Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 06, 2016

Oil recovery lifts high yield bonds

High yield oil and gas bonds have rebounded strongly from the lows seen in February, benefitting the wider high yield bond asset class.

- Markit iBoxx USD Liquid High Yield Oil & Gas Index spreads now half of recent all-time highs

- Basis between high yield oil and gas bonds and the rest of the market now at 18 month lows

- Oil bonds have rebounded by 50% from the lows and have now returned 21% for the year

Last week's Opec meeting and weak US jobs report provided a tailwind for already rising oil prices. The resulting positive impact on bonds issued by high yield oil & gas firms has pushed high yield bonds to the top of the developed market asset class.

The receding spectre of runaway oil production and a hawkish Fed for the near term has cemented improving investor sentiment in high yield oil and gas bonds.

Oil & gas spreads halve

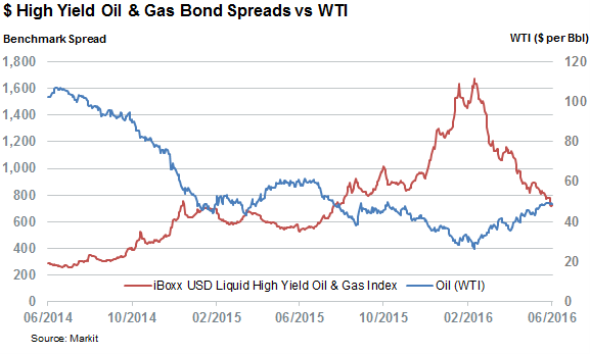

The extra spread required by investors to hold high yield oil and gas bonds is the most overt indicator of improving investor sentiment in the asset class, as that gauge of credit risk has halved from the highs seen in mid-February. At that time, investors required an all-time high of 1674bps of extra yield in order to hold dollar denominated bonds issued by non-investment grade rated oil and gas firms when WTI oil traded at its $26 per barrel lows.

Oil's rebound to just below the $50 mark in the subsequent three months has halved that measure of credit risk to 720bps, according to the Markit iBoxx USD Liquid High Yield Oil & Gas Index which tracks the asset class. The current spread is in line with that required by investors the last time oil traded in the $50 range, suggesting that the current rally has not harboured any lingering bearish sentiment for the asset class.

Improving sentiment lifts returns

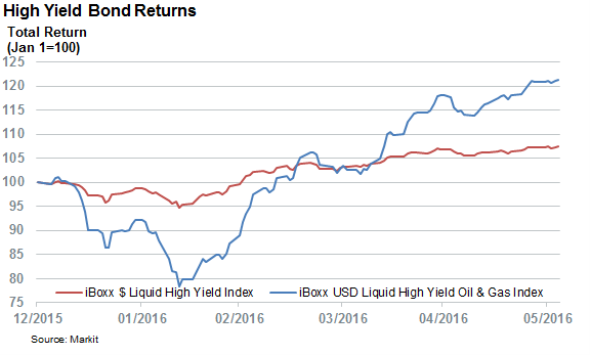

This improving sentiment is translating into real returns for holders of high yield oil and gas bonds as the Markit iBoxx USD Liquid High Yield Oil & Gas Index has delivered over 54% in total returns from its February lows. This phenomenal rebound has put the asset class into positive territory for the year, with the index now up by over 20% year to date (ytd) on a total return basis.

These returns have helped boost the returns delivered by the wider high yield asset class, given that oil and gas producers are the third largest constituent sector of the Markit iBoxx $ Liquid High Yield Index with an 11.7% weight in the current index.

While the total returns delivered by the wider high yield index are around a third of those delivered by its oil and gas component, the 7.4% ytd return delivered by the asset class puts it ahead of the major western currency denominated bond indices tracked by Markit iBoxx.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-Credit-Oil-recovery-lifts-high-yield-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-Credit-Oil-recovery-lifts-high-yield-bonds.html&text=Oil+recovery+lifts+high+yield+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-Credit-Oil-recovery-lifts-high-yield-bonds.html","enabled":true},{"name":"email","url":"?subject=Oil recovery lifts high yield bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-Credit-Oil-recovery-lifts-high-yield-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+recovery+lifts+high+yield+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062016-Credit-Oil-recovery-lifts-high-yield-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}