Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 08, 2016

UK recruitment industry reports further slowing of salary growth in December

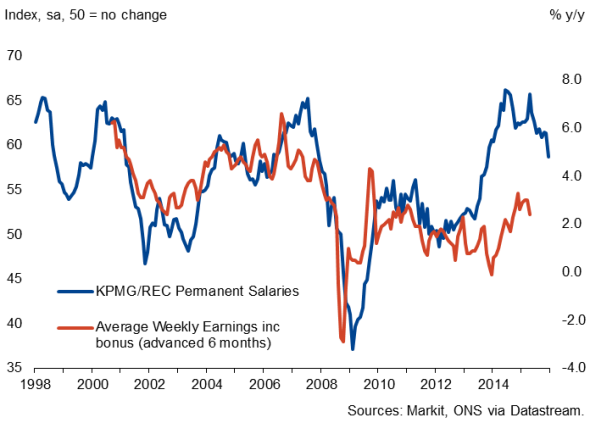

Pay pressures in the UK labour market eased at the end of 2015. The KPMG/REC Report on Jobs, published today, signalled that average starting salaries offered to new permanent hires rose at the slowest rate in 26 months in December. Although the rate of pay growth remained above the average seen since data were first available in 1997, the recent trend has been considerably weaker than the elevated pace seen earlier in the year.

Wage pressures

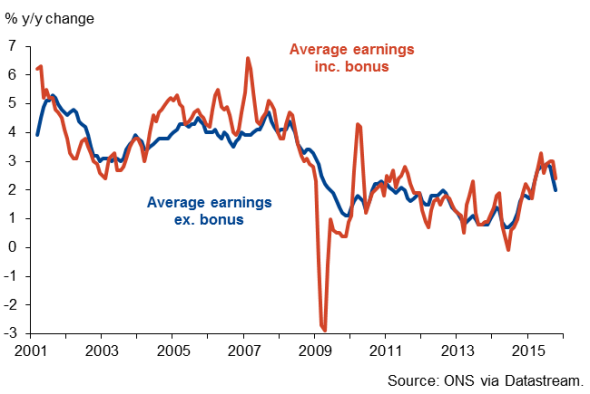

Slowing growth of permanent staff salaries suggests that average earnings growth across the UK labour market may ease further. Latest data from the Office for National Statistics showed that weekly earnings including bonuses rose 2.4% in the three months to October, the slowest growth since the three months to March. Excluding bonuses, pay growth was even weaker at just 2%. Having accelerated over the summer, earnings growth seems to be slipping back again, sending a dovish signal to Bank of England policymakers (see here).

Average earnings

There has already been a notable disconnect between the recruitment survey measure of pay awards for new hires and earnings across the broader labour force - with the latter failing to strengthen to a comparable extent - likely reflecting annual pay reviews based on inflation around zero. While skill shortages in a number of sectors such as construction and IT have fuelled salary inflation for new recruits in recent months, it seems pressures may now be easing even for those in-demand staff moving to new jobs.

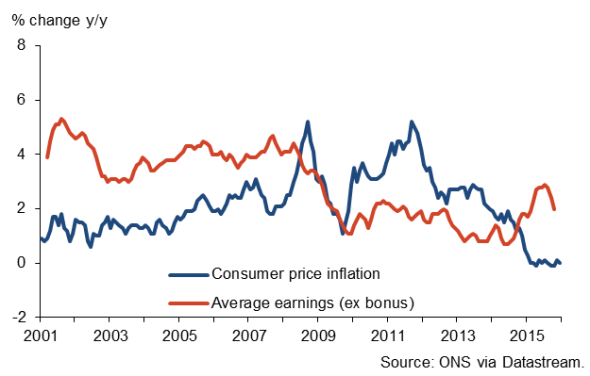

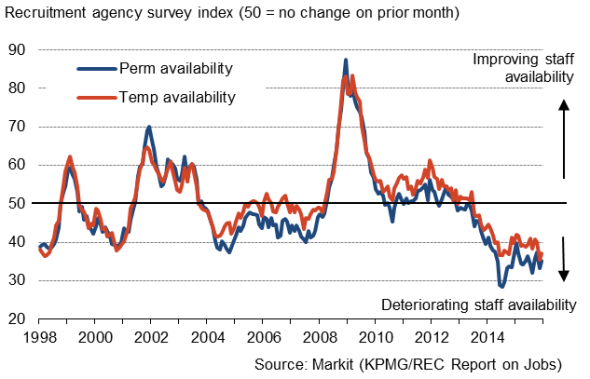

Still, survey measures of staff availability point to continued tightness in labour supply. With the unemployment rate now standing at its lowest in over seven years at 5.2%, at least some upward pressure on pay appears likely to be maintained in the coming months.

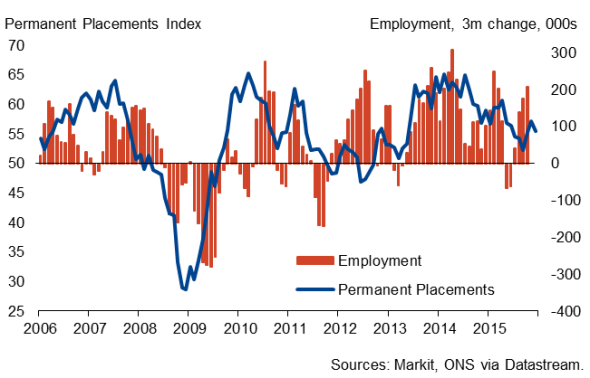

Meanwhile, recruitment consultants reported further solid growth of permanent staff placements in December, although the rate of growth eased from the seven-month high seen in November. Employment growth therefore looks set to have continued at a healthy pace of almost 100,000 per quarter in the closing months of 2015.

Consumer price inflation and average earnings

Permanent placements and employment

Recruitment survey staff availability

Jack Kennedy | Senior Economist, Markit

Tel: +44 149 146 1087

jack.kennedy@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Economics-UK-recruitment-industry-reports-further-slowing-of-salary-growth-in-December.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Economics-UK-recruitment-industry-reports-further-slowing-of-salary-growth-in-December.html&text=UK+recruitment+industry+reports+further+slowing+of+salary+growth+in+December","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Economics-UK-recruitment-industry-reports-further-slowing-of-salary-growth-in-December.html","enabled":true},{"name":"email","url":"?subject=UK recruitment industry reports further slowing of salary growth in December&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Economics-UK-recruitment-industry-reports-further-slowing-of-salary-growth-in-December.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+recruitment+industry+reports+further+slowing+of+salary+growth+in+December http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Economics-UK-recruitment-industry-reports-further-slowing-of-salary-growth-in-December.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}