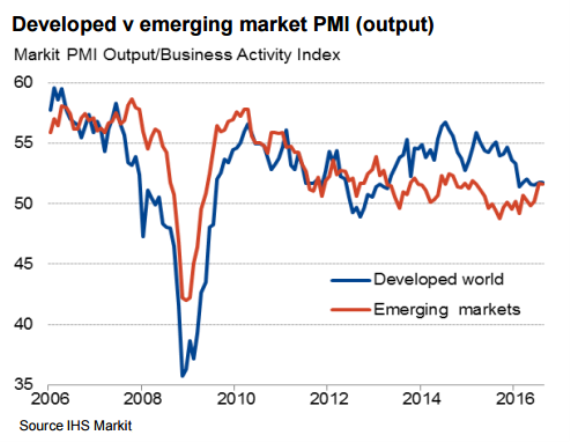

Emerging market economic growth managed to hang on to much of its momentum over August according to the latest release of the IHS Markit Emerging Market Composite PMI index. The August reading indicated that emerging market economies stayed in expansion territory for the third month in a row for the first time since the spring of last year. Growth in developed economies, while still in expansion territory, continued to be challenged with the current pace of expansion materially lower than the pace seen at the turn of the year.

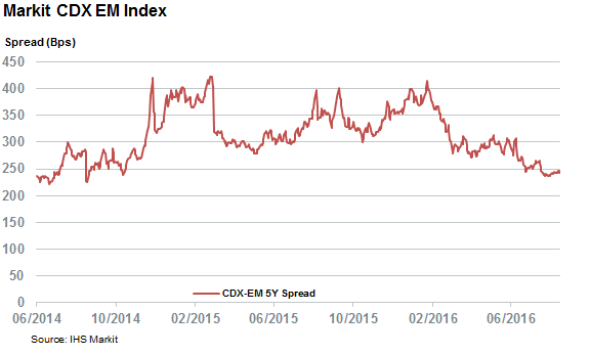

The diverging growth momentum between the two sets of economies has helped assuage investor sentiment towards emerging market credit risk, evidenced by the Markit CDX EM index, which tracks a basket of emerging market CDS contracts falling to its lowest level in over 18 months.

This improving sentiment has been universal given that every single one of the index's 14 constituents now trades with a tighter CDS spread. Even countries experiencing political turmoil such as Brazil and Turkey are trading materially lower for the year so far.

EM bonds surge

This relentless risk rally has translated into real returns for the holders of dollar denominated emerging market bond holders as the asset class which has proved to be one of the winning fixed income trades of the year so far. The asset class' outperformance was extended last month when Markit iBoxx USD Emerging Market Sovereign index delivered 1.7% of positive total returns. This feat, which was 230bps more than the total returns delivered by treasuries over the month, takes the year to date total returns delivered by emerging market sovereign bonds past the 13% mark, over twice that delivered by US treasury bonds.

Strong returns delivered by sovereign EM bonds has knocked over 110bps off the asset class' yield ytd, which is nearly twice the tightening seen by US Treasuries bonds over the same period of time. These plunging yields mean that US investors are now receiving 2.9% of extra yield by parking their money in dollar denominated EM sovereigns, which is roughly 20bps less than the average extra yield delivered by the trade in the six years since the Markit iBoxx USD Emerging Markets Sovereigns launched in 2010. This has left some wondering how long the good times can last.

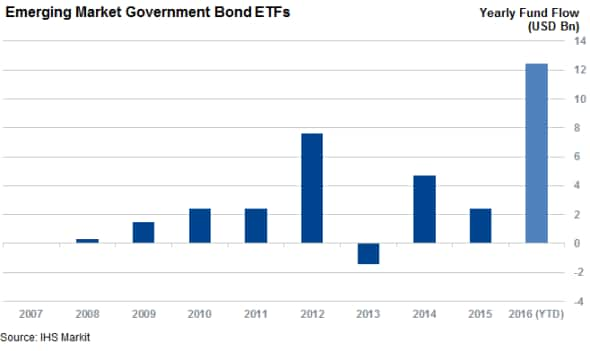

Investors have shown little signs of being turned off as the shrinking extra yield offered by dollar denominated EM bonds at the moment as ETFs which invest in the asset class have continued to experience strong inflows over the last few weeks. These consistent inflows have extended the asset class's inflow streak to 18 weeks, which extended the record year to date inflow tally gathered by EM government bond ETFs. The $12.24bn which has poured into the asset class ytd is over $5bn more than the previous record set back in 2012 which underscores how popular the trade has been with today's yield and growth hungry investors.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Credit-EM-bonds-continue-to-appeal-as-PMIs-pick-up.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Credit-EM-bonds-continue-to-appeal-as-PMIs-pick-up.html&text=EM+bonds+continue+to+appeal+as+PMIs+pick+up","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Credit-EM-bonds-continue-to-appeal-as-PMIs-pick-up.html","enabled":true},{"name":"email","url":"?subject=EM bonds continue to appeal as PMIs pick up&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Credit-EM-bonds-continue-to-appeal-as-PMIs-pick-up.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EM+bonds+continue+to+appeal+as+PMIs+pick+up http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Credit-EM-bonds-continue-to-appeal-as-PMIs-pick-up.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}