Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 07, 2015

Bumper US payroll growth fuels September Fed hike talk

Non-farm payrolls came in just shy of forecasts, but it's still yet another solid employment report. With the Fed's decision on the timing of the first rate rise 'data dependent', today's report does nothing to discourage the belief that a September hike is very much on the table, albeit by no means a done deal.

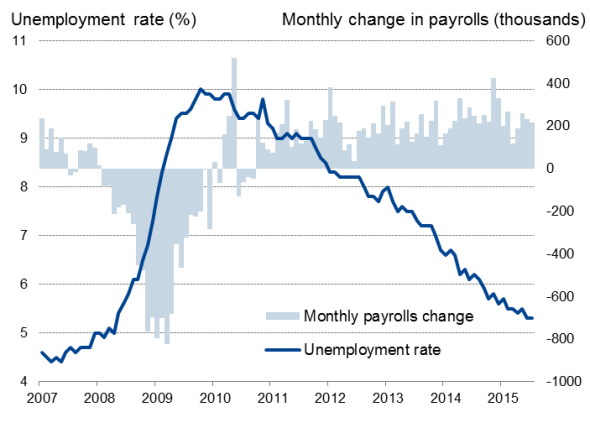

Non-farm payrolls increased by 215,000 in July, just missing expectations of a 225,000 rise. Markit's PMI survey data had also pointed to a 225,000 increase.

Private sector payrolls grew by a solid 210,000, just shy of an expected 215,000 rise, led by service sector hiring alongside gains in the manufacturing and construction sectors.

There were also slight upward revisions to the payroll numbers for May and June.

The additional hiring helped keep the unemployment rate at a seven-year low of 5.3%.

The data highlight how the labour market continues to tighten alongside a steady improvement in the economy, auguring for rates to rise later this year, and possibly as early as September.

US labour market

Survey data indicate that the pace of economic growth at the start of the third quarter was similar to the robust annualised 2.3% rate of increase seen in the second quarter.

Although revisions to GDP data suggest the recovery had been weaker than previously thought in previous years, policymakers will be more focused on the fact that slack has being substantially eroded, with the economy approaching full employment. Furthermore, the downturn in the economy at the start of the year has been revised away, removing nagging doubts about the robustness of growth that will have deterred policymakers from hiking rates.

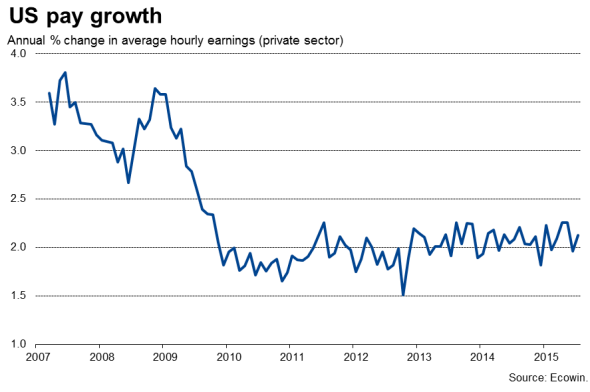

But not so fast; a September rate hike is by no means a done-deal, and any Fed tightening cycle when it does occur is likely to be very modest. Low inflation and subdued wage growth could create powerful arguments against rate hikes.

Core inflationary pressures remain weak amid disappointingly modest wage growth and falling commodity prices. Although wage growth picked up in July, it is hardly surging. Average pay is just 2.1% higher than a year ago.

Prices for oil and other commodities have meanwhile seen renewed falls in recent months, and slumping emerging market growth suggests they could remain low by historical standards, reducing the Fed's inflation projections.

The stronger dollar is also in effect doing some of the Fed's job in terms of tightening, curbing the pace of economic growth via lower exports and reducing inflationary pressures by cutting import costs.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Bumper-US-payroll-growth-fuels-September-Fed-hike-talk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Bumper-US-payroll-growth-fuels-September-Fed-hike-talk.html&text=Bumper+US+payroll+growth+fuels+September+Fed+hike+talk","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Bumper-US-payroll-growth-fuels-September-Fed-hike-talk.html","enabled":true},{"name":"email","url":"?subject=Bumper US payroll growth fuels September Fed hike talk&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Bumper-US-payroll-growth-fuels-September-Fed-hike-talk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bumper+US+payroll+growth+fuels+September+Fed+hike+talk http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082015-Economics-Bumper-US-payroll-growth-fuels-September-Fed-hike-talk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}