Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 07, 2016

Global economy on course for best quarter of the year

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

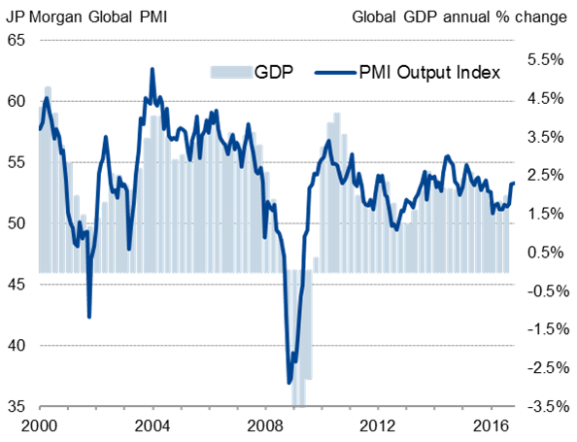

Global PMI signals strongest quarter so far this year

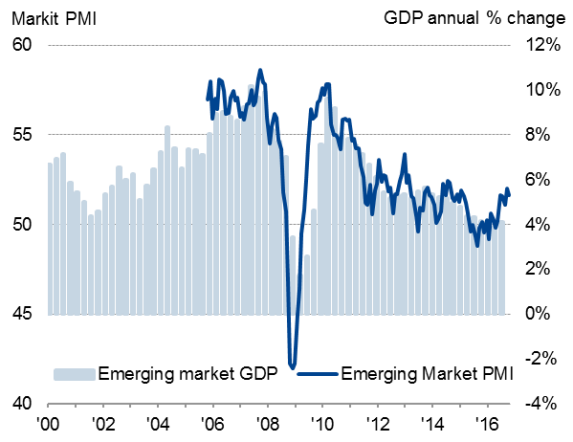

"The global economy is enjoying its strongest quarter so far this year, according to PMI survey data. The JPMorgan Global PMI", compiled by Markit from its various national surveys, held steady in November, unchanged on October's 11-month high of 53.3. The improvement means that the PMI signals annual global GDP growth (at market prices) accelerating towards 2.5% in Q4, breaking through the 2% barrier for the first time this year.

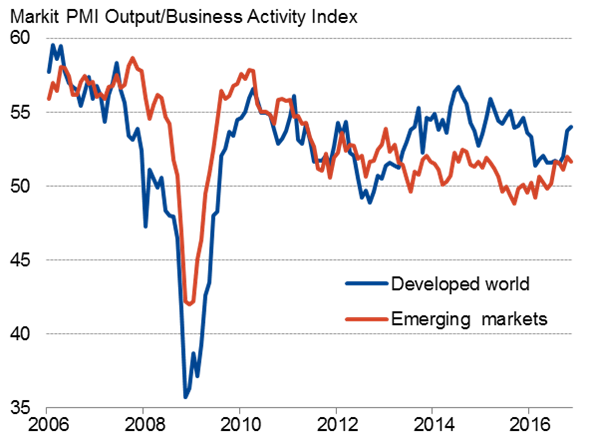

"The developed world continued to outpace the emerging markets. While business activity growth in the former accelerated to a 12-month high, the pace slowed slightly in the emerging markets. The latter are nevertheless on course for the strongest quarterly performance in just over two years.

Global PMI & economic growth

Sources: IHS Markit, JPMorgan

Developed & emerging market output

Source: IHS Markit

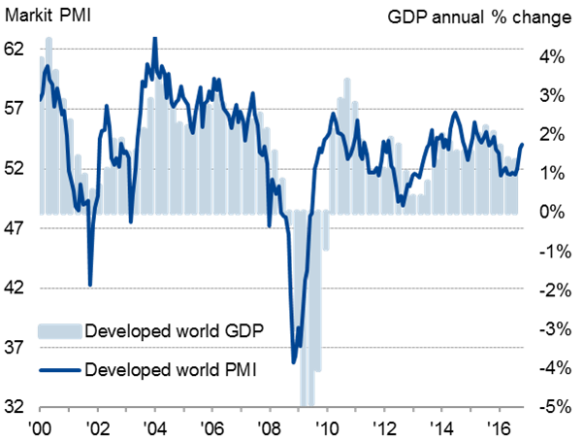

All four rich-world economies on course for buoyant end to 2016

"Growth of developed world business activity rose to a 12-month high in November, building on the marked upturn in momentum seen in October. The data are broadly consistent with annual GDP growth rising to a reasonable but unspectacular 2%.

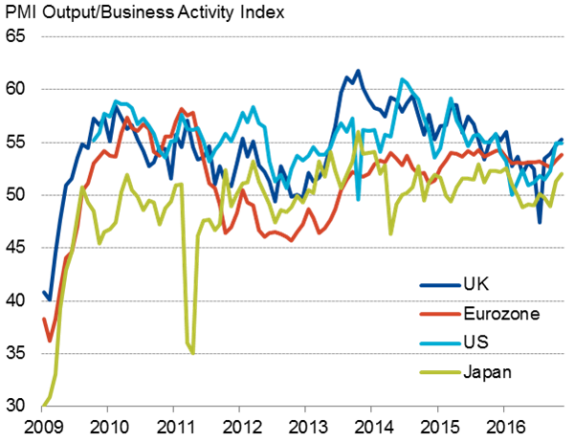

"Perhaps the most encouraging news was the extent to which developed growth was broad-based across the major rich-world economies. The US, UK, Eurozone and Japan are all enjoying the fastest growth of business activity so far this year on average in Q4, with the UK and US reporting the strongest expansions. All four saw growth accelerate further in November with the exception of the US, where the pace held steady on November's 11-month high.

Developed world PMI* & economic growth

Source: IHS Markit.

Main developed markets*

Sources: IHS Markit, CIPS, Nikkei.

* PMI shown above is a GDP weighted average of the survey output indices.

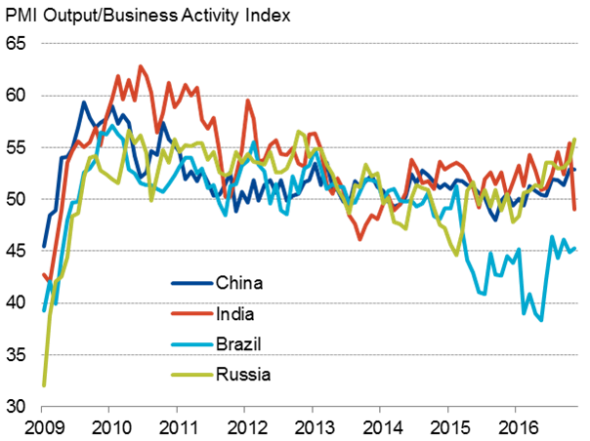

Mixed emerging market trends, with growth led by Russia

"The strongest expansion among the BRIC nations was seen in Russia, where the PMI surveys indicated the strongest monthly rise in business activity for four years, in spite of falling exports. Growth held steady at a robust 3" high in China, albeit with manufacturing growth likewise crimped by stagnant exports.

"Business activity meanwhile fell in India for the first time in almost 1" years, thanks to a steep fall in services activity which was widely linked to the withdrawal of high-denomination bank notes. Importantly, optimism about the outlook improved, suggesting the downturn will be temporary.

"Brazil continued to record the steepest downturn. That said, the rate of decline eased slightly in November, and has at least moderated compared to earlier in the year.

Emerging market PMI* & economic growth

Source: IHS Markit.

BRIC nations*

Sources: IHS Markit, Caixin, Nikkei.

* PMI shown above is a GDP weighted average of the survey output indices.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122016-Economics-Global-economy-on-course-for-best-quarter-of-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122016-Economics-Global-economy-on-course-for-best-quarter-of-the-year.html&text=Global+economy+on+course+for+best+quarter+of+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122016-Economics-Global-economy-on-course-for-best-quarter-of-the-year.html","enabled":true},{"name":"email","url":"?subject=Global economy on course for best quarter of the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122016-Economics-Global-economy-on-course-for-best-quarter-of-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+on+course+for+best+quarter+of+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07122016-Economics-Global-economy-on-course-for-best-quarter-of-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}