Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 06, 2016

Short selling time share and travel agents

Maturing internet companies like Airbnb are fuelling a wave of change across the hotel and leisure industry as consumers change their booking habits, attracting short sellers to vulnerable incumbents.

- Tripadvisor and Flight Centre come under pressure as competition heats up in online booking

- Short sellers target time share operators Diamond Resorts and Wyndham Worldwide

- Royal Caribbean Cruises sees surge in short interest on earnings miss

Last minute holiday shorts

Despite recent consolidation efforts, Marriot International and Diamond resorts are among the most short sold travel and leisure companies globally with over a fifth of shares sold short in each.

First, the travel industry grappled with increased transparency as the internet penetrated the realm of travel agents. This saw the impressive rise of price comparison websites and budget airlines as value conscious consumers started sifting for the best deals themselves.

The value (and cost) of travel agents to the end consumer has arguably lost out to online booking portals, airlines directly and successful aggregators. However, three-decade-old Australian Flight Centre, with over 2000 high street branches worldwide, has managed to persevere thus far, delivering earnings and sales growth.

However, Flight Centre is struggling to get earnings back above 2014 levels and is attempting to convert to a more online, mobile centred business. Short interest meanwhile surged back above 12% in the past week, while the stock has continued on a 30% plunge since March.

Booking Duopolies

While a decline in travel and other factors has seen more active shorting of Chinese online travel booking sites Ctrip and Qunar, duopoly sites Priceline (Booking.com) and Expedia (Trivago etc.) currently see negligible levels of short interest.

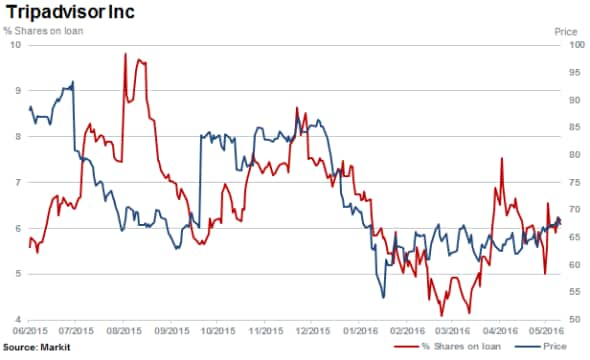

This is while competitor and lead supplier Tripadvisor has seen short sellers benefit from an almost 20% slide in shares in the past 6 months, with short interest declining to 6% currently.

Hotels and timeshare losing their novelty

While Airbnb growth will see the firm book almost 80m room nights in 2016 (from zero just 8 years ago) a billion nights is in reach within 10 years. This growth has undoubtedly come at the expense of traditional hotel and vacation providers, as well as limiting any substantial price growth in the industry.

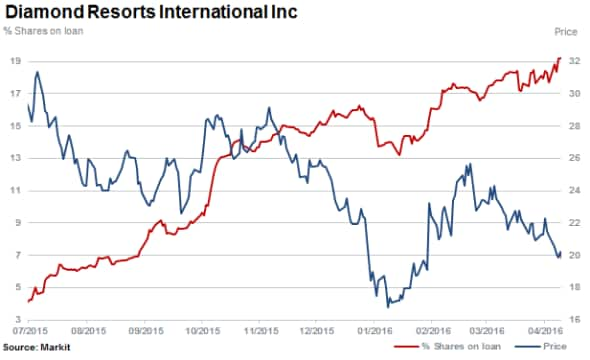

The most shorted vacation provider in the world currently is Diamond Resorts with over a fifth of its shares outstanding on loan currently.

The company sells vacation ownership (timeshare) and provides resort management and hospitality services. Shares have plummeted by 28% in the past 12 months; while short interest has risen seven fold reaching 21% of shares outstanding on loan. This is despite a positive earnings growth and future current consensus outlook.

Joining Diamond Resorts is peer Wyndham Worldwide who has seen short interest rise threefold to 8.9% and shares shedding a fifth in the past year.

Short interest in Marriot International has jumped almost five fold higher in the past 12 months rising above 21%. During this time the company almost lost out on its $12.4bn bid to acquire Starwood Hotels & Resorts to a rival offer from Chinese insurance firm Anbang. The deal will see the company become one of the world's largest hotel chains.

Not immune from changing terrestrial consumer trends is Royal Caribbean Cruises. The cruise liner has seen short interest almost double to 7.5% after an earnings miss in February 2016 with shares down a quarter year to date.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-equities-short-selling-time-share-and-travel-agents.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-equities-short-selling-time-share-and-travel-agents.html&text=Short+selling+time+share+and+travel+agents","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-equities-short-selling-time-share-and-travel-agents.html","enabled":true},{"name":"email","url":"?subject=Short selling time share and travel agents&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-equities-short-selling-time-share-and-travel-agents.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+selling+time+share+and+travel+agents http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-equities-short-selling-time-share-and-travel-agents.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}