Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 08, 2015

Gilts react to UK election; oil drives credit lower

Higher oil prices help emerging market credit, corporates hold up amid bund selloff and gilts react to UK election result.

- 10-yr gilts have reacted positively to UK election with yields down 7bps overnight

- Oil prices rise to new highs for the year, pushing Russian and Venezuelan credit spreads down

- Bunds have continued to retreat, while Euro corporate bond yields have held up

Gilts gain after election

Market participants woke up this morning to news that the Conservative party won an unexpected majority in the 2015 UK general election. A hung parliament had been forecast by opinion polls, leading to volatility in the UK stock and currency markets in the lead up to the decision.

The Conservative win was largely seen as a positive result for the economy. Credit markets reacted accordingly, with the 10-yr Gilt gaining ground overnight. Yields fell 7bps overnight to 1.91% but remain above the year to date average of 1.68%.

Notably, despite the expected hung parliament, the CDS market was relatively calm heading into the election with British spreads hovering around the 20bps level; much lower than the levels seen at the previous election in 2010.

Oil marches on

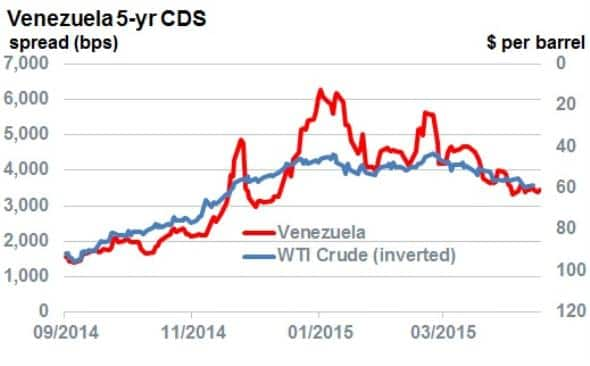

Touching above $60 for the first time since November last year, the price of oil has been on an upward trajectory since March. This trend has benefited oil exporting economies, whose credit is being viewed under a less bearish light over the last few weeks.

Chief among the countries seeing a tightening is Russia who's CDS spread has nearly halved from the highs seen in January. The latest spread is 340 bps, down from 620bps when oil hit its recent lows.

This trend can also be seen at the riskiest end of sovereign credit with Venezuela's CDS spread recently hitting the lowest level of the year so far.

Euro corporates spreads hold up

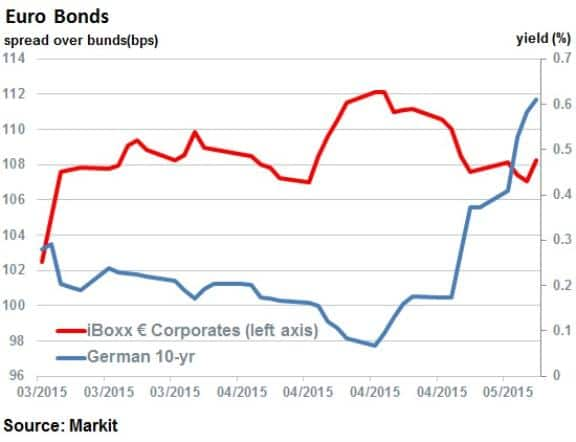

German bunds continued their rout this week as investors fled European sovereign bonds. The 10-yr bund yield, which gained 20bps last week, added another 21bps so far this week to end at 0.61%, according to Markit's bond pricing service. Amid vicious volatility, yields reached as high as 0.8% intraday on Thursday before retreating.

There was however little movement in corporate bond spreads. The Markit iBoxx € Corporates index has in fact tightened over the last two weeks, with the spread over bunds falling 4bps. The knock on effects of the underlying sovereign movement were shrugged off by market participants, suggesting that credit risk perceptions remained unchanged.

But the sovereign bond movement did have an impact on primary market issuance, with Italian construction firm Condotte cancelling its planned €250m high yield bond, citing market volatility. In March, French utility firm GDF Suez (now rebranded Engie), issued the first ever zero coupon corporate bond. With bund yields 25bps higher since then, and trending higher, the days negative corporate interest rates may have been short lived.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-credit-gilts-react-to-uk-election-oil-drives-credit-lower.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-credit-gilts-react-to-uk-election-oil-drives-credit-lower.html&text=Gilts+react+to+UK+election%3b+oil+drives+credit+lower","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-credit-gilts-react-to-uk-election-oil-drives-credit-lower.html","enabled":true},{"name":"email","url":"?subject=Gilts react to UK election; oil drives credit lower&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-credit-gilts-react-to-uk-election-oil-drives-credit-lower.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gilts+react+to+UK+election%3b+oil+drives+credit+lower http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08052015-credit-gilts-react-to-uk-election-oil-drives-credit-lower.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}