Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 07, 2015

Eurozone periphery plays catch-up as core shows renewed weakness

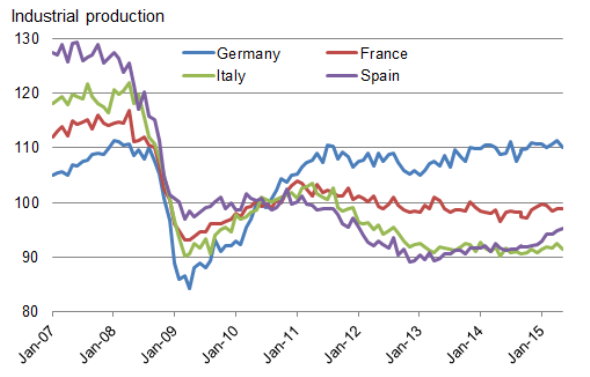

Industrial production trends are diverging within the eurozone area, with signs of renewed weakness in the 'core' contrasting with resurgent growth in the periphery. Production growth slowed to a crawl in Germany in the second quarter and fell marginally in France, but Spain is enjoying strong growth and a sustained upturn is evident in Italy. However, the industrial sectors of Spain and Italy remain one-quarter smaller than their price crisis peaks, highlighting the mountains still needed to be climbed by these countries in terms of rebuilding their industrial sectors.

The official data corroborate survey data which suggest that the eurozone economy continued to recover in the second quarter, on course to expand by a similar amount to the 0.4% increase in GDP seen in the first quarter. However, growth is being constrained by lacklustre performances in the currency union's two largest member states.

Core weakness

German industrial production fell by 1.4% in June, comprised of 4.5% slump in construction output and a 1.2% drop in factory output. Exports also fell 1.0% in June, accompanied by a 0.5% drop in imports. The June downturn contrasts with growth in the prior two months. Measured on a three-month basis, German manufacturing output was 0.2% higher in the second quarter and industrial production up 0.1%, but the latter is down from 0.5% in the first quarter.

The industrial sector should therefore provide some modest support to Germany's economy in the second quarter, but growth is frustratingly weak, especially given the additional stimulus applied to the eurozone economy this year in the form of the ECB's quantitative easing programme.

French industry also fared badly at the end of the second quarter, with production down 0.1% in June to take the second quarter 0.7% below the first three months of the year. The renewed decline is a set-back after production had shown promising signs of life earlier in the year. Output had risen 1.8% in the first quarter.

Periphery playing catch-up

Weakness in the 'core' contrasted with signs of stronger growth in the so-called 'periphery'. Industrial production in Spain rose 0.3% in June, rising 4.4% higher than a year ago in June, its steepest increase since March 2010. By comparison, output of the industrial sectors in Germany and France was just 0.6% higher than a year ago in June. Over the second quarter, Spain's industry has added 1.8% of output.

Although production fell in Italy in June, Italian industry has also seen its output rise over the second quarter as a whole, up 0.4% compared to the first three months of the year.

However, it should be remembered that Germany remains far ahead in terms of its recovery from the financial crisis. While production in Germany is just 1.3% below its pre-crisis peak, output is down 26.4% and 25.0% respectively in Spain and Italy, while output in France remains 15.5% lower.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Eurozone-periphery-plays-catch-up-as-core-shows-renewed-weakness.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Eurozone-periphery-plays-catch-up-as-core-shows-renewed-weakness.html&text=Eurozone+periphery+plays+catch-up+as+core+shows+renewed+weakness","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Eurozone-periphery-plays-catch-up-as-core-shows-renewed-weakness.html","enabled":true},{"name":"email","url":"?subject=Eurozone periphery plays catch-up as core shows renewed weakness&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Eurozone-periphery-plays-catch-up-as-core-shows-renewed-weakness.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+periphery+plays+catch-up+as+core+shows+renewed+weakness http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Eurozone-periphery-plays-catch-up-as-core-shows-renewed-weakness.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}