Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 08, 2017

Asia sector PMI points to rising capex but also sluggish basic materials

Growth was reported in the majority of Asian sectors in May, according to the Nikkei Asia Sector PMI. Encouragingly, many of the best performers were sectors that hint at rising capital investment, while a further downturn in basic materials was observed.

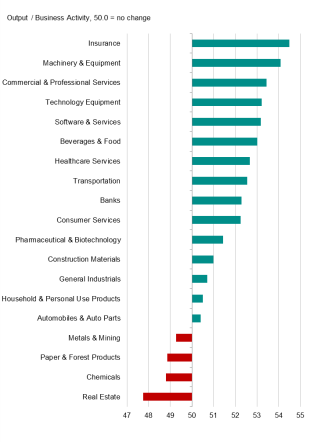

Of the 19 sub-sectors covered by the PMI surveys, 15 recorded an increase in business activity in May, up from 14 in April. The fastest growth of output was registered among insurance companies, the sector moving up to first place from second. Last month's growth leader, commercial & professional services, slipped to third in the rankings.

Nikkei Asia Sector PMI Output Index: May 2017

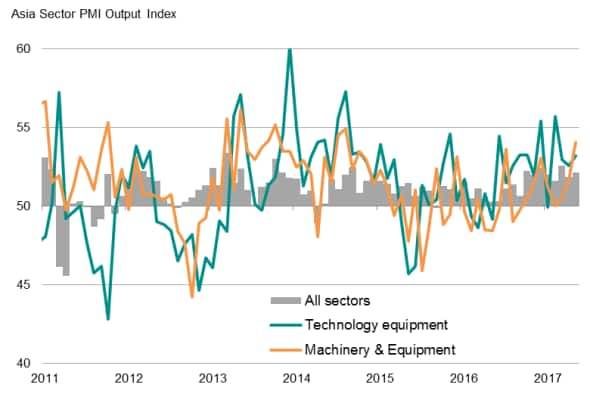

The other top performing sectors were manufacturers of machinery and equipment and producers of technology equipment. Both sectors are indicators of capital expenditure by companies, suggesting that their solid performances bode well for the sustainability of the current upturn.

Growth in technology equipment and machinery

Sources: IHS Markit, Nikkei, Datastream.

The surveys indicate that economic growth continued at a steady pace in Asia, with the Asia Composite PMI Output Index showing the twentieth straight month of expansion in May. However, there are signs of easing in the manufacturing sector across the region, which continues to lag behind wider global manufacturing growth trends, mainly the result of a fall in the Caixin China Manufacturing PMI to an 11-month low.

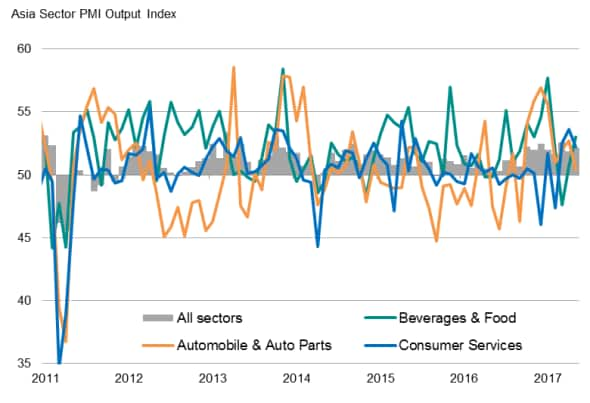

While consumer spending remained resilient, buoyed by ongoing employment growth across Asia, there were nuances as to what consumers spend on. Consumers became increasingly cautious with their spending amid rising prices, especially on durable and discretionary goods. Slower expansions were seen among makers of automobiles and auto parts, as well as providers of consumer services. On the other hand, manufacturers of food and beverages recorded faster output growth.

Consumer spending

Sources: IHS Markit, Nikkei, Datastream

Sectors related to basic materials were among the worst performers in May, with chemicals, metals & mining, paper & forest products all seeing a contraction in output. Only real estate fared worse, coming in at the bottom of the rankings again.

Continued growth in capex sectors

Looking ahead, strong expansions in sectors relating to capex are likely to continue. Solid inflows of new orders and buoyant optimism towards the 12-month outlook for output were seen in both technology equipment and machinery & equipment. In contrast, the weakening demand seen in real estate and metals & mining looks likely to persist in the near-term.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-Economics-Asia-sector-PMI-points-to-rising-capex-but-also-sluggish-basic-materials.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-Economics-Asia-sector-PMI-points-to-rising-capex-but-also-sluggish-basic-materials.html&text=Asia+sector+PMI+points+to+rising+capex+but+also+sluggish+basic+materials","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-Economics-Asia-sector-PMI-points-to-rising-capex-but-also-sluggish-basic-materials.html","enabled":true},{"name":"email","url":"?subject=Asia sector PMI points to rising capex but also sluggish basic materials&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-Economics-Asia-sector-PMI-points-to-rising-capex-but-also-sluggish-basic-materials.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asia+sector+PMI+points+to+rising+capex+but+also+sluggish+basic+materials http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-Economics-Asia-sector-PMI-points-to-rising-capex-but-also-sluggish-basic-materials.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}