Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 06, 2014

Week Ahead Economic Overview

The week sees the first estimate of third quarter GDP and inflation numbers for the eurozone amid an important labour market update and the publication of the latest Inflation Report in the UK. Outside of Europe, key releases include industrial production numbers for China and Japan and retail sales data in the US.

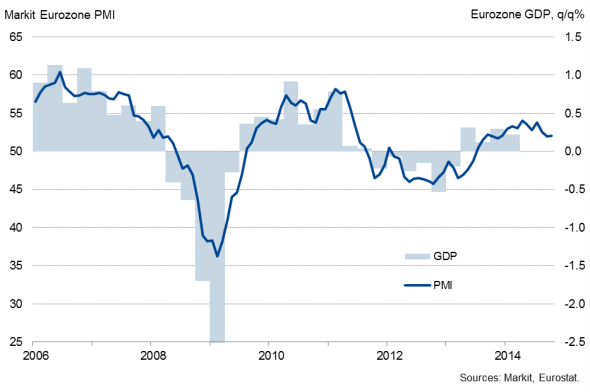

Eurozone GDP and the PMI

There has been mixed news on the performance of the eurozone economy in the third quarter. Hopes that the region's economy returned to growth, having stagnated in the second quarter, have steadily been eroded by weak official data for many countries. Although Spain's economy grew by 0.5% in the three months to June, weak industrial production data across the euro area suggest that the region may struggle to see any growth at all in the third quarter. Domestic demand remains subdued in many countries and geopolitical tensions weigh on confidence. However, technical factors, such as a failure to have properly accounted for school holiday timings in Germany, may have accounted for some of the third quarter weakness. Markit's PMI data offer some encouragement in this respect, having signalled a marginal expansion of around 0.2-0.3%, with Ireland's economy recovering strongly, Spain seeing a still-robust upturn and Germany's service sector providing an important prop to growth in the region.

The single currency area also sees the release of final inflation numbers for October, after a first 'flash' estimate showed consumer prices rising at an annual rate of 0.4%, up from 0.3% in September. The European Commission expects inflation to pick up from 0.6% in 2014 to 1.0% in 2015 and 1.6% in 2016 as economic activity is projected to gradually strengthen and wages are expected to rise.

In the UK, the publication of the Bank of England's quarterly Inflation Report, issued alongside updated labour market data, will be the highlight of the week. The report is likely to reveal a lowering of the Bank's inflation and growth forecasts, and should also provide key insights to the timing of possible interest rate rises.

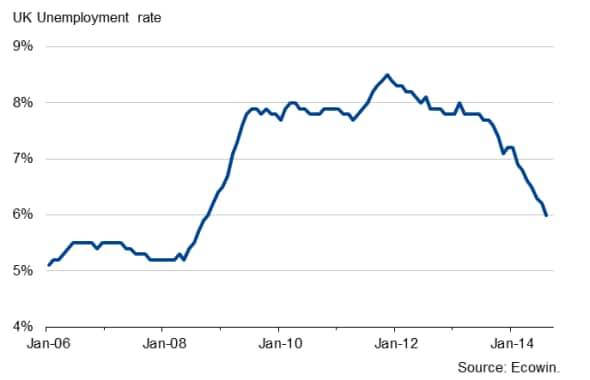

The UK jobless rate fell to a six-year low 6.0% in the three months to August, with the total number of unemployed down by 154,000 to 1.972 million, dropping below two million for the first time since November 2008. It is likely that the unemployment rate will have fallen further to 5.9% in the third quarter. However, policymakers are reluctant to put the brakes on the economic recovery, as wage growth remains weak and PMI data point to a marked slowdown in economic growth, with the all-sector PMI dropping to a 16-month low in October.

UK unemployment rate

Industrial production numbers for October are released in China, and policymakers will be looking for signs that growth has picked up further since hitting a post-crisis low in August. Survey data from Markit and HSBC showed output and new orders rising only marginally in recent months, suggesting that industrial production growth may remain relatively weak.

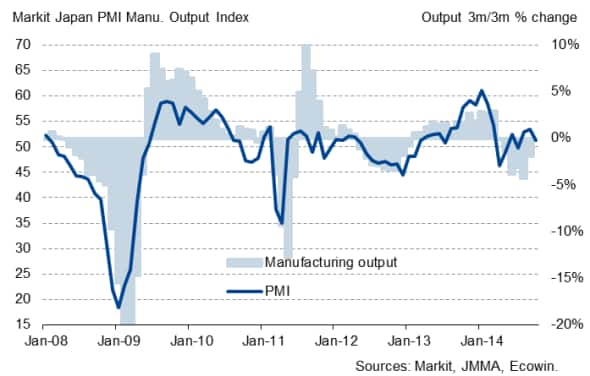

Japan also sees the release of industrial production data. The country is struggling to gain any meaningful traction in economic growth following the consumption-tax induced downturn of the economy in the second quarter, when gross domestic product dropped 1.7%. Industrial production fell 1.9% in August, leaving the sector in need of an improbably large rebound in September if it is not to prove a drag on overall output in Q3.

Japanese industrial production and the PMI

Retail sales numbers for October are meanwhile released in the US and will give further insights into the health of the US economy at the start of the fourth quarter after PMI results signalled a slowing in the rate of economic growth. Survey data are currently pointing to GDP rising at an annualised rate of 2.5% at the start of the fourth quarter. A steep fall in retail sales in September had been a key catalyst of market turmoil and renewed concerns about the health of the US economy.

Monday 10 November

UK Regional PMI data and the Ulster Bank Ireland Construction PMI are released by Markit.

The latest Visa Europe: UK Expenditure Index is out.

Trade data are meanwhile issued in India, while China sees an update on inflation numbers.

Sentix investor confidence data are released for the euro area.

In Greece, inflation figures are published, while industrial output data are out in Italy.

Housing starts numbers are released in Canada.

The US sees an update on employment trends.

Tuesday 11 November

In Australia, business confidence information and house price figures are published.

Current account data and consumer confidence numbers are released in Japan.

The British Retail Consortium issues its latest Retail Sales Monitor.

South Africa sees the release of manufacturing output numbers.

The NFIB Research Foundation publishes its Business Optimism Index for October.

Wednesday 12 November

The UK Commercial Development Activity Report is published by Markit and Savills.

Australia meanwhile sees the release of consumer sentiment data and wage inflation numbers.

Industrial output figures and inflation data are out in India.

In South Africa, retail sales numbers are issued.

The euro area sees an update on industrial production data.

The Bank of England publishes the final Inflation Report of the year, while the Office for National Statistics updates its labour market data.

Wholesale inventory sales numbers are a highlight in the US.

The OECD publishes a statistics release on composite leading indicators.

Thursday 13 November

Industrial output data are out in China in Japan, with China also seeing retail sales numbers and Japan seeing the release of machinery orders numbers and the Reuters Tankan Index.

Mining production data are meanwhile issued in South Africa.

Inflation numbers are out in Germany, Italy and Spain, while Greece sees an update on unemployment figures.

The European Central Bank publishes its latest monthly report that contains a detailed analysis of the prevailing economic situation.

The Royal Institution of Chartered Surveyors publishes its latest house price balance results.

House price data are meanwhile issued in Canada.

In the US, initial jobless claims are out.

The OECD publishes a statistics release on harmonised unemployment rates.

Friday 14 November

Wholesale price inflation data are out in India.

Third quarter GDP and inflation numbers for October are released in the eurozone.

The Office for National Statistics issues an update on construction output figures for the UK.

Retail sales numbers are out in Brazil.

In Canada, manufacturing sales data are issued.

The US Federal Budget is announced and retail sales numbers as well as import and export prices are issued.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06112014-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}