Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 07, 2015

Week Ahead Economic Overview

In a busy week for data watchers, first quarter GDP numbers are released for the eurozone while the Bank of England announces its latest interest rate decision and publishes the second Inflation Report of the year. Meanwhile, industrial production and retail sales numbers are out in the US and China.

In the week after the most-closely fought UK general election in a generation, the Bank of England announces its latest interest rate decision. According to the initial GDP estimates, economic growth in the UK slowed sharply to 0.3% in the first quarter of 2015. However, survey data have signalled stronger growth in recent months, suggesting that the disappointing GDP numbers are likely to be revised higher and that growth should bounce back in the second quarter. Nevertheless, a lack of inflationary pressures and weak official data support the view that the first rate hike is unlikely to take place before the end of the year. No change is therefore expected at Monday's meeting.

The Bank will also publish its second Inflation Report of the year, in which updated growth and inflation forecasts are presented. The report will provide further guidance as to when interest rates will start rising again. We expect growth forecasts to be revised lower but for resurgent inflation later this year to imply that rates will need to start rising in late-2015 or early-2016.

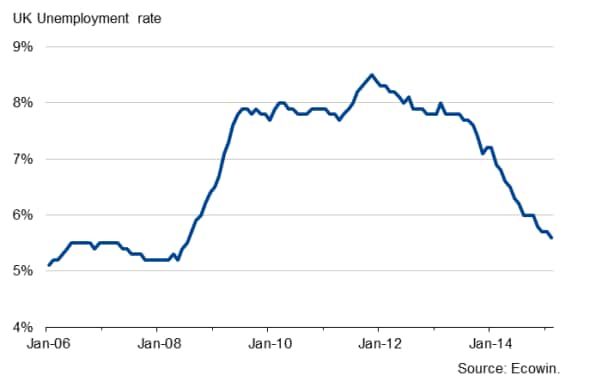

Other important releases in the UK include industrial production numbers and a labour market update. Industrial output data showed a disappointing start to the year, rising a mere 0.1% in February. Moreover, April's Markit/CIPS Manufacturing PMI fell to its lowest level since last September, suggesting that the goods-producing sector is facing strong headwinds. However, it looks as if the labour market is avoiding any ill effects from slower production growth, with a further drop in unemployment expected in Wednesday's labour market report. The report will be most eagerly scoured for signs of nascent wage growth picking up further, thereby increasing scope for interest rates to start rising later this year.

UK unemployment rate

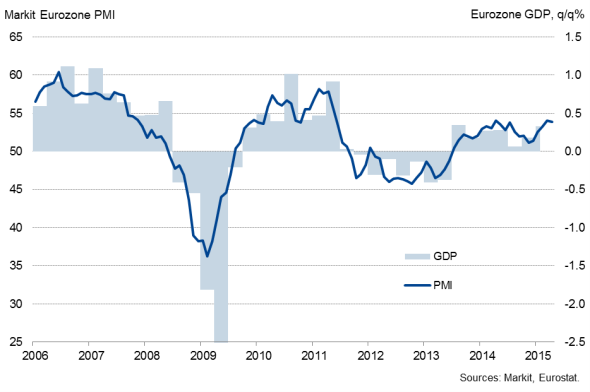

In the eurozone, Eurostat releases its first estimate of first quarter GDP numbers. The region's economy expanded 0.3% in the final three months of last year and survey data point to a slightly stronger pace of growth in the opening quarter of 2015. In Spain, GDP rose 0.9% in the three months to March and PMI data are consistent with Germany having grown by approximately 0.4%, France having expanded by 0.2% and Italy to have eked out 0.1% growth.

Eurozone GDP and the PMI

The news out of the eurozone will inevitably focus on Greece, however, with the deadline for the repayment of loans to the IMF due on 12 May. Tensions have intensified in the debt negotiations and, with survey data adding to signs that Greece has slid back into recession the credit default swap market is currently pricing in a 71.5% probability of default over the next five years, according to Markit data.

After US economic growth almost stalled in the first quarter, Fed policymakers have indicated that they are in no rush to hike interest rates but will be scrutinising the data flow for signs that the current weakness of the US economy is only temporary. Industrial production and retail sales data for April will provide data watchers with more information about the health of the US economy at the start of the second quarter. Industrial production fell 0.6% in March, according to official data from the Federal Reserve, thereby killing any chance of policymakers hiking interest rates in June. PMI data for April meanwhile showed manufacturing output growth slowing to the weakest in 2015 so far as the dollar's appreciation is hurting the economy.

US manufacturing output and the PMI

Industrial production data and retail sales numbers are also updated in China and are eagerly awaited for signs that recent stimulus efforts have helped boost economic growth. The HSBC manufacturing PMI for April showed operating conditions deteriorating at the strongest rate in a year, suggesting that more stimulus measures may be required to ensure the economy doesn't slow further from the 7.0% annual growth rate in the first quarter.

Monday 11 May

England & Wales regional PMI results and the Bank of Scotland PMI are released.

The National Australia Bank releases updated business confidence data.

In India, trade balance numbers are out.

The Bank of England announces its latest interest rate decision.

Greece meanwhile sees the release of industrial output figures.

Employment trends data are issued in the US.

Tuesday 12 May

Japan's Cabinet Office publishes its latest Leading Economic Index, while India sees the release of consumer price and industrial output data.

Wholesale price numbers are meanwhile issued in Germany.

In the UK, the British Retail Consortium releases its latest Retail Sales Monitor, while the ONS issues industrial production numbers.

Manufacturing output data are meanwhile updated in South Africa.

In the US, the NFIB Research Foundation publishes its Business Optimism Index.

Wednesday 13 May

Wage inflation numbers are issued in Australia.

Industrial output and retail sales data are published in China, while Japan sees the release of current account figures.

In India, M3 money supply information are issued.

Consumer price data are released in Germany, Italy, Spain and France, with the latter also seeing the publication of current account numbers and non-farm payrolls figures.

The first estimate of first quarter GDP is released in the eurozone alongside industrial production data.

The latest UK Commercial Development Report is published. Furthermore, a labour market update is released by the Office for National Statistics and the Bank of England publishes its second Inflation Report of the year.

In the US, retail sales figures are issued alongside import and export price data.

Thursday 14 May

Wholesale price data are released in India.

The Royal Institution of Chartered Surveyors issues results from its latest housing survey.

Meanwhile, retail sales numbers are published in Brazil.

Canada sees the release of house price data, while initial jobless claims and producer price numbers are out in the US.

Friday 15 May

Japan sees the release of consumer confidence figures.

First quarter GDP numbers are released in Greece and Russia.

Construction output data are released by the UK's Office for National Statistics.

Eurostat issues trade balance figures for the currency union.

In Canada, manufacturing sales numbers are out, while the US sees the release of industrial output data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07052015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}