Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 08, 2014

Irish PMI signals fastest economic growth for 14 years

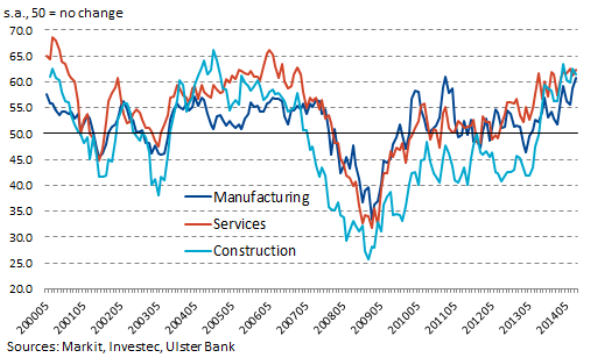

The recovery in the Irish economy continued in August, with PMI" data covering the combined manufacturing, services and construction sectors pointing to the fastest rate of output growth since the height of the dot-com boom in mid-2000.

Ireland continues to make progress in recovering the output lost during its deep recession, with PMI data suggesting that the economy has grown rapidly so far this year.

Ireland is also one of the brighter spots in the eurozone at present, seeming to avoid the slowdowns seen across much of the currency area in recent months and posting the highest PMI readings of the eurozone economies covered by Markit's surveys.

PMI Output Indices

Growth led by service providers

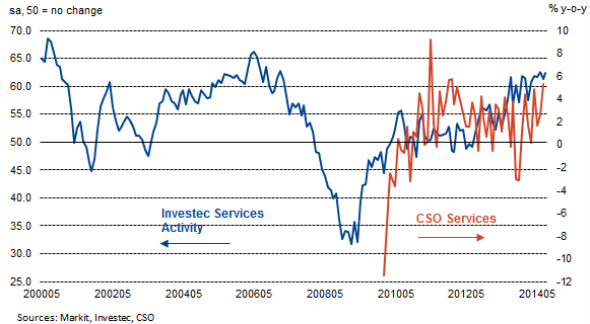

The fastest expansion of the three monitored sectors was at services companies, with panellists reporting a general improvement in market demand in August. The monthly Investec Services PMI has signalled a continuous increase in activity for just over two years.

The official monthly series covering service sector output is more volatile than the PMI data, but has also pointed to growth, particularly during 2014. The latest release (covering July data) signalled a 5.3% year-on-year increase in services activity.

Services business activity

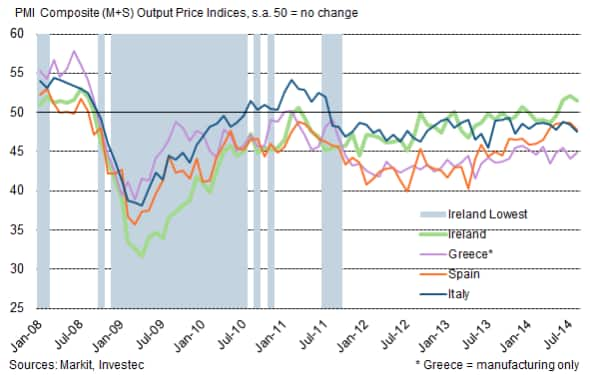

One of the keys to Ireland's recovery has been the extent to which companies have been able to keep prices low to improve their competitive position relative to other economies, particularly those in the eurozone. Output prices across the manufacturing and service sectors fell almost continuously between the middle of 2008 and end of 2013, with an especially aggressive pace of discounting compared to other struggling eurozone economies at the start of this period.

PMI Output Price data

However, in recent months improving demand conditions have enabled Irish companies to start raising their output prices again, in contrast to the trend seen in the likes of Spain and Italy. While this will help firms to strengthen margins, which had been squeezed over a long period of time, this may also erode some of Ireland's competitive advantage.

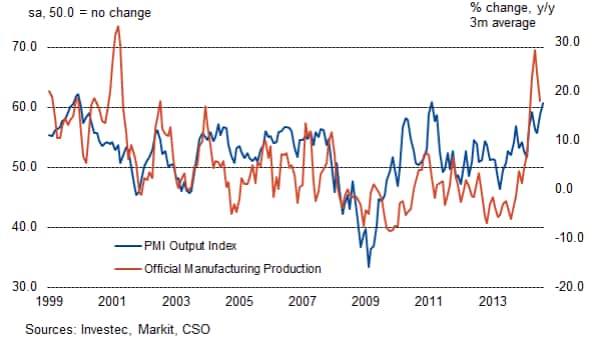

Manufacturing output growth quickens to fastest in three-and-a-half years

The Investec Manufacturing PMI pointed to the sharpest expansion in factory output since February 2011 during August. The UK and US have been frequently mentioned as sources of new export orders, as Ireland benefits from improving economic conditions in its two largest trading partners, helping to shield the economy from weakness appearing in other eurozone member states.

Again, the official manufacturing production data can be volatile, and have been so in recent months as output has increased and fallen sharply on a monthly basis. However, the underlying trend in official data appears to back up the PMI's signal of solid growth in the sector.

Manufacturing Production

In fact, the manufacturing sector has more or less recovered the output lost during the recession, something which can't be said for the economy as a whole, which remains some 5.1% smaller than it was at the end of 2007.

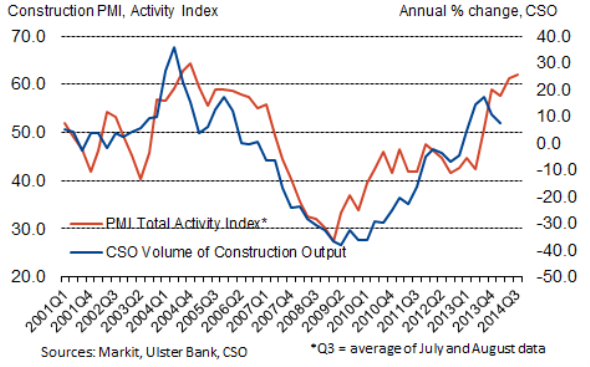

Construction growth extends to one year

The sector most severely affected by the recession was construction. The Ulster Bank Construction PMI Total Activity Index signalled falling output in each month between June 2007 and August 2013, the longest period of continuous decline in output ever recorded by a national Markit PMI survey. Moreover, the contraction was steeper than those seen in the manufacturing and service sectors.

However, the construction sector returned to growth in September last year and, with the release of today's August data, has now seen building activity increase for 12 successive months. Growth in recent months has been substantial and suggests that official construction output will continue to increase in the second and third quarters of 2014. However, the severity of the downturn means that any rises in output are from a low base and the building sector remains a long way from outright recovery.

Construction Output

Construction firms are strongly optimistic that the recovery will continue over the coming year, however, with the PMI Future Activity Index at a near-record high in August. More than 65% of companies forecast activity to rise over the next 12 months.

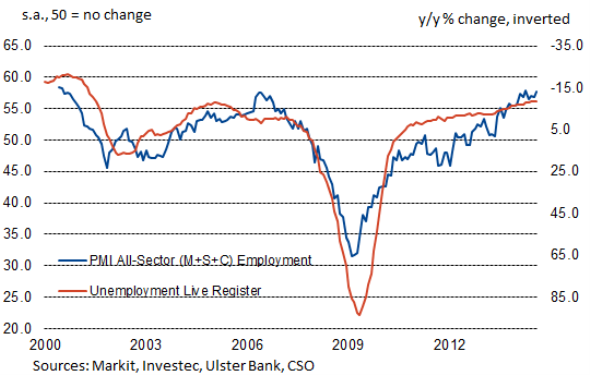

Labour market improvements recorded

Improving demand has helped companies in Ireland to raise staffing levels, and the all-sector PMI Employment Index has now been above 50.0 in each month throughout the past two years. Rising employment has helped to reduce the unemployment rate in Ireland to 11.2%, just below the eurozone average, although net emigration will also have had an impact on levels of unemployment.

Labour Market

The extent of the downturn experienced in Ireland during the recession means that it will be some time yet before the economy can be said to have fully recovered, but the signs from the PMI surveys remain positive and suggest that the economy is moving in the right direction. The PMI data for September will be released at the start of October and complete the picture for the third quarter of 2014.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014Irish-PMI-signals-fastest-economic-growth-for-14-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014Irish-PMI-signals-fastest-economic-growth-for-14-years.html&text=Irish+PMI+signals+fastest+economic+growth+for+14+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014Irish-PMI-signals-fastest-economic-growth-for-14-years.html","enabled":true},{"name":"email","url":"?subject=Irish PMI signals fastest economic growth for 14 years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014Irish-PMI-signals-fastest-economic-growth-for-14-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Irish+PMI+signals+fastest+economic+growth+for+14+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092014Irish-PMI-signals-fastest-economic-growth-for-14-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}