Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 06, 2016

Waning US hiring trend adds to signs of second quarter economic weakness

The pace of hiring in the US eased more than expected in April, adding to signs that the slowing in the rate of economic growth in the first quarter may persist into the second quarter.

April's data are especially important to policymakers, who are eager to see if the slowdown in the economy in the first quarter will be only temporary. By adding to indications that economic weakness is lingering into the second quarter, these disappointing numbers greatly reduce the likelihood of the Fed hiking rates this side of the presidential election.

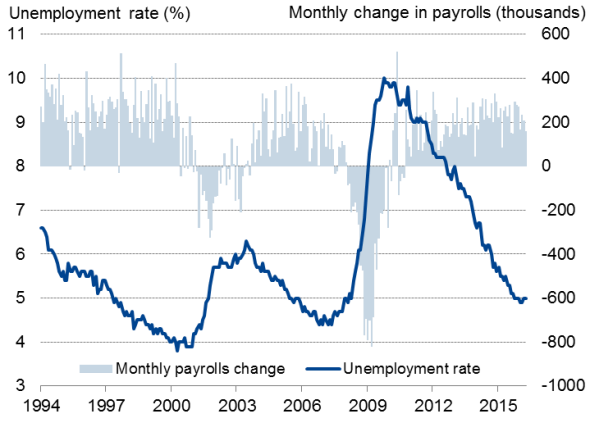

Non-farm payrolls rose by 160,000 in April, below consensus expectations of a 202,000 increase. The rise was the smallest seen for seven months. Gains for February and March were also revised down from 245,000 and 215,000 respectively to 233,000 and 208,000, to show 19,000 fewer jobs being created in the prior two months.

The unemployment rate meanwhile held at 5.0%, just above the eight-year low of 4.9% seen in January and February and confounding market expectations of a drop to 4.9%.

Though wages meanwhile rose 0.3% during the month, pushing pay up 2.5% on a year ago, that's still a disappointingly weak pace of wage inflation given the low rate of unemployment.

The payroll gain was driven almost entirely by services. Manufacturing added just 4,000 jobs, the mining headcount cull continued with a loss of 7,000 jobs, the retail sector shed 3,100 staff and construction added just 1,000 workers.

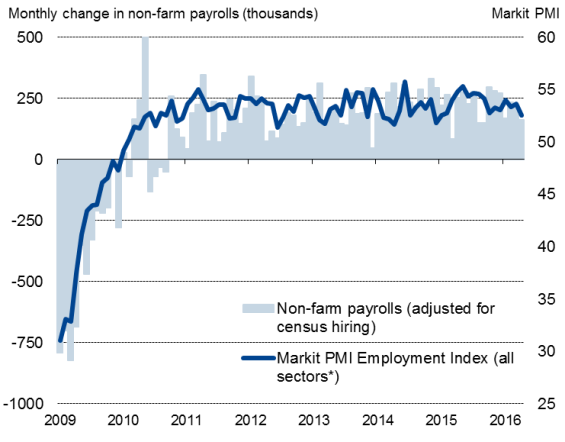

The increase in employment was exactly in line with Markit's PMI surveys*, which also provide insight as to why hiring has waned. Survey participants report that hiring has slowed in response to disappointing order book inflows and heightened uncertainty about the economic and political outlooks. In the manufacturing sector, the strength of the dollar has compounded these worries. With these concerns showing no signs of abating in April, and election uncertainty intensifying, it would be surprising if the hiring trend didn't slow further in coming months.

The PMI surveys had also indicated that the economy slowed sharply in the first quarter, with only a very modest upturn in April, casting doubt on expectations that the first quarter slowdown will prove temporary.

US labour market

Markit PMI Employment Index

* Manufacturing only pre-October 2009.

Sources: Markit, Bureau of Labor Statistics.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Economics-Waning-US-hiring-trend-adds-to-signs-of-second-quarter-economic-weakness.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Economics-Waning-US-hiring-trend-adds-to-signs-of-second-quarter-economic-weakness.html&text=Waning+US+hiring+trend+adds+to+signs+of+second+quarter+economic+weakness","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Economics-Waning-US-hiring-trend-adds-to-signs-of-second-quarter-economic-weakness.html","enabled":true},{"name":"email","url":"?subject=Waning US hiring trend adds to signs of second quarter economic weakness&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Economics-Waning-US-hiring-trend-adds-to-signs-of-second-quarter-economic-weakness.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Waning+US+hiring+trend+adds+to+signs+of+second+quarter+economic+weakness http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Economics-Waning-US-hiring-trend-adds-to-signs-of-second-quarter-economic-weakness.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}