Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 07, 2014

UK deficit widens in third quarter, but export downturn shows signs of easing

A drop in exports over the third quarter adds to the recent flow of disappointing data on the health of the UK economy. However, exports rose in September, meaning the third quarter drop in goods exports was the smallest seen over the past year, and there are tentative reasons to believe that the export trend will start to pick up again.

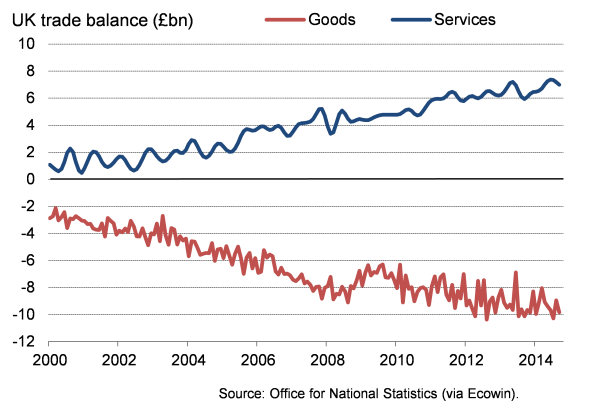

Deficit widens

The UK's overall trade deficit widened to "2.838 billion in September and the goods trade deficit rose to "9.821bn, according to the Office for National Statistics. Trade was hit by weak exports to the European Union and rising imports of oil.

Exports of goods were up 4.2% compared to August, but imports were up 5.8%, including a 27.6% surge in oil imports.

However, the trade data are volatile, meaning it is best to look at quarterly averages. Despite the September rise, goods exports over the third quarter as a whole were down 0.5% compared to the second quarter, which had seen a 1.5% drop. Goods imports were meanwhile up 0.6% in the third quarter, leading to a "0.9bn widening of the trade deficit to "29.0bn.

Exports to EU countries were down 1.2% in the third quarter, which was in part offset by a 0.3% rise to non-EU nations. Exports to EU countries are running some 11.2% lower than a year ago.

Trade balance

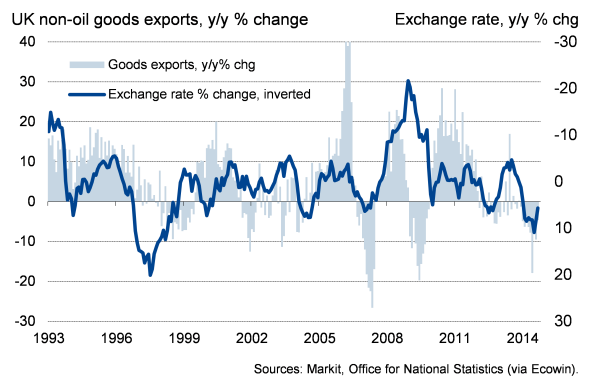

Non-oil goods exports and the exchange rate

Worsening survey data

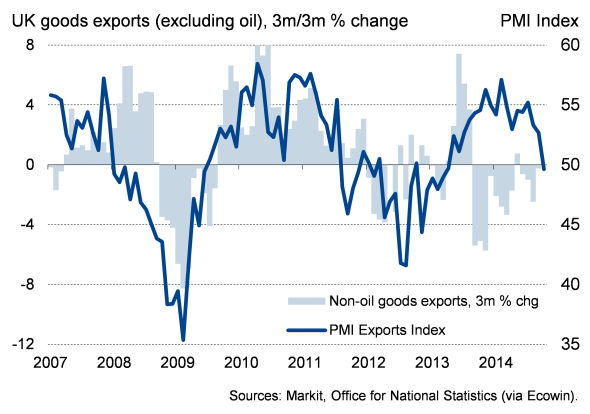

The trade situation looks to deteriorate further in October. The Markit/CIPS Manufacturing PMI" survey registered a second successive drop in new export orders at the start of the fourth quarter. This represents a major turnaround from the robust export growth recorded by surveys such as the PMI and British Chambers of Commerce earlier in the year.

Eurozone drag to fade

The weak export performance largely reflects a lack of demand in the eurozone, which is once again teetering on the brink of another recession. Over the third quarter, the UK recorded its widest ever trade deficit with Germany, its largest trading partner, due to falling exports and rising imports.

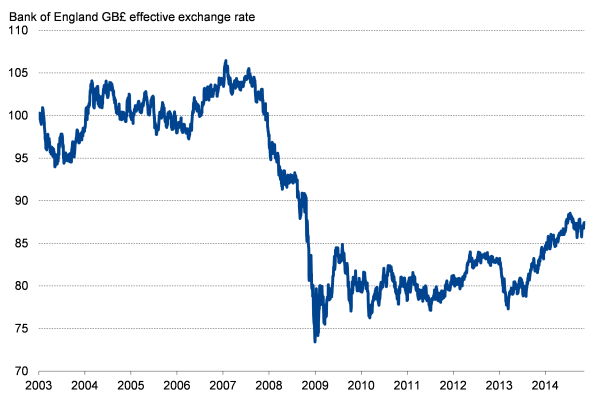

Sterling's appreciation has also played a role in hitting exports. Although down from highs seen in the summer, the pound remains around 6% stronger than late last year against a basket of currencies.

Exchange rate

Looking further out, however, there is hope that export performance may start to improve. The recent flow of disappointing UK economic data have pushed back expectations of when the Bank of England is likely to start raising interest rates, which has in turn been a key factor in pulling sterling off its recent highs. This should help reduce export prices abroad and make UK goods more competitive. Second, renewed stimulus by the European Central Bank should hopefully also start to lift spirits in the euro area and bolster demand for UK goods.

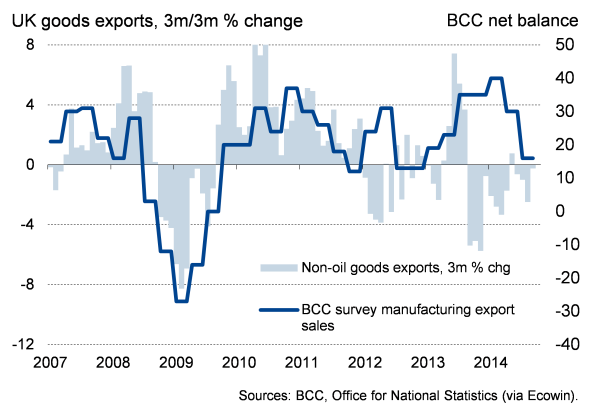

Exports and the surveys

Interestingly, the official data on exports have diverged from the PMI and British Chambers of Commerce surveys to a significant extent, as illustrated by the charts below. The surveys have portrayed a far superior export performance by UK manufacturers over the past year, but are both showing signs of weakening.

Exports and the PMI survey

Exports and the BCC survey

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-UK-deficit-widens-in-third-quarter-but-export-downturn-shows-signs-of-easing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-UK-deficit-widens-in-third-quarter-but-export-downturn-shows-signs-of-easing.html&text=UK+deficit+widens+in+third+quarter%2c+but+export+downturn+shows+signs+of+easing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-UK-deficit-widens-in-third-quarter-but-export-downturn-shows-signs-of-easing.html","enabled":true},{"name":"email","url":"?subject=UK deficit widens in third quarter, but export downturn shows signs of easing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-UK-deficit-widens-in-third-quarter-but-export-downturn-shows-signs-of-easing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+deficit+widens+in+third+quarter%2c+but+export+downturn+shows+signs+of+easing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-UK-deficit-widens-in-third-quarter-but-export-downturn-shows-signs-of-easing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}