Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 09, 2014

Markit economic overview

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

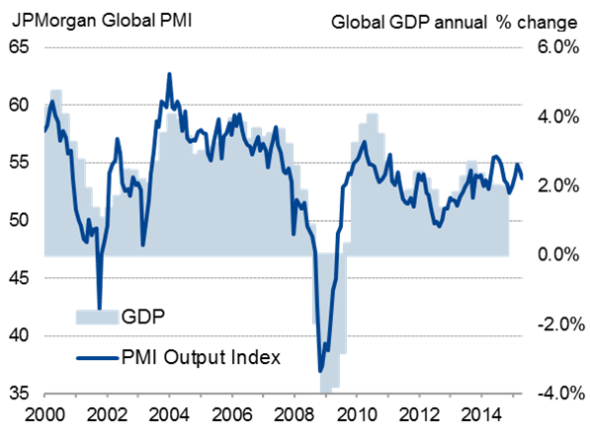

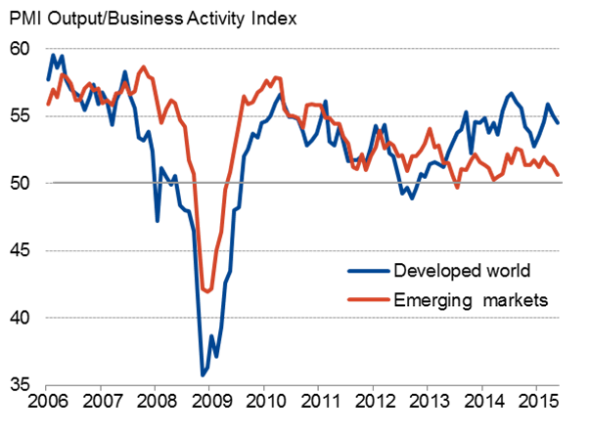

The JPMorgan Global PMI", compiled by Markit, remained well above the 50.0 no-change level in August, roughly consistent with the global economy growing at an annual rate of just over 3% in Q3 so far. The developed world continued to outperform emerging markets, though the gulf narrowed. The latter saw the fastest expansion since March of last year while the developed world headline PMI hit a three-month low.

The global upturn was once again spearheaded by powerful expansions in the US and UK. Meanwhile, Japan continued to recover from April's sales tax rise, though growth remained modest. The pace of growth in the emerging markets continued to revive from stagnation earlier in the year, hitting a 17-month high largely on the back of an upturn in China. In contrast, signs of renewed weakness were evident in the eurozone.

Global upturn still led by powerful US and UK growth

The strength of the US upturn was highlighted by US factories showing the strongest monthly improvement in business conditions of all countries covered by Markit's PMI surveys in August. The surveys suggest the US economy is set to have grown at a 4% annualised rate again in Q3, with business activity surging in factories and across the vast services economy. The data beg the question as to how long the US economy can grow at this pace without requiring a hike in interest rates to cool demand, but a disappointing non-farm payroll gain of 142k in August meant no rate rise is likely this year.

An upturn in the PMI surveys added to signs that the UK economy is set to grow by 0.8% again in Q3. However, a worrying slowdown in manufacturing contrasted with faster services and construction growth, painting a mixed picture for confused and divided policymakers. Although a near-record increase in job vacancies adds to the upbeat picture, record low wage growth suggests rate rises can wait until next year.

ECB takes action as eurozone growth disappoints

The euro area's plea for some members to reform and boost competitiveness was meanwhile put firmly into focus as two founding members - Italy and France - were two of only four countries globally to see business conditions deteriorate, with France sitting at the bottom of the league table. In contrast, the more aggressive reforming countries of Ireland and Spain appeared in the top six places. Growth meanwhile slowed in Germany.

The ECB cut rates and launched "QE lite" to boost the stuttering eurozone recovery. The headline PMI fell in August, but remained in growth territory to suggest that the economy is on course to expand by a disappointing 0.3% in Q3.

Japan's PMI rose further above the 50.0 no-change level in August to indicate that GDP is likely to have revived in Q3, having shrunk in Q2 as a sales tax hike hit spending. However, growth was limited to the export-oriented manufacturing sector. Services stagnated, pointing to subdued domestic demand. While a renewed recession may be avoided in Japan, policymakers will fear that the recovery remains all-too fragile.

China's service sector rebounds, while manufacturing growth slows

Markit's (HSBC) PMI data indicated that, although the pace of expansion slowed in China's factories, growth picked up in services to push the overall PMI to the highest since March of last year. The data suggest the economy remains on course to hit the government's 7.5% growth target for the year. The upturn follows mini-stimulus measures implemented earlier in the year, when the economy showed signs of flat-lining.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-Markit-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-Markit-economic-overview.html&text=Markit+economic+overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-Markit-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Markit economic overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-Markit-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markit+economic+overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092014-Markit-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}