Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 07, 2016

Global economy fails to pull out of slow lane in August

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

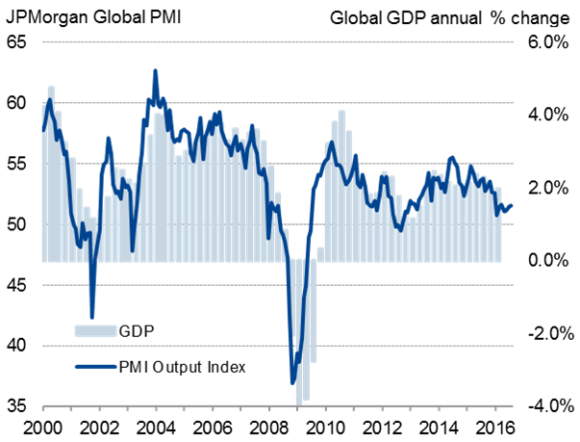

The JPMorgan Global PMI", compiled by Markit from its various national surveys, inched higher for a third successive month from 51.5 in July to 51.6 in August. However, although rising, the PMI readings for the last two months point to annual global GDP growth of only 1.5% in the third quarter, suggesting the global economy remains locked in its slowest growth phase for just over three years.

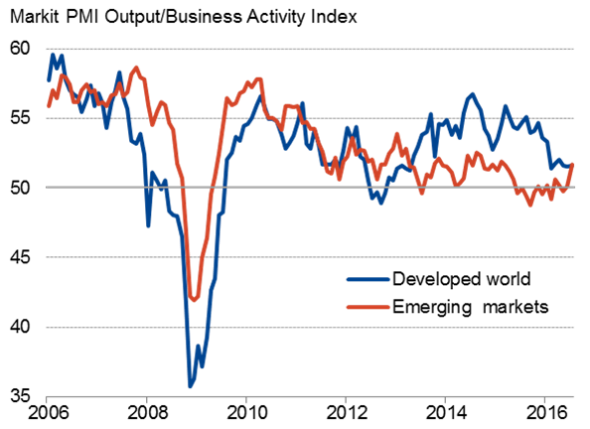

While emerging markets continued to enjoy their strongest expansion for one-and-a-half years, the rate of growth remained weak by historical standards. Similarly, the developed world continued to report only sluggish growth, having down-shifted a gear in February, enduring its worst spell since early-2013.

Global PMI & economic growth

Developed v emerging market output

Sources: IHS Markit, JPMorgan.

Manufacturing sees Q3 upturn

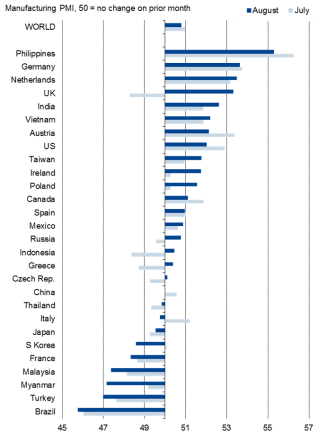

The JPMorgan Global Manufacturing PMI" fell from an eight-month high of 51.0 in July to 50.8 in August. The latest reading is nevertheless one of the strongest seen in recent months, buoyed by faster output growth, and indicates that factories are enjoying their best quarter so far this year, albeit by a slim margin.

Of the 28 countries covered by the PMI surveys, only nine reported a deterioration in manufacturing conditions, with Brazil and Turkey seeing the steepest declines. Some 18 countries reported improvements, led by the Philippines. China's producers reported no change.

Sources: IHS Markit, JPMorgan, ISO, CIPS, NEVI, Nikkei, BME, Bank Austria, Investec, AERCE, Caixin, HPI, Thomson Reuters Datastream.

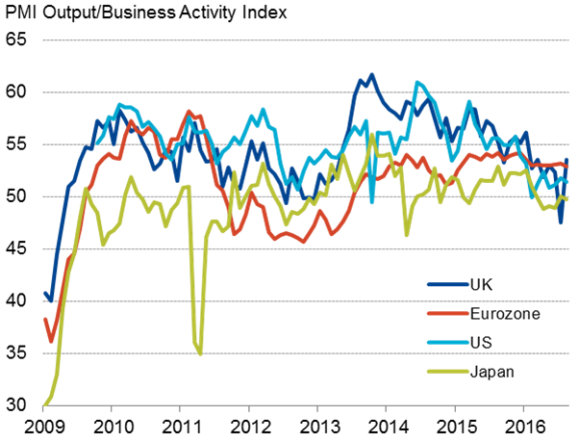

Developed world upturn remains subdued despite UK rebound

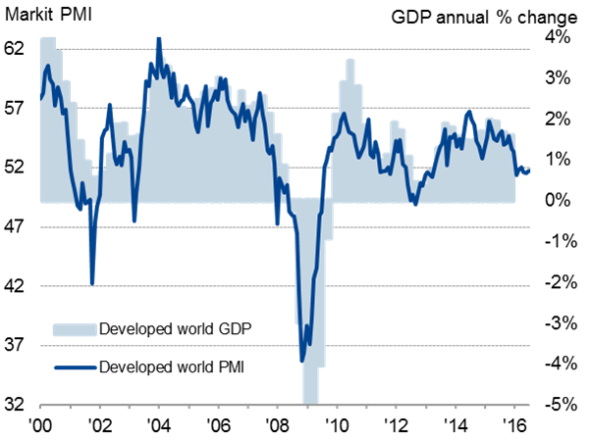

A PMI reading of 51.8 meant the developed world continued to report only a sluggish expansion in August, having down-shifted a gear in February, enduring its worst spell since early-2013. Although the rate of growth nudged up to a four-month high, the survey data are still signalling annual GDP growth (at market prices) of less than 1%.

Looking at the largest developed world economies, the biggest news was a record rise in the UK PMI in August, reversing a sharp decline in July as confidence revived after the initial shock of the 'Brexit' vote. Only subdued growth (around 1% annualised) continued to be recorded in both the US and the euro area, and Japan registered a marginal contraction.

Developed world PMI* & economic growth

Sources: IHS Markit, JPMorgan

Main developed markets

Sources: IHS Markit, CIPS, Nikkei.

* PMI shown above is a GDP weighted average of the survey output indices.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Economics-Global-economy-fails-to-pull-out-of-slow-lane-in-August.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Economics-Global-economy-fails-to-pull-out-of-slow-lane-in-August.html&text=Global+economy+fails+to+pull+out+of+slow+lane+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Economics-Global-economy-fails-to-pull-out-of-slow-lane-in-August.html","enabled":true},{"name":"email","url":"?subject=Global economy fails to pull out of slow lane in August&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Economics-Global-economy-fails-to-pull-out-of-slow-lane-in-August.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+fails+to+pull+out+of+slow+lane+in+August http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092016-Economics-Global-economy-fails-to-pull-out-of-slow-lane-in-August.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}