Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 09, 2015

US jobless rate falls amid year-end hiring surge, but wage growth disappoints

The US labour market continued to boom at the end of last year, adding further fuel to expectations that the Fed will be the first major central bank to start tightening policy in 2015.

However, the dataflow over the next two months will be crucial in determining whether the FOMC will aim for a mid-2015 rate rise or, as survey data indicate, delay until later in the year if the economy shows signs of slowing.

Hiring surge continues

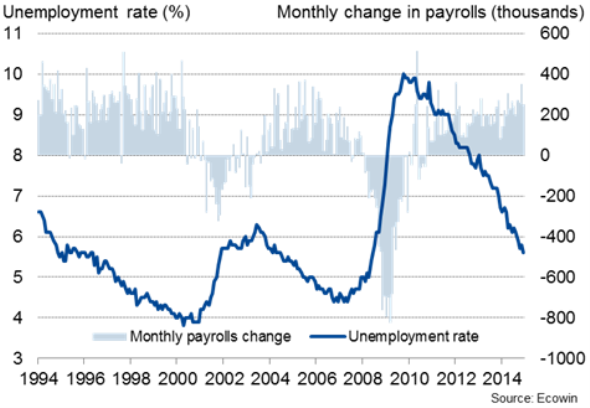

Non-farm payrolls rose by 252,000 in December, beating expectations of a 240,000 rise. The latest increase was driven by a 240,000 rise in private sector employment. November's gain was revised up from an already impressive 321,000 to 353,000, with October also seeing a more modest upward revision.

The latest rise means the US economy added 2.952 million jobs in 2014, up from 2.311 in 2013. Some 866,000 were added in the final quarter, making it the best calendar quarter since 1999.

The additional hiring helped push the unemployment rate down to a six-and-a-half year low of 5.6%, down from 5.8% in November, though a fall in the participation rate from 62.9% to 62.7% also contributed to the decline in the jobless rate.

Non-farm payrolls and unemployment

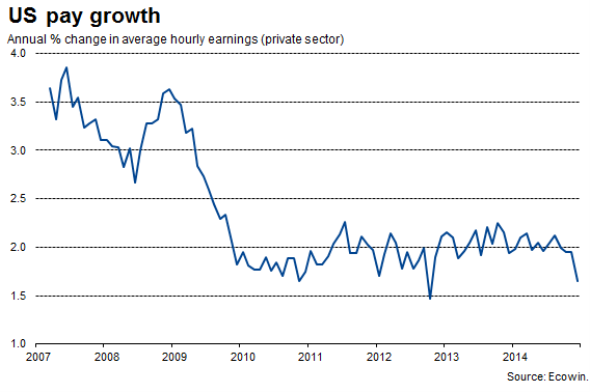

Once again, the fly in the ointment was wage growth, a downturn in which suggests that the recent improvements seen in the economy are still not feeding through to employees. Annual pay growth fell from 1.9% to 1.7%, its lowest since October 2012.

Economy cooling

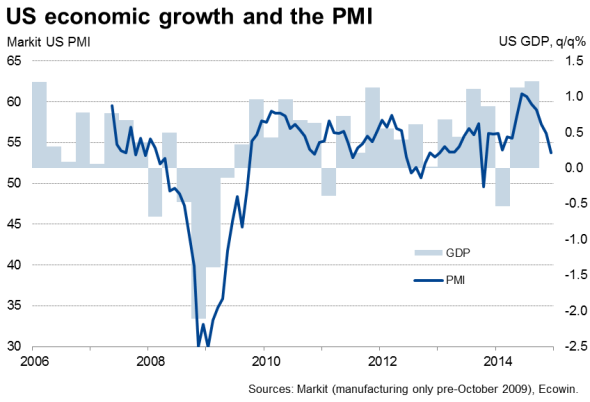

It is doubtful that hiring will be sustained at this pace for much longer. Markit's PMI surveys flashed a clear warning light that the economy lost considerable growth momentum towards the end of last year. The surveys found companies growing more concerned about the economic outlook at home and abroad, leading to the weakest growth of business activity since the government shutdown hit the economy in late-2013. The surveys point to GDP growth waning, dropping to perhaps half the 5.0% annualised pace seen in the third quarter.

So far, there has been little official data to confirm the surveys' suggestion of slower growth, though this is mainly because the official data tend to be published with a delay relative to the surveys. The latest data up to November showed industrial production and retail sales running 1.3% and 1.0% higher than the third quarter respectively, pointing to solid fourth quarter GDP growth.

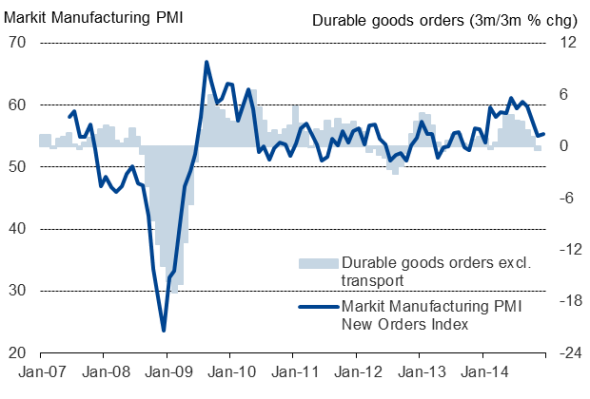

However, it's notable that factory orders data have turned down sharply, signalling an even starker deterioration than the business surveys.

Next week's official data on retail sales and industrial production will therefore provide more insight into fourth quarter economic growth trends.

Factory orders

Rate hike timing

The minutes from the latest FOMC meeting highlighted how policymakers do not seen any need to raise interest rates before April, which has focused market expectations on a mid-2015 rate rise. Today's employment report adds conviction to that belief, but the dataflow over the next two months will be crucial in determining whether rate rises will be delayed until later in the year.

If the slowdown in the survey data is borne out by the official data, and continues into the first quarter, it will most likely be enough to encourage the ultra-cautious FOMC to delay rate hikes further.

This is exactly what appears to be happening in the UK, with a softening of the economic data causing expectations of rate rises to be pushed back into late-2015, and possibly even 2016.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-US-jobless-rate-falls-amid-year-end-hiring-surge-but-wage-growth-disappoints.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-US-jobless-rate-falls-amid-year-end-hiring-surge-but-wage-growth-disappoints.html&text=US+jobless+rate+falls+amid+year-end+hiring+surge%2c+but+wage+growth+disappoints","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-US-jobless-rate-falls-amid-year-end-hiring-surge-but-wage-growth-disappoints.html","enabled":true},{"name":"email","url":"?subject=US jobless rate falls amid year-end hiring surge, but wage growth disappoints&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-US-jobless-rate-falls-amid-year-end-hiring-surge-but-wage-growth-disappoints.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+jobless+rate+falls+amid+year-end+hiring+surge%2c+but+wage+growth+disappoints http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-Economics-US-jobless-rate-falls-amid-year-end-hiring-surge-but-wage-growth-disappoints.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}